Lirunex Review – All About Lirunex.EU Broker

If you follow the growing trend and are interested in foreign exchange markets, you need a reliable online financial trading company to avoid threats of fraudsters. With this in mind, we have written this Lirunex forex broker review to help you select the right brokerage service.

One of the recommended options for trading is Lirunex. It is an offshore-based company (registered in the Republic of Maldives, lirunex.com) for international traders and a Cyprus-based broker (lirunex.eu) for European customers. Both entities are authorized by a respective financial market regulator.

As for services, generally speaking, this forex provider maintains a secure trading environment along with a popular trading platform and a lot of trading instruments.

Traders can choose from many safe payment methods to transfer funds to and from their accounts. In addition, this brokerage firm is a good fit for beginners due to the adequate learning materials. Also, its customer support is equally good as its other features.

We also recommend reading these licensed brokers’ reviews: IC Markets, Trade Republic, and TIO Markets.

| Headquarters | Republic of Maldives, Cyprus |

| Regulation | LFSA, CySEC |

| Platforms | MetaTrader 4, Lirunex Trading App, ZuluTrade, Chills Trading |

| Instruments | Forex, indices, commodities, shares |

| Demo Account | Yes |

| Minimum Deposit | 500 EUR/USD (EU) / 25 USD (Rest of the world) |

| EUR/USD Spread | 1.5 pips |

| Base Currencies | EUR, USD |

| Education | Beginner’s guide, market analysis, economic calendar, forex calculator, FAQs, trading strategies |

| Customer Support | 24/5 |

Lirunex Regulation and Safety of Funds

In terms of regulation, forex trading is a heavily controlled industry. Financial authorities lay down strict legislation that brokers must comply with.

Trading is risky per se, but dealing with unlicensed brokerage companies is much more dangerous. When it comes to the Lirunex forex broker, you can trade with peace of mind with this company since it is a fully licensed and regulated business.

Since this company has branches in the Republic of Maldives and Cyprus, it holds two trading credentials. The first is awarded by the Labuan Financial Services Authority (LFSA), while the second is certified by Cyprus Securities And Exchange Commission (CySEC).

The latter is considered a tier-two supervisory agency. It covers traders against a broker’s insolvency with the 20,000 EUR compensation fund. Further, Lirunex keeps your funds separate from its assets (i.e., segregated accounts). Hence, in the case of bankruptcy, traders are not affected.

Nevertheless, an adverse event is less probably to occur because, per the CySEC requirements, all brokers must maintain a minimum of 730,000 EUR operating capital. In other words, Lirunex is financially sustainable. It also employs negative balance protection preventing traders from losing more than invested. All in all, your money is protected when investing with this company.

Lirunex Trading Instrument

Regarding Lirunex forex broker markets, this multi-asset broker provides access to a wide range of products across popular global markets. The offer includes as follows.

- Currency pairs (major and minors): EUR/USD, AUD/JPY, CAD/NZD;

- Metals: gold, silver, aluminum;

- Soft commodities: wheat, coffee, corn;

- Indices: NASDAQ Index, FTSE 100, CAC 40;

- Shares: Nike, Apple, Google;

- Energies: crude oil, natural gas, wind power.

Additionally, the Lirunex forex provider ensures you can trade on the preceding markets under auspicious terms of exchange on one of the most sought-after trading platforms (MetaTrader 4).

