Windsor Brokers Review: A Guide to Cutting-Edge Platforms and Tailored Account Options

Founded in 1988, Windsor Brokers LTD is a renowned veteran in the economic industry. They have a capital adequacy ratio of 56%, exceeding regulatory requirements. It’s safe to say they prioritize a secure trading environment. They serve clients in over 80 countries, including Thailand, Indonesia, Malaysia, South Africa, Dubai, and the USA.

So, their global presence is a testament to their credibility. Windsor Brokers has cutting-edge platforms and tailored account options. Join us as we delve into their exceptional features. Keep reading our Windsor Brokers review.

Guaranteeing Safety: Windsor Brokers’ Regulatory Commitments

So, is Windsor Brokers regulated? When it comes to the safety of your investments, Windsor Brokers takes no shortcuts. This truly goes without saying. Operating under multiple regulatory bodies, this broker leaves no room for compromise.

Strict Windsor Brokers Regulations Uphold Trust

With regulations from the Financial Services Commission (FSC) in Belize, the Cyprus Securities and Exchange Commission (CySEC), and compliance with MiFID standards, Windsor Brokers maintains a strong foundation. It’s worth noting that Windsor Brokers Ltd holds licenses from EEA-authorized authorities. This allows them to provide trading solutions within Europe.

We always advise caution when dealing with offshore or non-licensed brokers. Still, Windsor Brokers stands apart. The additional regulations imposed by reputable authorities elevate their status. They also assure clients of their dedication to compliance and protection.

Rest assured, your funds are securely held in segregated accounts with top-tier banks. Windsor Brokers prioritizes data protection. It builds a safe and secure trading environment that instills confidence in its clients. Trust in their commitment to safety and embark on your trading journey with peace of mind.

This broker is also regulated by IFSC (Belize), JSC (Jordan), FSA (Seychelles), and CMA (Kenya).

| General information | |

| Name: | Windsor Brokers Ltd |

| Regulation status: | Regulated Broker, IFSC (Belize), JSC (Jordan), CySEC (Cyprus), FSA (Seychelles), CMA (Kenya) |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | https://windsorbrokers.com/ |

| Active since: | 1988 |

| Registered in: | Cyprus |

| Contact info: | [email protected], https://twitter.com/windsorbrokers |

| Trading platforms: | MT4 |

| Majority of clients are from: | Malaysia, South Africa, Kenya, United States, India |

| Customer support: | Yes, call, email, & live chat |

| Compensation fund: | Yes |

Disclosing Windsor Brokers’ Investment Products

Windsor Brokers’ broad array of products offers limitless possibilities. Since its start, the company has strived to empower investors. They did it by providing seamless access to global markets through an impressive range of trading instruments.

With over 600,000 financial assets at your fingertips, Windsor Brokers ensures you have ample choices to diversify your portfolio. Explore the realm of forex, including crypto, CFDs, futures, metals, and bonds. This will enable you to tap into various market sectors and capitalize on new trends.

Windsor Brokers includes a respectable selection of trading instruments. Their primary focus lies on CFDs and FX. Still, it’s critical to note that asset availability may vary depending on the entity.

Windsor Brokers takes the extra mile to protect you in even the most extreme market conditions. Their robust risk management systems provide unparalleled protection. Also, substantial capital reserves and numerous safeguards protect your investments.

Trading Platforms

Innovation meets functionality with Windsor Brokers’ cutting-edge trading platforms. These guarantee you have the power to conquer the markets. They provide seamless access to trading through carefully selected platforms.

Renowned Windsor Brokers MT4 is at the forefront, a platform trusted by industry professionals worldwide. This powerful execution software empowers traders of all levels with its advanced charting functions. The modern and innovative interface further enhances its appeal.

Thanks to Windsor Brokers’ multi-device functionality, trade whenever and wherever you desire. Do you prefer desktop trading, WebTrader, or mobile and tablet applications? No matter what is your answer, Windsor Brokers has you covered.

Control your trading journey and unlock your full potential with Windsor Brokers’ state-of-the-art platforms. These platforms are designed to empower traders and fuel their success in the dynamic world of finance.

Windsor Brokers’ Account Options: Choose Your Trading Journey

Let’s explore their range of available accounts tailored to meet your specific needs. With a diverse selection, traders can find the appropriate fit for their trading style.

