SVK Markets Review – Who Is SVKMarkets.Desinian.Co.Uk?

SVK Markets is an FCA-licensed broker that offers trading with a range of assets, including FX, CFDs, and commodities. The broker offers MT4 and a variety of other platforms.

Additionally, this firm provides online spread betting. Our SVK Markets review is a look at the broker’s product line, including spreads, deposits, bonuses, and assets.

Please take the time to read this thorough analysis of authorized brokers such as LCG London Capital Group, TradeATF, and BCR.

SVK Markets Pros and Cons

Pros:

- Forex courses

- FCA license

- Mobile Platform

- 1:200 leverage

- Multi-platform offers including MetaTrader

Cons:

- No bonuses

- Limited payment options

- One live account

- Unverified status with the FCA in the last 12 months

| Headquarters | United Kingdom |

| Regulation | FCA |

| Platforms | MT4, AT Pro, Web & Mobile |

| Instruments | Forex, Commodities, Indices, Shares |

| Demo Account | Yes |

| Minimum Deposit | £100 |

| EUR/USD Spread | 0.72 pts |

| Base Currencies | GBP, USD, EUR |

| Education | Yes |

| Customer Support | 24/5 |

Regulation and Security SVK Markets

SVK Markets is a licensed trading brokerage licensed by the UK FCA. Regulation in the United Kingdom demands that activities be carried out in line with management and service provider standards.

All funds are completely separated and in different bank accounts, guaranteeing that client’s funds won’t be used for corporate purposes.

Furthermore, SVK Markets is a member of the FSCS. This means that in the event of the company’s bankruptcy, it ensures all clients against investment losses up to a maximum of £85,000.

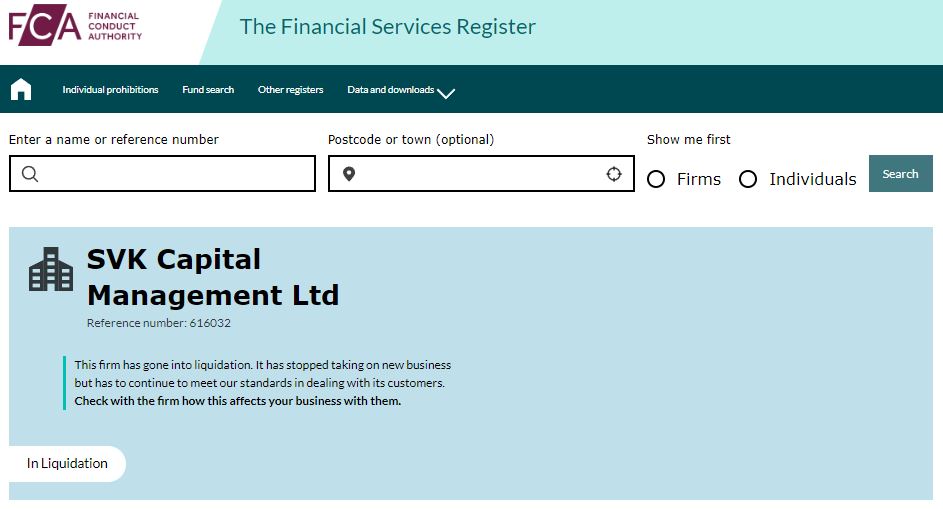

However, we have to mention that SVK Capital Management, the company that owns SVK Markets, went into liquidation last year in June. Meaning that the company has stopped taking in new business. Furthermore, the company hasn’t confirmed its details with FCA in the last 12 months.

Account Types Available

SVK Markets has only one live account. Users can trade the entire range of forex, CFD, and spread betting items. The minimum deposit is $100, with position sizes starting at 0.01 lots. For overseas traders, a variable leverage of up to 1:200 is available.

SVK Markets provides a risk-free demo account. Clients can use virtual funds to try out the broker’s program before risking money. Given SVK Markets’ vast product offer, the demo account could also be a useful opportunity to test interest rates and bond trading.

SVK Markets Trading Software Overview

SVK Markets offers 7 trading platforms.

