Interactive Brokers Review – Who Is Interactive Brokers?

Interactive Brokers is a trading firm that was founded in 1977. Over their long career as a brokerage, they provide a broad spectrum of services in 120 markets, making them a truly global broker.

Throughout the years, this broker has also won many awards for things ranging from “Best online broker” to “Offering of instruments”.

Aside from the wide array of markets in which their services are available in, this company also offers a diverse set of instruments that their clients can invest in.

They have taken its position as one of the best brokerages globally due to their client-first attitude, easily visible in their low fees/ low commissions and the great trading environment that they provide.

Traders should know that this brokerage is regulated by a number of tier-one regulatory agencies, therefore they are clearly trustworthy. Your money is safe with this broker.

Interactive Broker’s Pros and Cons

Even though this is a legitimate broker with top-tier regulation there are still pros and cons which must be considered when choosing a broker:

Pros

- Strong research tools

- Top-tier regulation

- Low commissions

- Great educational tools

Cons

- Their website is difficult to navigate at times

- Prohibitively high minimum deposit

Overall, this broker’s only real downsides are how confusing their website can be to navigate at times and the high minimum deposit. The firm has clearly put the bulk of its efforts into the segments that truly matter for trading rather than the website itself.

Another issue that comes up with this broker is that, even though they provide a phenomenal trading environment, they also have a high minimum deposit of $2000. This makes this broker more suitable for institutions and professional traders.

| Headquarters | USA |

| Regulation | CFTC, ASIC, FCA, IIROC |

| Platforms | TWS, WebTrader |

| Instruments | Stocks, Options, Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

| Demo Account | Available |

| Minimum Deposit | $2000 |

| EUR/USD Spread | 0.1 pips |

| Base Currencies | Various currencies |

| Education | Professional trading academy |

| Customer Support | 24/7 |

Interactive Brokers Regulation and Security

When looking for a new broker, the first and most important thing traders should look for is the regulatory status. This means making sure that the broker is regulated by a tier-one regulatory agency like

- ASIC

- BaFIN

- CySEC

- FCA

- IIROC

- CFTC

This is something that can be checked on the agency website, by searching for the broker’s legal name.

Traders interested in Interactive Brokers are in luck, as this broker is regulated by a number of tier-one agencies including the CFTC, ASIC, the FCA, and IIROC. This level of regulation allows the broker to legitimately provide their services in over 120 markets, as well as 218 countries.

Trading with this broker is, of course, safe as they are in full compliance with the strict regulations put forth by top-tier regulatory bodies.

Interactive Brokers Account Types Available

As mentioned before, this broker provides its service to institutions and individual traders alike. This is followed through in the account types that the broker offers. Interactive Brokers has made the following account types available:

- Trader

- Institution

The trader account is suitable for those getting into investing, and small businesses. This option has a number of ways the trader can configure their account based on their individual needs.

The institution account is geared more towards larger institutions and meeting their needs. This account type is made for hedge funds, wealth managers, and trading groups.

Having only two account types available may seem to limit but traders should also take into consideration all of the configurations which are available to them. This allows for a truly tailor-made unique trading experience for those who know what it is that they are looking for.

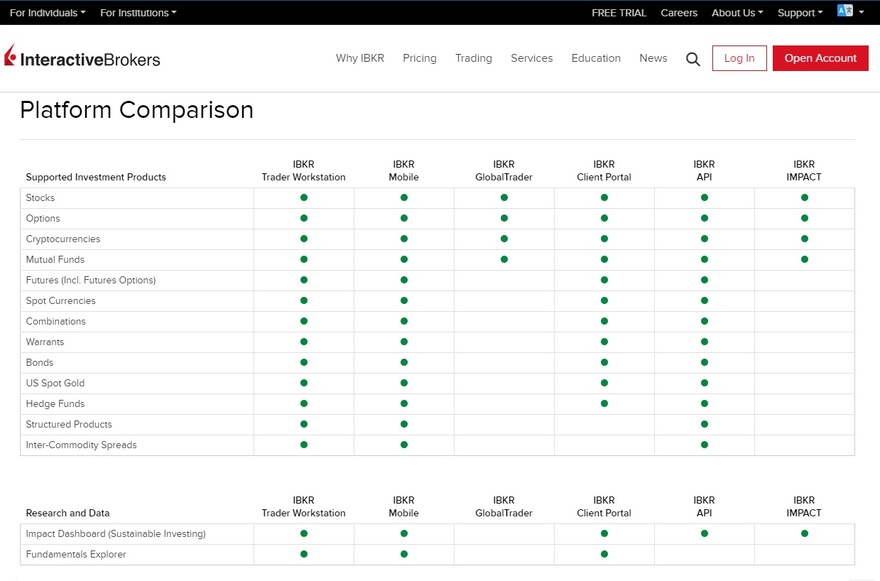

Interactive Brokers Trading Software

Interactive Brokers provides comprehensive trading software for its clients allowing them the ability to trade on desktop, and on mobile.

The desktop platform TWS has won many awards for the platform’s incredible flexibility as well as the diverse set of tools that it offers its users. This award-winning platform offers enough functionality to satisfy even the most demanding traders.

For their mobile trading solution, International Brokers has come out with their own proprietary app called IBKR. This app brings an almost desktop trading experience to its users with the variety of tools that are available.

Aside from the tools, the app makes available users will also see that the app is quite fast and responsive making trading via the app a breeze.

All in all, the platform options brought by this broker are solid, offering traders what they need in order to have a satisfying trading experience with little to no holdups.

