Tradeview Review – All About TradeView.Eu Broker

Tradeview is owned by Tradeview Europe Ltd, a company offering online financial services. It was established in 2004 and the office is located in Malta. In just a few years, Tradeview became an internationally recognized brokerage company.

The complete story of the company’s growth and expansion can be found on its official website, explained meticulously.

Since the very beginning, this company has managed to provide exceptional service, reliable trading platforms, and efficient customer support. Tradeview is fully regulated and licensed by MFSA and CIMA.

Having been regulated and licensed, this broker provides remarkable trading experience, fast trading platforms, reliable customer service, and a variety of trading instruments.

Attop from all that, some additional learning tools can be found on the site to enhance clients’ trading experience and help them grow as traders.

| Headquarters | Malta |

| Regulation | MFSA, CIMA |

| Platforms | MT4, MT5 |

| Instruments | CFDs on shares, commodities, forex, indices, Cryptocurrencies |

| Demo Account | Yes |

| Minimum Deposit | $100 |

| EUR/USD Spread | from 0 to 0.2 |

| Base Currencies | USD, EUR, GBP, JPY, CAD, AUD |

| Education | Yes |

| Customer Support | 24/5 |

Tradeview Regulation and Safety of Funds

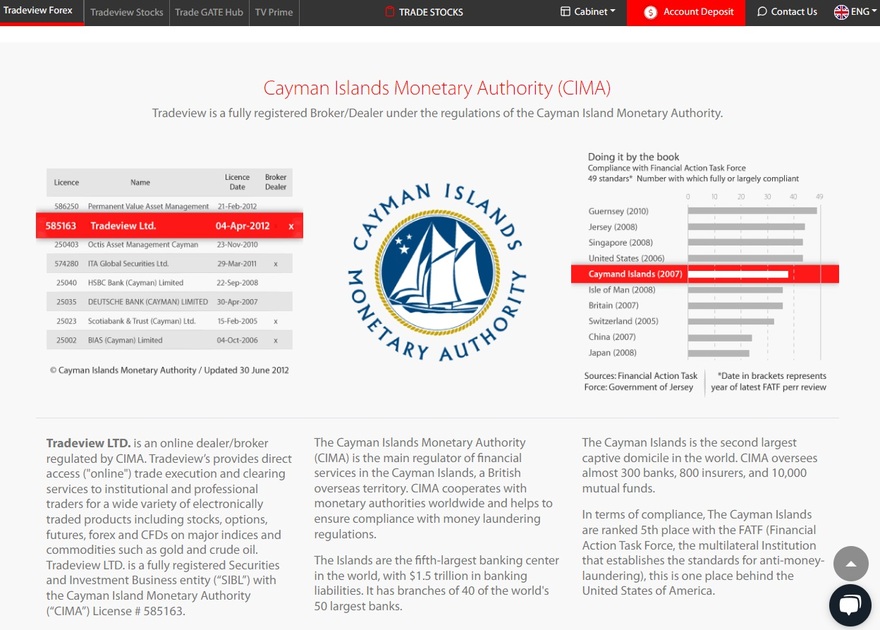

Being authorized by a European regulator and being fully licensed, Tradeview is a brokerage company that can ensure the safety of your funds. This firm is licensed by the main regulator of financial services in the Cayman Islands – the Cayman Islands Monetary Authority (CIMA).

Additionally, Tradeview holds a license from the Malta Financial Services Authority (MFSA), the jurisdictional regulator in Malta.

When a broker is regulated, it means that they have passed the terms and conditions necessary for the regulator to give them a license.

Not every brokerage firm can easily meet those conditions. These rules that govern the broker’s business are strict and are there to ensure the customers can invest safely.

So it is highly recommended to always double-check a potential broker of choice if they are regulated and licensed. Only then will you know that you can entrust them with your funds.

Tradeview Trading Instruments

Tradeview offers trading instruments through the CFD model. CFD means the contract for difference and it’s an agreement between two parties: buyer and seller.

