eToro Review – All About eToro.com Brokerage

Specializing in CFD trading, eToro is a widely popular brokerage site with exceptional service. Established in 2007, eToro has been serving over 6 million customers in over 150 countries across the globe.

The company’s history, background and licenses are impeccable. This social investment network has revolutionized investing and trading. Mainly focused on social collaboration and investor education, this multi-asset investment platform is a great place for traders to connect and share.

It’s our mission to bring you a detailed eToro review so you can, as a potential investor, judge if this broker dealer is the right one to please your trading needs.

eToro Pros and Cons

First and foremost, the impressive circumstance is that eToro owns three licenses by top tier regulators – CySEC (Cyprus), FCA(UK) and ASIC(Australia). eToro also has one license by a minor regulator – FSAS (Seychelles).

When the firm has multiple regulations, you know you can’t go wrong. Plus with that many years being one of the leaders in the industry is a good sign of the broker’s reliability. But that’s not all that this successful Forex services provider has to offer.

The site provides rich educational material for every customer to have a chance of enhancing their financial knowledge and skills. You can additionally train yourself to become a better trader by opening a Demo account. From it you can test the prestigious eToro proprietary platform that also has a mobile version.

Just saying that eToro has good trading conditions simply isn’t enough. Besides the low commissions and fee-free deposits, crypto withdrawals come with 1% fee.

Traders preferring MetaTrader platforms will not like the fact that eToro doesn’t offer MT4 and MT4.

In the end, customer support may have a world-class service but it is only available 24/5.

| Headquarters | Israel |

| Regulation | CySEC, FCA, ASIC, FSAS |

| Year Established | 2007 |

| Minimum Deposit | $10 |

| Trading Platforms(s) | eToro desktop and mobile app |

| Signals | Yes |

| US Clients Accepted? | Yes |

| Islamic Account | Available |

| Segregated Account | Available |

| Managed Accounts | Available |

| Support Hours | 24/5 |

| Customer Support | Email, live chat, fill-in online form |

| Demo Account | Available |

Is eToro Safe? Security and Regulation

It’s already been said that eToro has certificates by CySEC (Cyprus), FCA(UK) and ASIC(Australia) and one offshore regulator – FSAS (Seychelles). We can conclude that eToro’s legitimacy is unquestionable but what does it really mean to have a license from CySEC and FCA?

EEA brokers, as well as UK financial services providers first have to give proof of indenting to establish a long-lasting business. CySEC expects brokers to give proof of owning at least 730 000 € while FCA requires them to invest no less than 730 000 £.

After that, all brokerage houses have to ensure the clients’ funds are safe and secure from potential misuse by the company. That’s what segregated bank accounts serve for.

Similarities between EU and UK regulatory standards is the leverage limitations to 1:30, compensation scheme and negative balance protection. The numbers are slightly different, though. In the UK, the customers have access to the Financial Ombudsman Service that can help protect their interest in case of dispute.

Financial compensation covers the sum of up to £85 000. In the EU, the regulatory directive obligates the payment of up to €20 000 in case of company bankruptcy.

One of the main rules that EU and UK brokers abide by is transparency in terms of transactions reporting. Every agency has to make a report to the jurisdictional regulator in due time so suspicious activities like money laundering are prevented.

ASIC is the main financial institution in charge of regulating and supervising the brokerage activity in Australia. They also have bonuses banned, just like in the EU and UK. Segregated bank accounts, 1:30 leverage, negative balance protection and transactions reporting is mandatory for the AU brokers as well. However, in Australia customers don’t have access to the compensation scheme.

FSAS is the regulatory body in the Seychelles. Although an offshore zone, FSAS keeps their database of the brokers with licenses that sell their financial services in the area. Still, the regulatory criteria in the offshore zones is pretty loose, which is pretty visible in case of leverage, for example.

That still doesn’t deny the fact that eToro has more than one tier 1 regulation and that they respect the licensing rules in every jurisdiction they operate.

eToro Leverage

Leverage is one of the crucial elements of investing and profiting from buying or selling an instrument. Basically, your leverage increases your exposure to an instrument. Increased leverage means bigger exposure to the particular financial instrument, proportional to the leverage ratio.

eToro retail clients can have different maximum leverage according to the rules that jurisdictional regulators impose.