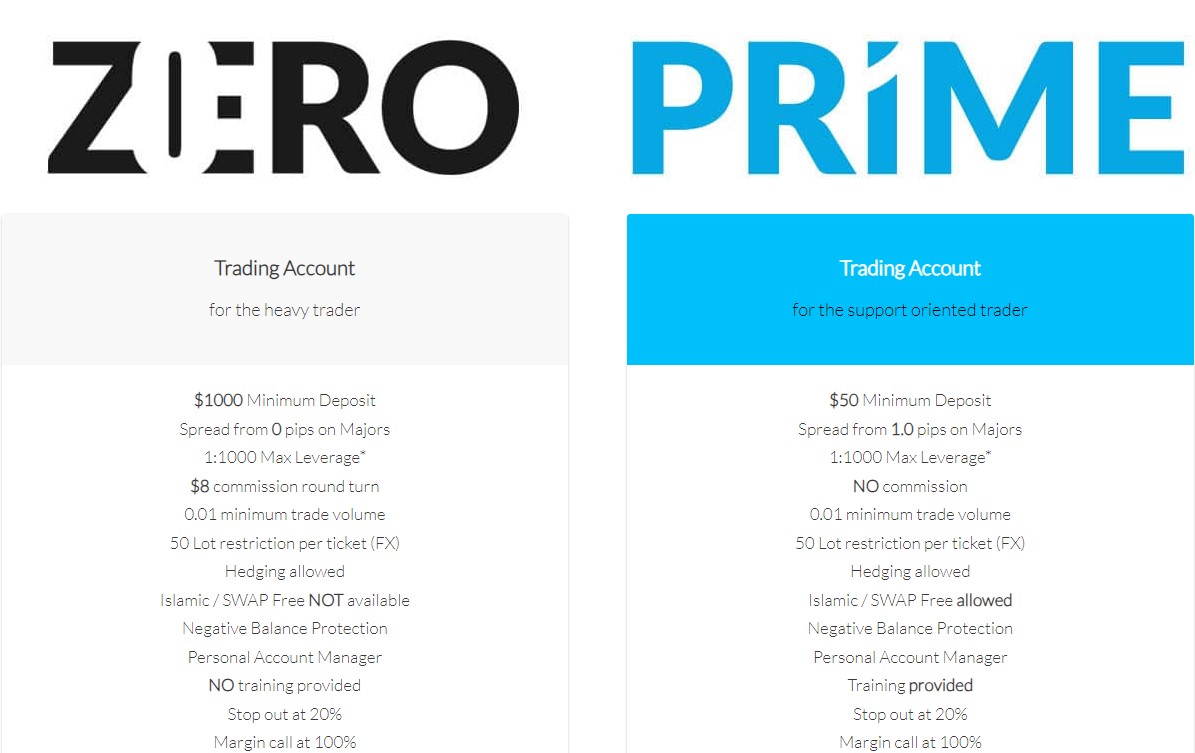

- VIP ZERO. Designed for seasoned professionals, the VIP ZERO account caters to the needs of experienced traders. To access this exclusive account, a higher minimum deposit of $1000 is required. Benefit from a spread of 0 pips, allowing precise execution and enhanced profitability.

- MT4 Trading Account (PRIME). Ideal for beginners and those introducing themselves to trading. MT4 (PRIME) offers seamless access to the world of finance. You will see a minimum deposit requirement of $50. Also, this account grants access to commission-free trading, starting with spreads starting at 1.0 pips.

Both account types share key features. These are a maximum leverage of 1:1000, a minimum trade volume of 0.01, hedging, and negative balance protection. The stop-out level is set at 20%, while a margin call occurs at 100%.

Not yet ready for live trading? Take advantage of their demo account, allowing you to practice and refine your strategies risk-free.

Trading Opportunities

Windsor Brokers has competitive spreads tailored to your account type. The Zero Account starts with a 0 pip spread, ensuring precise execution.

The Prime Account, suitable for newbies, offers an average spread of around 1.0 for EUR/USD. With transparent and fair pricing, Windsor Brokers enables educated trading decisions. Taking advantage of their favorable spreads will maximize your profitability.

If you need help choosing the right broker that works with your trading style, including platforms like Webull, contact us today!

Windsor Brokers Bonus Terms and Conditions

Experience a world of thrilling promotions with Windsor Brokers as we unravel the enticing terms and conditions that come with their exclusive bonuses. These promotions are designed to reward users with a Live account, adding extra value to their trading journey.