Interactive Brokers Available Trading Instrument

One of the biggest benefits of such a long-lasting and well-established brokerage is the variety that they are able to offer their clients. With Interactive Brokers clients can trade the following instruments:

- Stocks

- Options

- Futures

- Forex

- Warrants

- Bonds

- Mutual Funds

- Structured Products

- Physical Metals

- Inter-Commodity Spreads

With this level of diversity, individual traders, as well as institutions, have the opportunity to build a diverse portfolio. It is important to note that with so many options there are few limitations put on the clients.

Interactive Brokers clearly strives to provide a full trading service for their users. This mostly eliminates the need to look for a secondary broker.

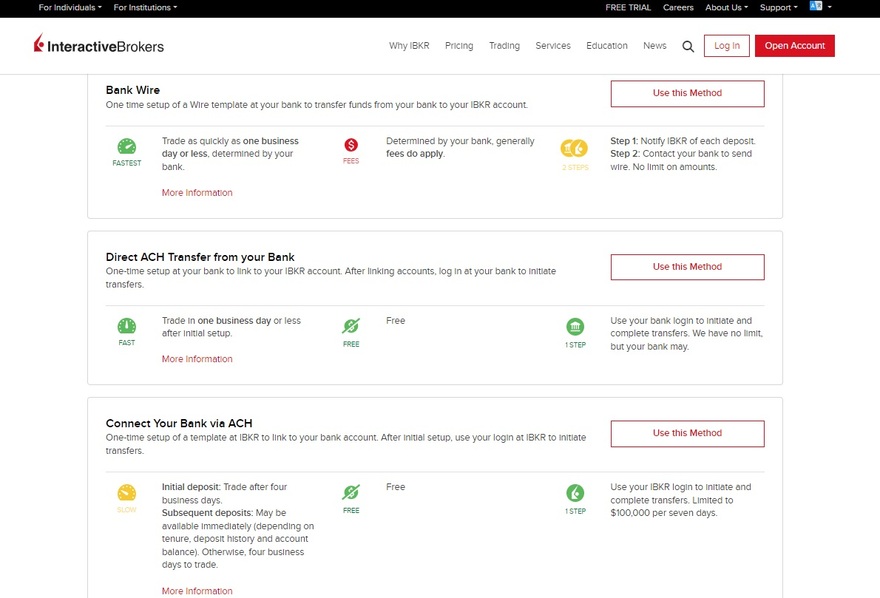

Interactive Brokers Deposits and Withdrawals

Interactive Brokers make the standard payment methods available to their clients; however, traders should check what payment methods are available in their area as this is something that can vary depending on the residence of the trader.

Clients of this broker can make deposits via wire transfer or credit card as well as BPAY and direct rollover (IRA only). This is a fairly standard and straightforward deposit offering.

The withdrawal of funds is made simple by this broker and offers a nice perk. The perk that this broker offers its clients is one free withdrawal per month.

For this withdrawal, all fees are waived. However, all subsequent withdrawals will be subject to their withdrawal fee which thankfully is fairly low.

Education and Resources

In doing the Interactive Brokers review, we have found that outside of the healthy trading environment this brokerage provides, they also give their users access to incredibly useful educational materials.

The primary educational tool is the free trial that they provide. With the free trial, traders gain access to the trading platforms provided by the broker as well as a variety of tools that the broker gives users to ensure their success.

Another tool clients can use is the comprehensive IBKR research tool as well as the news, giving traders a crucial insight into what is happening with the markets at all times.

Finally, the best educational tool offered by Interactive Brokers is Traders Academy. Here traders of all skill levels have a chance to improve and further their education in the investments space.

Customer Service

An item that consistently comes up in all Interactive Brokers reviews is the fact that they have incredible customer support. 24 hours a day 6 days a week clients of this brokerage have access to these means of support:

- Phone

- Interactive chat

The only downside to the support that this broker provides is that they do not have any physical branches in the 218 countries that they provide their services in. This means that there is no way for a client to have a physical in-person meeting for support.

This, however, is more than made up for by the other means of support that the broker provides. We have found them to be incredibly responsive to all three available means of support. All issues that are brought up are quickly handled.

Interactive Brokers Overall Summary

All in all, those interested in Interactive Brokers have come across a quality broker that has many benefits. For starters, clients know that their funds are safe with this broker as they are regulated by multiple top-tier regulatory bodies.

This is not a good enough point to sell someone on using a broker’s services. That is why this broker goes above and beyond by providing a whole host of quality educational material for their users including the Traders Academy.

The trading environment provided by this brokerage is a healthy one and we have not noticed any predatory behaviors that are common among scam brokers.

Furthermore, this broker has developed an extremely intuitive and reactive mobile trading platform allowing for trades on the go with an experience easily compared to the desktop trading experience.

To sum up this Interactive Brokers review in a few words: This is a quality broker that truly puts the client’s needs first.

FAQs About Interactive Brokers

How Do I Open an Interactive Brokers Account?

Opening an account with this broker is very straightforward and happens online.

How Long Does an Interactive Brokers Withdrawal Take?

Making a withdrawal from this broker is simple but the amount of time it takes is dependent on where you are making a withdrawal from as well as the withdrawal method you have selected.

Do Interactive Brokers Offer Demo Accounts?

This broker offers a comprehensive demo account that gives users full access to all the tools provided by the broker.

What Is the Minimum Deposit at Interactive Brokers?

The minimum required to deposit by this broker is $2000 making them more suitable for institutions as well as professional traders.

Do Interactive Brokers Have a Mobile Trading Application?

This broker provides its proprietary mobile trading app called IBKR.