Account Types Available

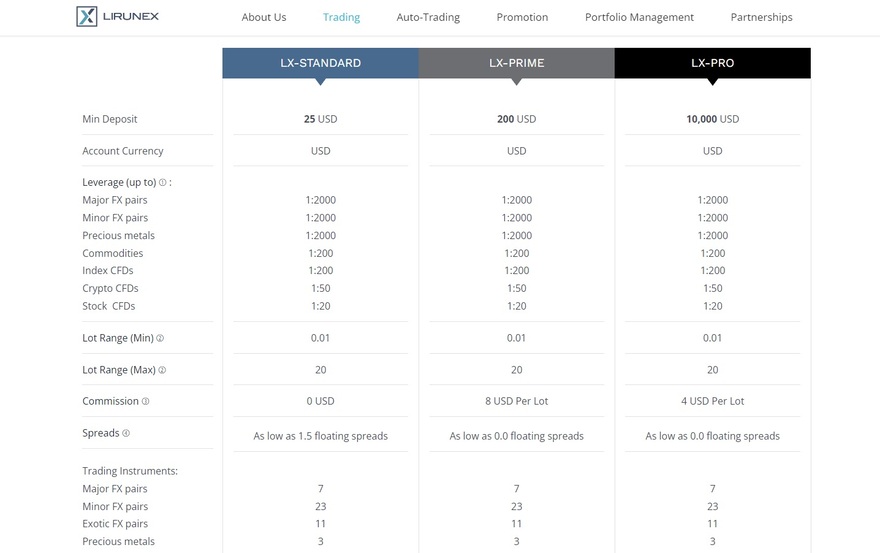

Speaking of types of accounts at Lirunex, this broker provides several options. First, a demo account is available (both at .eu and .com), a handy tool for newbies since it enables trading for free and without risk. Then there is also an Islamic account (only at .com) designed for Muslim traders. Lastly, the following live trading accounts are on offer.

- LX-Standard: 500 EUR/USD minimum deposit, leverage 1:30, commission 0 EUR/USD per lot, spreads 2.0 pips;

- LX-Prime: 2,000 EUR/USD minimum deposit, leverage 1:30, 8 EUR/USD per lot, spreads 0.6 pips;

- LX-Pro: 10,000 EUR/USD minimum deposit, leverage 1:200, 4 EUR/USD per lot, spreads 0.0 pips.

Concerning these terms, they are for EU-based traders (Lirunex.eu) and follow the CySEC/ESMA standard. In contrast, Lirunex.com has different conditions, e.g., starting deposit is 25 USD, and the maximum leverage is 1:1000.

Trading Software Overview

With reference to trading software, the broker keeps pace with leading brokerage companies by providing cutting-edge technology. Alike the accounts, the offer of platforms depends on your location. EU-based clients get access to MetaTrader 4 (MT4).

It is one of the most widely used trading platforms, available as a mobile app, browser-based platform, and desktop version. On top of this, MT4 is user-friendly and contains advanced features like stop loss, copy trading, and fast execution.

Aside from MT4, international traders can choose from a proprietary mobile application and auto-trading services. The former is the Lirunex trading app, downloadable on Google Play and Apple Store, allowing trading on the go. The latter are ZuluTrade and Chills Trading, which enable copy and auto trading.

