Blueberry Markets Review – Learn More about blueberrymarkets.com

Formed in 2016 by the Forex expert Dean Hyde, Blueberry Markets is based on the idea of providing customers with a superior platform, low spreads, and a high level of client service.

As a part of the EightCap Pty LTD of Australia, Blueberry Markets is regulated under the Australian financial authority – ASIC. The prestigious license is solid proof of Blueberry Markets being an exceptional online services provider with their legal status fully regulated.

This Blueberry Markets review will shine a light on some of the best retail trading services, along with some disadvantages, of course. Since our honesty wouldn’t allow us anything less, we advise you to read our review entirely and then decide if this trading platform is right for you or not.

Blueberry Markets Pros and Cons

Blueberry Markets have a reputation as a reliable and safe brokerage thanks to the ASIC license. However, this level of protection and security of funds surely stands for AU clientele. International clients fall under another license – VFSC regulation from the Republic of Vanuatu. This is a downside as the trading conditions don’t match the quality level and security of the ASIC regulation.

With relatively low minimum deposits and low classified trading fees, Blueberry Markets is among the most competitive brokerage services on the market. Clients can place their trades whenever they wish and have no fear of the inactivity fee or deposit and withdrawal charges.

Trading a number of financial assets across all world’s markets is made easier thanks to the installment of the best trading software in the retail industry – MT4 and MT5.

| Headquarters | Australia |

| Regulation | ASIC, VFSC |

| Platforms | MT4, MT5 |

| Instruments | Forex, Cryptocurrencies CFDs, Stocks CFDs, Indices, Commodities |

| Demo Account | Available |

| Minimum Deposit | $100 |

| EUR/USD Spread | 1 pips |

| Base Currencies | USD, CAD, AUD, EUR, SGD, NZD, GBP |

| Education | Articles, Video Tutorials |

| Customer Support | 24/7 |

Are Blueberry Markets Safe or Scam? License and Regulation

ASIC is Australia’s corporate, markets, and financial services regulator. As one of the leading world’s financial regulators, it incorporates some of the strictest licensing standards. Obtaining a license is a long and complicated process. There is no way around it because its purpose is to keep the customers safe and the market clean and fair.

The licensing process starts off with the brokerage firm investing at least 1.000.000 AUD as proof they intend on running a legitimate business. Further conditions include the safekeeping of clients’ funds in segregated bank accounts under special security protocols. These prevent the broker from misusing clients’ capital as it’s stored separately from the company’s own investments.

Australian brokers have to respect the maximum leverage of 1:30, just as EU and UK brokers do. Leverage cap, along with the negative balance protection are the risk-reducing methods since the Forex market can often be unpredictable and fluctuating.

AU traders are also protected by the Financial Ombudsman of Australia (AFCA). This is another guarantee that clients aren’t alone in case their broker-dealer goes bankrupt or their business fails some other way.

Generally, these conditions for safe and reliable trading services only cover Australian investors. All other traders fall under the regulatory directive of VFSC – The Vanuatu Financial Services Commission. Far loose and less secure, this financial entity doesn’t impose a leverage cap and there is no compensation fund for traders.