That’s why UK, EU and AU clients have maximum leverage of 1:30 for major currency pairs, 1:20 for minor Forex pairs, 1:10 for commodities, 1:5 for CFD stocks and ETFs, and 1:2 x2 CFD crypto assets.

Offshore clients can enjoy higher leverage. For currency pairs it can go up to 1:400. Max leverage for Gold and other commodities is 1:100, 1:10 for non-major indices, CFD stocks and ETFs. Leverage on CFD crypto currencies goes up to 1:5.

eToro Accounts Types Available

Several types of accounts are available at eToro. However, retail traders only have one default live trading account for that purpose. Other account types are designed for corporations or professionals. Let’s take a look:

- Personal (retail) account – The basic eToro trading account. Investors can buy and sell all available instruments at eToro, copy other traders, and invest in Smart Portfolios. Leverage can be limited, depending on the user’s location.

- Professional account – Option to use higher leverage than the one available on the retail account. Not everyone can open a professional account. Clients who are well trained investors with high funding abilities or have worked in the financial sector are eligible.

- Corporate account – Account specially designed for business entities and corporations that are investing the company’s capital.

- Islamic account – Swap-free accounts where there’s no overnight credit or fees so islamic traders can use it in accordance with Sharia laws.

- Demo account – eToro’s virtual portfolio for practicing investing risk-free.

Trading Instruments at eToro

The choices of tradable assets at eToro are indeed various. Over 5000 financial instruments are available. They’re all grouped in the following categories:

- Stocks (Hexo Corp, Drive Shack Inc, Clovis Oncology Inc, Jaguar Health)

- Indices (NSDQ100, SPX500, GER40, UK100, DJ30, RTY, VIX.FUT, FRA40, AUS200)

- ETFs (SPY, VOO, QQQ, GLD, INDA, TLT, XLE, SWDA.L, ISF.L, ARKK)

- Currencies (USD/CHF, GBP/USD, USD/JPY, EUR/USD, AUD/JPY, USD/MXN)

- Commodities (Gold, Oil, Sugar, Platinum, Natural Gas, Nickel, Coffee, Wheat, Copper)

- Cryptoassets (BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, TRX, SOL, UNI)

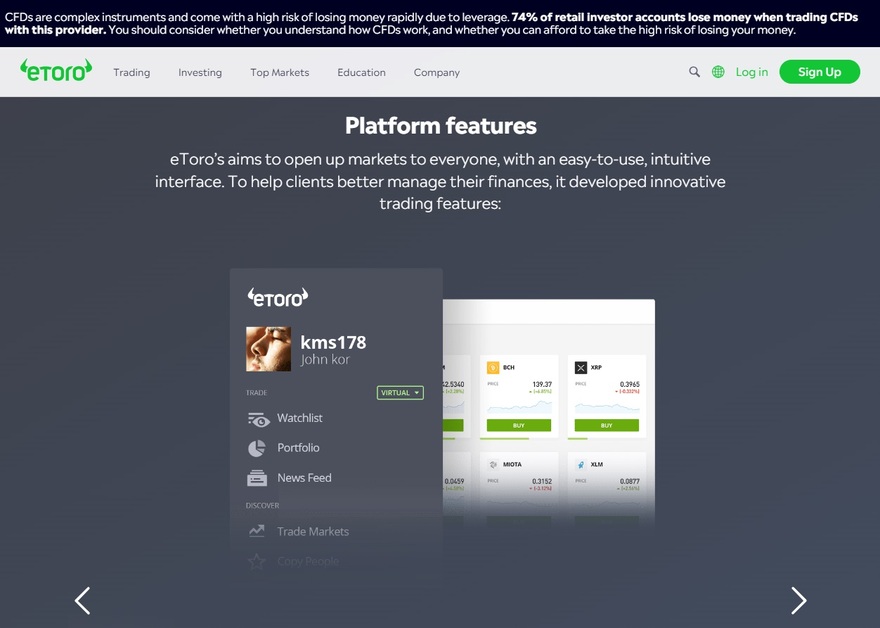

eToro Trading Platforms Overview

The custom eToro trading platform is specially designed for eToro clients. This multi-asset trading terminal can be used on desktop or mobile devices, it only depends on your preference.