- AT Pro

- Advantage Web

- MetaTrader 4

- Android Trading App

- iPhone App

- iPad App

- Windows Mobile App

Along with strong trading tools, each piece of software offers its own special features for trading and the ability to trade from any location or device.

AT Pro – Enhances accuracy, productivity, and graphing, taking trading capability to a whole new level. The platform has the most complete charting package, with the option to use various strategies and auto trading.

Advantage Web – Provides a highly adaptable web trading platform with the ability for one-click dealing, or via charts with complex layouts and a user-friendly interface.

MT4 – One of the most effective forex trading platforms, with an impressive array of features and formats to increase trading possibilities. MT4 is also available on mobile devices.

Mobile Trading – The application includes live charts, different order types, and trading history. It is a simple-to-use and free-to-download tool that will fulfill the demands of both new and experienced traders. It’s available on iOS, Android, and Windows devices.

Trading Instruments You Can Trade

SVK Markets provides more tradable products than the majority of well-known brokers, including.

- Forex – EUR/USD, AUD/USD, and USD/JPY

- Shares – UK 100, Germany 30, and France 40

- Commodities – Crude Oil, Energy, Wheat

- Metals – Gold, Silver, Platinum

- Bonds – UK Gilts, Euro Bunds, US bonds

Deposits and Withdrawals Process

Clients can use wire transfers and credit/debit card transactions with SVK Markets. Of course, it appears to have a fairly limited range. However, these payment options are the safest and most common.

SVK Markets require a deposit of at least $100, although you can start trading right away using a demo account without taking any risks.

There are no charges for deposits or withdrawals with SVK Markets, so you can move funds without worry, using the same withdrawal options as your initial deposit.

Leverage and Spread

The leverage levels, which enable trading of larger sizes through the “loan” taken from the broker, may greatly boost your trading skills, but you must learn how to use the tool properly.

Recent regulation changes imposed limits on leverage amounts for retail traders, as officials realized the possible risk of funds being lost.

As a result, SVK Markets, a UK-regulated firm, may provide a maximum of 1:30 for major Forex products and even lower 1:20 for smaller currency pairings or 1:10 for commodities.

During trading hours, SVK Markets’ spreads are 1 point fixed on major FX pairs and indices. While outside trading periods the spreads are tight and flexible. Silver spreads start at 2.5 points, palladium spreads at 4, and gold spreads start at 0.3 points.

Education and Resources

In addition to giving traders access to high-quality trading tools and systems, SVK Markets also offers services that are needed for success. These include learning and educational resources that are vital in the face of changing global market settings.

Regarding education, the broker cooperates with Serene Education, the UK’s top provider of forex training, for their famous client support, world-class forex trading courses, and proven money-making methods.

Customer Service

For traders to accurately manage their assets and use the platforms, technical support is crucial. A decent client service expertise should include prompt and precise resolution of any issues.

Contacting this broker is possible via online form, email, phone, or social media. It does not offer a live chat option as most other brokers do.

SVK Markets Overall Summary

The broker is a well-known broker with plenty to offer potential traders. It’s especially useful for beginners who want to learn about spread betting or CFDs on known financial markets.

The training classes for new traders and the various platform options are also appealing to us. However, we feel dissatisfied with the fees and poor customer help.

The broker is regulated by FCA in the UK. However, it has been in liquidation since June of last year and it has stopped taking on new work. Additionally, when looking up the firm SVK Capital Management Ltd, it seems that the business is temporarily closed.

FAQs About SVK Markets Brokers

How Do I Open an SVK Markets Account?

As of recently, opening a new account on SVK Markets is impossible.

How Long Does an SVK Markets Withdrawal Take?

Withdrawals are typically processed within 3 to 5 business days. Transfers through bank wire may take longer.

Does SVK Markets Offer Demo Account?

SVK Markets does offer a demo account to its potential users.

What Is the Minimum Deposit at SVK Markets?

The minimum deposit required at SVK Markets is £100.

Does SVK Markets Have a Mobile Trading Application?

This broker provides its users with a range of platforms, as well as Mobile trading applications, for people who want to trade on the go.