The agreement means that the seller will pay the buyer the difference between the product’s current value and the value it has at the contract expiration moment. If this difference happens to turn out negative, the buyer is obligated to pay the seller.

Some of the asset classes available through CFD are

- Currency pairs (USD/CAD, GBP/USD, AUD/USD, etc)

- Shares in individual companies (Facebook, Tesla, Amazon, etc)

- Futures (oil, coffee, etc)

- Indices (ASX, DAX, FTSE, NASDAQ, Nikkei, and SGX)

- Metals (gold, silver)

- Energies (natural gas, WTI, Brent Crude Oil )

- Cryptocurrencies (Bitcoin, Litecoin, Ethereum)

Tradeview Account Types Available

First off, a potential client can choose if they are willing to start with a Live or Demo account. If they aren’t yet sure about investing, they can give a shot at trading with a Demo account. In case they have already decided to invest, they can straight away start with a Live account.

There are 3 options if a client wants to give access to their account to more than one person:

- Individual account (for only one person)

- Joint account (account used by more than one person, with each party verified)

- Corporate account (account started by a legal entity, authorized by a government)

Two FX account types are:

- Innovative Liquidity Connector Type 7

- Innovative Liquidity Connector Type 5

Both of those accounts offer various features, with slight differences, depending on what the client prefers. ILCT7 includes a spread of $3.5 and an ILCT5 spread of $2.5. The commission per side varies from 0 on ILCT7 and is fixed at $1000 for ILCT5.

Tradeview Trading Software

Trading software available at Tradeview is accessible on desktop or mac, and also on mobile. Trading platforms to choose between are world-class MT4 and MT5.

There are some differences between them, and experts claim that MT5 is faster and generally exceeds MT4 in the overall quality of services.

These trading platforms have become the industry standard over the course of past years for their reliability and speed. Since Tradeview offers access to these platforms for trading, the client can experience exceptional tools and features.

They can deal with thousands of trading instruments across different asset classes. This way, whether they have an experienced trader as a client or just a beginner in the broker world, all their trading needs can be tended to.

MT4 helps users develop their own trading strategy, customize their own charting package, and use it in different languages. MT5 has a built-in Meta-Trader market, you can copy trades and use the Expert Advisor- a trading robot.

Both platforms are very rich in features and users can customize them depending on their personal preferences.

Deposits and Withdrawals Methods at Tradeview

Tradeview offers many ways possible to make an initial deposit. Clients can invest funds via credit/debit card, bank wire transfer, Neteller, PayTrust, PayU, Bitwallet, etc. It depends purely on the client’s preference. The minimum deposit needed is $100.

Withdrawals are processed the same way the deposit was initially submitted from. For example, if the client has made a deposit via a credit/debit card, the money they withdraw will go to that same card.

Tradeview doesn’t charge any additional fees or impose any withdrawal conditions on its clients. However, a $ 10-a-month fee will be regularly charged in case of prolonged inactivity.