Please note that not all supported countries are eligible for these promotions. However, for eligible traders, a range of exciting perks await:

- $30 Windsor Brokers no deposit bonus on Prime Account. A $30 welcome bonus is exclusively available on the Prime account. This bonus provides a boost to your initial deposit, giving you an edge right from the start.

- Up to $10,000 bonus. Enjoy up to $10,000 in deposit bonuses. With a 20% bonus on each deposit, you can maximize your trading profitability.

- Loyalty Program. Windsor Brokers’ loyalty program rewards dedicated traders with rewards. As you continue your trading journey, you earn additional benefits and unlock exclusive perks.

- $30,000 Trading Challenge. Immerse yourself in the ultimate forex trading challenge. Here you can compete for a chance to win a share of the impressive $30,000 prize pool. Test your skills and reap the rewards.

Seize these incredible opportunities and reap Windsor Brokers’ bonus offerings.

Windsor Brokers: Education

Discover a wealth of trading knowledge with Windsor Brokers’ extensive educational resources. Engage in informative webinars where industry experts share valuable insights and strategies. Access a diverse library of educational videos covering various trading topics. You can learn trading psychology at any time.

Expand your trading vocabulary with the extensive glossary, grasping the terminology. Finally, elevate your trading skills today and unlock your full trading potential.

Partnership Programs: Expand Your Connections and Earn Rewards

Partnership programs let you earn additional income. You can connect with others whether you’re an Introducing Broker or interested in the affiliate program.

If you have a vast network of acquaintances, refer them to the firm. By doing so, you connect them with the right partner and benefit financially from their engagement.

The process is straightforward. For every successful referral, you’ll receive compensation based on the services. As long as your referred acquaintances remain active, your rewards will continue.

Customer Reviews: The Enigma of 2.4-Star Ratings

One cannot help but find it perplexing that this reputable broker has a 2.4-star rating on Trustpilot. In a sea of mixed opinions, individual experiences can vary significantly. While some customers may have encountered challenges or expressed dissatisfaction, it is crucial to approach these reviews with a discerning eye.

As with any investment decision, it is wise to conduct thorough research and consider multiple sources. For a free consultation and access to dependable brokers such as LiquidityX, feel free to reach out to us.

Funding and Withdrawal: Simplifying Your Transactions

Windsor Brokers presents seamless funding and withdrawal methods. They truly provide you with hassle-free options.

Choose from a variety of payment methods, including credit and debit cards, Webmoney, Skrill, and wire transfers. These reliable options ensure secure and swift transactions. Windsor Brokers processes deposits and withdrawals instantly, providing prompt access to your funds.

Commission Fee for Zero Trading Account Holders

For users with a Zero Trading account at Windsor Brokers, it’s imperative to see an $8 commission fee. This fee is applicable to each trade executed on the account.

The commission fee ensures fee transparency. Moreover, it allows traders to understand the costs associated with their trading activities.

Windsor Brokers: Pros & Cons

Let’s evaluate the pros and cons of this broker. Stay tuned.

Pros of Windsor Brokers:

- Established reputation

- Global presence

- Regulatory compliance

- Diverse products

- Cutting-edge platforms

Cons of Windsor Brokers:

- Mixed reviews

- Limited account options

- Commission fee

It is advisable to conduct thorough research and carefully evaluate your personal requirements.

Long Story Short – Windsor Brokers

Windsor Brokers is an established and globally recognized brokerage. It has a solid reputation and is compliant with regulations. They present a diverse range of investment products and cutting-edge trading platforms.

Yet, mixed customer reviews and the commission fee for Zero Trading account holders should be considered. Conducting research and assessing personal needs is crucial before engaging with Windsor Brokers, EverFX, or any other broker.

Looking for a trusted broker by your side? Reach out to us, and we’ll connect you with top-notch brokers tailored to your unique needs.

FAQs

What is the Commission for Windsor Brokers?

The commission varies based on the account type and specific trading activities. It is $8 for the Zero account.

Who Owns Windsor Brokers?

Windsor Brokers, founded in 1988 by the late Nicolas Abuaitah, is now led by his son, Johnny Abuaitah.

Are Windsor Brokers Regulated?

Yes, Windsor Brokers is regulated by multiple regulatory bodies, including FSC in Belize and CySEC.