Some of the many advanced features that the software offers are analyst consensus, one click trading, watchlist, price alerts, stop loss and take profit, and procharts.

Creators’ idea behind the platform was to make a single, multi-asset platform that all users can easily comprehend and use, regardless of their level of expertise. That’s why the eToro trader features tools and options for both novices and professionals.

Users can access thousands of assets and trade with low and transparent fees. All around a well-made, intuitive and easy to use, eToro platform is almost on par with industry leading platforms.

eToro Deposits and Withdrawals Process

Funding your live trading account at eToro is possible through many depositing methods. Some of them aren’t available in every country. Although considering there’s many channels to choose from, we have no doubt you can still pick a transferring method that is safe and fast at the same time.

A range of payment methods includes:

- eToro Money

- Credit/debit cards

- Paypal, Neteller, Skrill, and other e-wallets

- Bank transfer

All of the funding methods above approve instant deposits except the Bank wire transfer that requires 4-7 days to pass before the funds appear on your account. The minimum first-time deposit varies from $10 to $10,000.

To withdraw your funds, you have to fill in an online form and send a withdrawal request. The processing time may vary, but generally, it doesn’t take more than 10 business days. Be warned that withdrawal requests are subject to a withdrawal processing fee which is $5 for every sum above $30. Plus any withdrawals sent in currencies other than USD are subject to conversion fees.

Education and Resources

eToro Academy is a rich resource of various educational materials. Detailed articles feature all relevant subjects of the trading process. From trading 101, trading basics and more complex guides, a trader of any experience and knowledge level can undoubtedly find something useful.

The simplest articles explain the start to every trading process. You can find the step-by-step instructions on how to install the software, place trades and develop your strategy. Then you can learn how to plan your every investment and how to manage risks. Every tradable asset group is also explained.

Aside from very intuitive and complex articles, you can find webinars, video tutorials, podcasts and sign up for upcoming webinars. The best part of it all is that it provides plenty of knowledge and is completely free!

Customer Support

Contacting the staff at eToro is quite an easy process. The highly responsive staff answers your inquiries in the shortest notice and is helpful in every kind of situation you may find yourself in. Several channels to communicate are available for customers 24/5:

- Email – multiple email addresses are available on the site and you can choose to contact the office that’s in charge of your language area

- Live chat – for instant answers, regardless of your type of problem

- Online form – to send a detailed explanation of the situation, also gets fast replies

eToro Overall Summary

eToro is an honest, reputable broker with several licenses and a company you can trust to keep your funds safe. As mentioned in this eToro review earlier, customers can rest assured their funds are safely kept on segregated accounts and secured from misuse.

Great trading conditions, varying leverage depending on the user area and access to thousands of trading instruments make for an ultimate trading experience. To help you gain edge on every market, eToro offers an outstanding platform with a dedicated mobile app for trading on the go. Trading costs are low and all deposits are instant and fee-free.

There’s many advantages to trading at eToro and we have tried to explain the most attractive of them in this honest eToro review.

Since we’re always brutally honest, we had to point out some negative sides to investing with this broker. Most notable ones are customer support not being available 24/7 and withdrawal fees existing. With the USD being the only main currency, converting fees will apply, too.

eToro is still an excellent broker despite the minor flaws and we wholeheartedly recommend you to try them out.

FAQs About eToro Broker

Are my Deposited Funds Protected at eToro?

Yes. eToro is a brokerage enterprise that incorporates depositing on segregated bank accounts so any misuse of your funds is prevented.

Where Can I View eToro Legal Documentation?

All legal documents are viewable from the eToro official website. Policies, regulatory information and licenses, Terms and Conditions and more can all be found there.

What Are eToro Order Limits and Stop Levels?

The maximum Stop Loss permitted when you open a position is 50% of the position amount.

What Are the Benefits of Becoming an Affiliate?

Biggest advantage of becoming an eToro affiliate are commissions of up to $250 and your own custom affiliate tracking system.

What Bodies Are eToro Regulated Under?

eToro has several regulations and licenses issued by CySEC, FCA, ASIC, and FSAS.