Account Types Available at Blueberry Markets

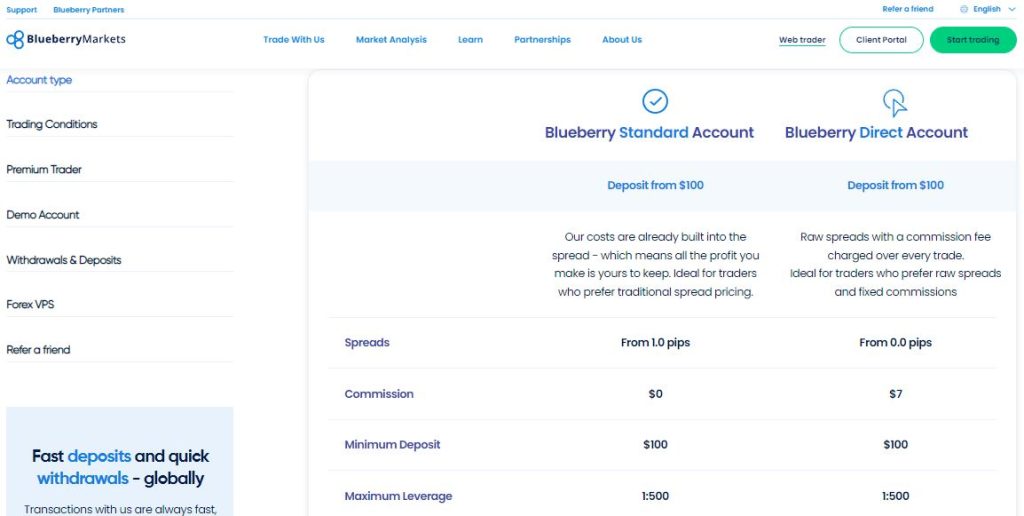

If you want to experience the difference in trading all sorts of tradable securities with tight spreads and ultra-competitive commission rates, you should open one of the two account types at Blueberry Markets:

- Blueberry Standard Account

- Blueberry Direct Account

The fee following the registration of each account type is only $100, which is pretty much what most other world-famous brokers ask for. The major difference between these accounts is the trading costs in terms of spreads and commissions.

For instance, the Standard account offers spreads starting at 1.0 pips with $0 commissions. This account is probably most suitable for traders who prefer traditional spread pricing. On the other hand, the Direct account has super-tight spreads starting from 0.0 pips and the commission following every turn being $7. Investors that are looking for raw spreads and fixed commissions will find this account type more interesting.

Other features offered are the same for both account types: leverage goes up to 1:500, depending on the zone of regulation. The same platforms are accessible from both accounts, as well.

Trading Platform Overview

Unparalleled in their speed and richness in features, MetaQuotes platforms have achieved absolute dominance in the online trading industry. No other software could even come close to the reliability, flexibility, and number of advanced options that MT4 and MT5 provide.

MT4 came out before its successor but has been in the top preferred and popular platforms to this day. With thousands of online tools to plug in, one-click trading, instant order execution, and unmatched customizability, MT4 is still world-famous for its usefulness.

MT5 is an entirely new platform that was launched much later. However, it took over the online trading world by storm and still holds the top spot. As the world’s most reliable and fully customizable platform, it, without a doubt, exceeds MT4 in even more advanced features. With even more types of pending orders, built-in indicators, analytical objects, and timeframes, it gives traders an advantage over the entire competition.

Webtrader has the goal to offer investors to access MetaTrader features from their internet browser, from anywhere in the world. Without the need to download and install anything, you can open a live trading account, fund it, and just log in to the web terminal to start trading.

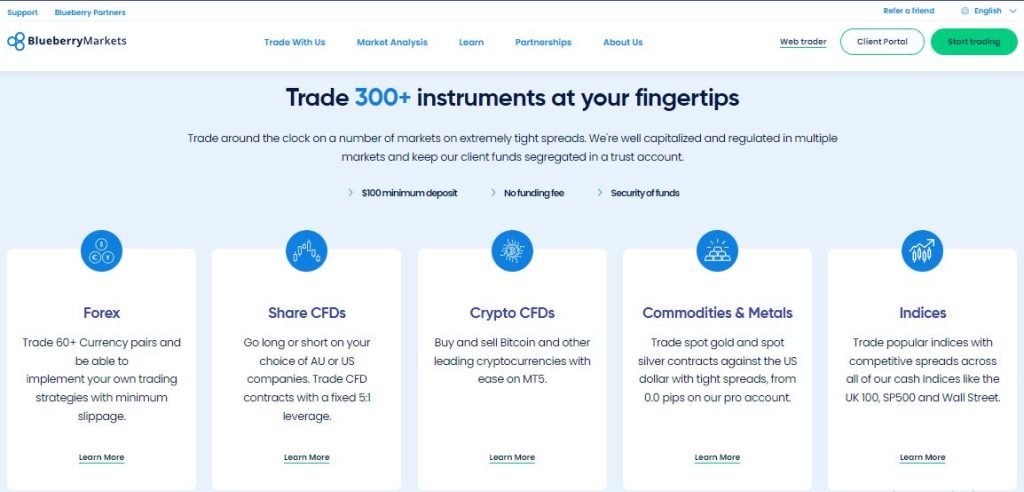

Blueberry Markets Trading Instruments

Blueberry Markets explicitly focuses on currency pairs trading across the global markets. However, we’re all aware of the ever-increasing demand for more versatile and exotic tradable assets. Blueberry Markets has accurately responded to that by unlocking more instruments from the following categories:

- Forex majors cross, and commodity currencies (EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, EUR/GBP, EUR/JPY, EUR/CHF, GBP/JPY)

- Share CFDs (Amazon, Tesla, Facebook, Netflix, Walmart, Bank of China)

- CFDs on Cryptocurrencies (Bitcoin, Litecoin, Ethereum, Ripple, Dogecoin, Cardano)

- Commodity CFDs (Brent Crude Oil, Natural Gas, Silver, Gold, Palladium)

- Indices CFDs (AU200, GER30, UK100, EUSTX50, FRA40, JPN225)

Deposits and Withdrawals

Funding and withdrawing funds from a trading account at Blueberry Markets is without any fees and hustle-free. Both processes are basically instantly performed, except in the case of bank transfers when the cash requires more time to get to the owner’s account.

Otherwise, the payment methods are many and all are completely safe. The only factor that may make some of them unavailable for traders is the location of the investor’s residence.

In short, the transactions can be processed via the following services:

- Bank wire

- Credit Card (Visa and MasterCard)

- Electronic wallets (Dragonpay, FASA , Neteller, Paytrust, Perfect Money, Skrill)

- Digital currencies (Bitcoin, Ethereum, and USDT)

Take note that the minimum amount to withdraw is at least $50 or the corresponding currency. Additionally, Blueberry Markets does cover the fees they’re responsible for. However, some fees occur due to the involvement of the processing banks. In the case of bank wire withdrawals, fees might be around $25.

Education and Resources

Free guides, articles, and video tutorials are all part of the educational program for traders of three different levels of experience and knowledge:

- Beginner

- Intermediate

- Advanced

The first stage of learning includes getting familiar with the Forex basics. Understanding the building concepts is how you prepare yourself to advance, after all. Traders who are venturing into the Forex world for the first time can learn how to place trades, how risk-managing works, hedging, pips, gap trading, and many other topics?

Intermediate-level investors first get educated on liquidity, particular indicators inside the platform, top strategies, spot trading, and other particularities useful for traders of this level.

Finally, professional traders can also find something useful. Whether they want to learn about pull and bear indicators or about MQL5, Blueberry Markets has them covered.

Customer Service Overview

At any hour and any day, every Blueberry Markets client has the option to contact customer support for help. Because the broker forces a philosophy strictly oriented on client protection and satisfaction, they’re at every user’s service 24/7.

For instance, clients can see the full official details of the Australian and Vanuatu teams. Whether the user wishes to reach out to the staff by email, phone, message, or live chat, they can do so whenever they feel the need to.

The help Center at Blueberry Markets includes a FAQ page and additional articles that go in-depth with explaining how to resolve the most common issues.

Blueberry Markets Overall Summary

Credible and trustworthy, Blueberry Markets is a reliable Australian broker with proper licenses. The trading conditions are on par with the world’s most influential brokerage houses. In the sense of costs, fees, and commissions, this broker-dealer is very affordable. Quite lucrative trading conditions provide traders with a chance to make a good turnover with a low initial deposit.

What we’d like the traders to be aware of, as pointed out in this Blueberry Markets review, is the different regulatory terms for non-AU investors. The foreign clientele has to watch out for the increased leverage and not all safety guarantees that Australian traders enjoy.

However, professionals who deal with risks well and would like to trade under increased leverage can do so with this broker and they will not regret it.

FAQs About Blueberry Markets Broker

How Long for my Blueberry Markets Account to be Approved?

The account approval process lasts around one business day. The account is opened within 15 minutes.

Who Is the Blueberry Markets Regulated by?

This company has two regulations – by the Australian ASIC and VFSC in Vanuatu.

Is there a Minimum Deposit at Blueberry Markets?

Yes, and the minimum deposit requirement for both account types available is $100.

Is there a Minimum Amount I can withdraw at Blueberry Markets?

In case you want to apply for a withdrawal, the minimum amount can’t be lower than $50.

Does Blueberry Markets Have a Demo Account?

Yes. For a limited period of time, you can trade different financial instruments with virtual funds.