Deposits and Withdrawals Methods

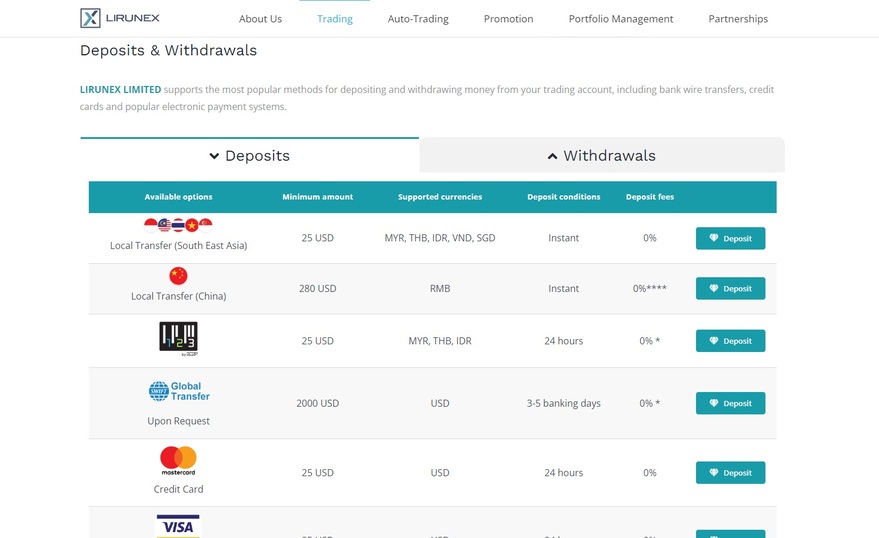

In relation to the deposit and withdrawal procedure at Lirunex, this FX broker accepts a vast array of means of payment and is unambiguous about terms.

So, European traders can use the following funding methods: VISA, Mastercard, wire transfers, ePay.bg, GiroPay, MisterCash, WebMoney, and Sofort. The minimum deposit goes from 50 EUR/USD to 300 EUR/USD, the processing time is up to 24 hours, and the deposit fee is 2%.

As regards withdrawals, EU-based traders can draw funds out via VISA, Mastercard, and bank transfers. Funds appear on your account within 7-10 business days for credit/debit cards and include a 2% fee. It takes 24 hours for bank transactions; there is a 35 EUR fee for global bank transfers, while a 6 EUR fee is for bank transactions within the EU (SEPA).

This broker doesn’t charge for deposits and withdrawals; banking institutions levy all fees. Additionally, the range of payment methods for depositing and withdrawing is broader (including crypto wallets) for international clients.

Education and Resources

As introduced, broker is a good choice for those embarking on forex trading due to its offer of educational resources. The beginner’s guide consists of lots of materials explaining forex trading step-by-step.

However, this broker is equally a good fit for advanced traders who will find helpful market analysis and an economic calendar that provides info about economic events and indicators. Likewise, the forex calculator will come in handy, saving you time. Lastly, anyone interested in this company will appreciate its comprehensive FAQs section answering questions in detail.

As mentioned earlier, a demo account is available at Lirunex. This option simulates real trading, and this company strategies introduce you to the most popular trading strategies and styles and allow you to pick the most suited and test them.

Customer Service

In connection to the Lirunex customer support, it is available 24/5. Traders can seek help via phone, email, and a web form. The Lirunex website (both versions, i.e., .eu and .com) is modern and easy to navigate, consisting of a dedicated section with legal documents, contributing to the broker’s transparency.

On top of this, Lirunex.com is a multilingual webpage available in several languages. On the negative side, both website versions lack online live chat.

Overall Summary

In summary of the Lirunex broker review, this brokerage company enjoys a good reputation and has a proven track record of delivering professional financial trading services. It is accredited by the Malaysian LFSA (Lirunex.com) and CySEC (Lirunex.eu), headquartered in the Republic of Maldives and Cyprus.

Lirunex markets involve plenty of tradable assets, serving clients in the EU and globally. Aside from global reach, transparency, and funds protection, the strength of Lirunex is its modern trading platforms and lots of funding methods. Education is also good. Customer support can be expanded in terms of communication channels.

Overall, whether based in the EU or the rest of the world, you will enjoy the Lirunex competitive and all-inclusive offer.

FAQs About Lirunex Broker

Which Method Can I Use to Withdraw Funds at Lirunex?

Lirunex provides numerous funding methods and a few withdrawal methods (VISA, Mastercard, and bank transfers).

Do Lirunex have Negative Balance Protection?

Yes, it has. Lirunex is a fully licensed broker that provides negative balance protection.

Which Platforms Does Lirunex Offer?

Lirunex offers MetaTrader 4 (Lirunex.eu) and Lirunex Trading App, ZuluTrade, and Chills Trading (Lirunex.com).

Is Lirunex Regulated?

Yes, it is. Lirunex holds two licenses. One with CySEC for its EU branch and the other with LFSA for its international branch.

Does Lirunex Offer Demo Account?

Yes, it does. Lirunex provides a demo account, allowing you to test platforms, conditions, and styles without costs.