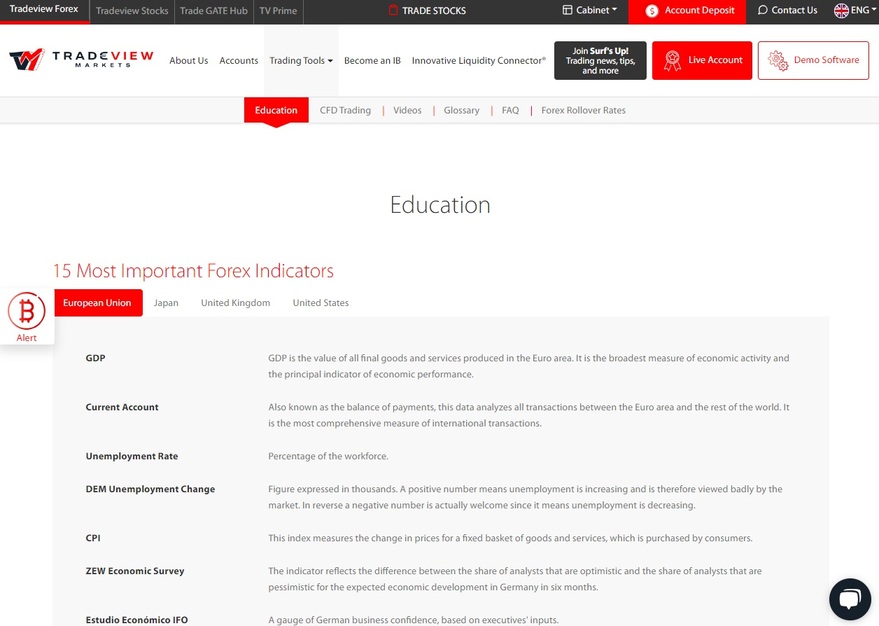

Education Available at Tradeview

Not only does this broker offer a variety of features and excellent trading platforms, but beginners in online trading can get help expanding their knowledge through educational tools found on this site.

There are 3 types of getting extra information on all variables and factors in online trading:

- TradeGATEHub (The Global Active Trading Environment you can join and learn from pro traders in real time)

- Surf’s Up! (news events, key insights, and analysis that would help users invest smarter)

- Tradeview Academy (knowledge and information to develop trading skills or refine the existing knowledge and experience)

Customer Service

Every reliable broker has the purpose of helping clients answer some burning questions as fast as necessary and therefore, have the best experience possible. Tradeview has made sure their customer service is easy to get in touch with.

Clients can either contact support through email at [email protected] or by calling +356 20311017. However, user support is only available during business days, weekends excluded.

This can be seen as a downside to their efficiency, but once contacted, the staff is fast to reply, friendly and reliable.

Besides that, the company provides addresses and contact information of six offices around the world, if the clients would find it easier to contact them in the office.

Tradeview Overall Summary

Having been licensed and regulated, and having a long tradition of successful business and good practice, Tradeview is a reliable and authentic broker. Since Tradeview is regulated, clients can rest assured that their funds are safe.

They can invest and immediately start trading on reliable, user-friendly, customizable platforms. Or, if they choose to, they can first open a demo account and use their virtual funds to test out the trading process.

For all novices in online trading, as well as experienced traders, Tradeview has provided learning options too. Users can either gather new knowledge and useful facts or just expand their already existing understanding of online trading.

In case of any questions and doubts, very fast and effective customer support available 24/5 is there to help the clients and can be contacted via phone or email.

Tradeview has provided their user’s direct access to over 50 liquidity providers which all quotes come directly from. On top of that, orders are executed quite efficiently.

Overall conclusion we can come to is that this trader is worth your time in case you decide to invest here. You will be provided with numerous reliable trading options, services, instruments, and other beneficiary factors to make your trading successful.

While there is always risk in online trading, finding the best broker that can meet your requirements and expectations is the best way to ensure you enjoy your trading experience.

Attop of that, reading online reviews and user experiences can help you choose the broker that best suits your trading preferences.

FAQs About Tradeview Broker

- Which Method Can I Use to Withdraw Funds at Tradeview?

Withdrawing funds work the same way they were deposited (credit/debit card, bank wire transfer, crypto, Neteller, PayTrust, etc).

- Does Tradeview have Negative Balance Protection?

Yes, thanks to automated risk management, accounts are safe from going into a negative balance.

- Which Platforms Does Tradeview Offer?

Tradeview offers Metatrader 4 and Metatrader 5 trading platforms, which are top-tier platforms of today.

- Is Tradeview Regulated?

Tradeview is fully regulated and licensed by MFSA and CIMA, therefore an acclaimed and trustworthy broker.

- Does Tradeview Offer Demo Account?

Yes, you can open a Demo account in case you haven’t decided to invest yet.