FP Markets Review – Is FPMarkets.Com A Reliable Broker?

FP Markets is one of the most popular brokers for forex and CFD, established back in 2005 in Sydney, Australia. Not only do they have more than 18 years of trading experience but they also follow regulations set by both ASIC and CySEC.

FP Markets is a global company operating in 192 countries and has more than 12,000 clients. It offers low fees and the industry’s best MetaTrader platform.

In continuation of our FP Markets broker review, we will give you all the needed information regarding their services and explain why we think they are a good choice for investing. The table down below will also give you all the necessary information about things like minimum deposit, demo account, and educational materials.

| Country of Regulation | Australia, Cyprus and St. Vincent & Grenadines |

| Products Offered | Forex, Shares, Indices, Commodities, Bonds, Metals, and Digital Currencies |

| Stock Trading Fees Class | Class A |

| Inactivity Fee Charged | No |

| Withdrawal Fee Charged | No |

| Minimum Deposit | $100 AUD |

| Depositing with Electronic Wallets | Visa, MasterCard, PayPal, Bank/Wire Transfer, Neteller, Skrill, Sticpay, Rapyd, Perfect Money. |

| Platforms | MT4, MT5, Iress, Web Trader. |

| Demo Account | Yes |

| Customer Service Channels | Phone, e-mail, live chat. |

Is FP Markets Legit? Regulation and Security

One of the first questions you should ask when deciding whether to work with a broker or not is – is it regulated?

Regulatory bodies monitor the behavior of the brokers and if things go wrong, they will take necessary action. Before trading online with any broker, you should be sure they’re a legitimate online agent. And as for this broker, we can assure you that FP Markets is legit and possesses licenses for providing trading services.

FP Markets is regulated by top-tier regulatory agencies. The Australian Securities and Investment Commission (ASIC) regulates FP Markets activities in Australia, and the Cyprus Securities and Exchange Commission (CySEC), in other locations.

Trading with a regulated company will ensure that traders are not treated unfairly and that everything the broker does, is legal.

FP Markets Fees and Cost

FP Markets broker offers highly competitive pricing through its MetaTrader offering.

As for the IRESS account, the option is less affordable but still good for active traders with high-balance accounts. The charges are based on a commission plus percentage from trade basis according to the instrument.

Overall FP Markets proposes a very competitive offering on the market with no fees charged for withdrawals, deposits, or inactivity which makes fee ranking low.

FP Markets may charge high fees for CFDs (not stock CFDs), but their forex fees are reasonable. For clients on the FP Markets ECN Raw Account, the spread is smaller, and you only pay $3 per lot per trade, as commission. Clients on the Standard Account, on the other hand, will have a higher spread but won’t have to pay commission.

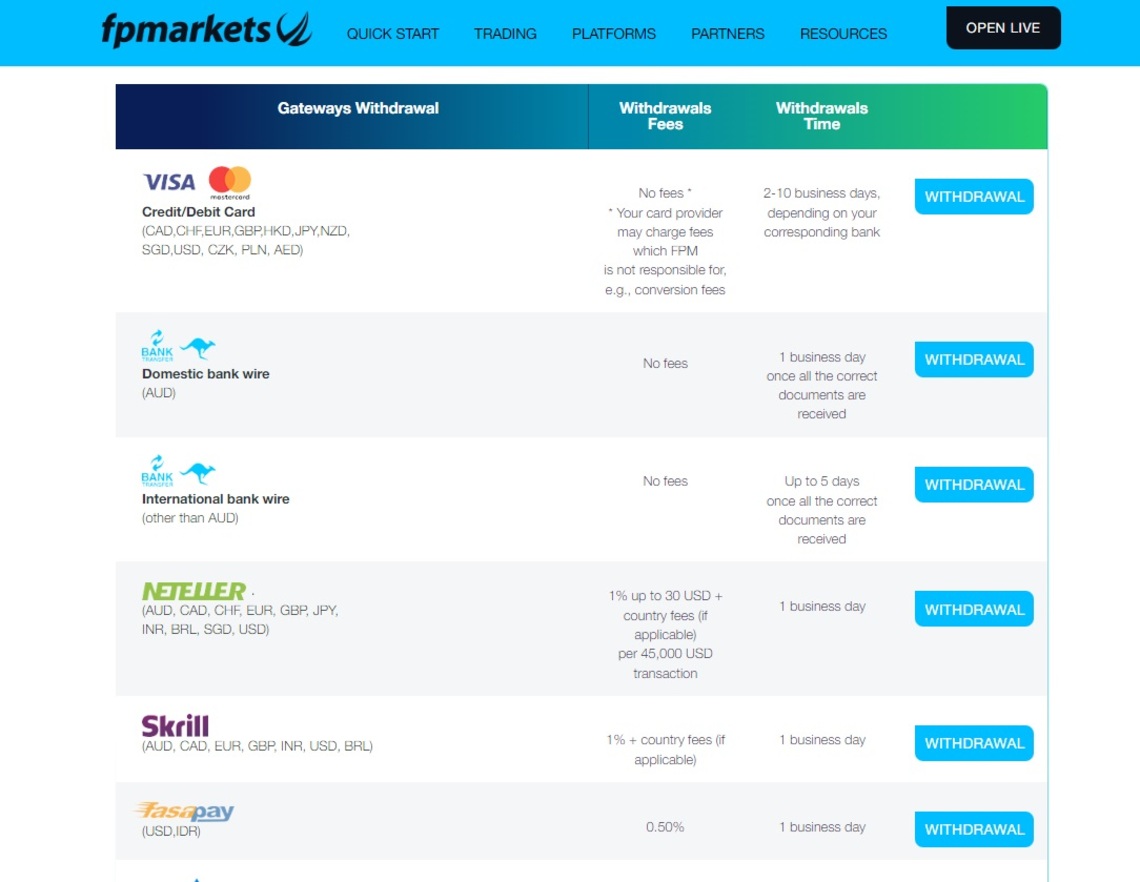

FP Markets Deposits and Withdrawals

FP Markets offers many deposit methods including:

- Visa or MasterCard

- Bank Wire

- PayPal

- Neteller

- Skrill

- PayTrust

- Ngan Luong

- Fasapay

- Broker to broker

FP Markets’ minimum deposit is set at $100 AUD which is not bad, considering the fact that many regulated brokers will ask for much more in order to start trading with them. And as we already mentioned, the broker does not charge any fees for these transactions.

As for withdrawals, the broker also doesn’t charge any fees and offers the same methods as for deposits. On average, the FP Markets withdrawal time is one business day.

Lastly, this broker has no online complaints made against them regarding withdrawal issues or any other problem traders often face while working with some other trading firms. This is why we always urge people to invest with brokers who haven’t violated any terms and conditions as this will ensure your money is safe.

Trading Platforms at FP Markets

This broker has the latest technology in trading software. From popular options like MT to lesser-known platforms, FP Markets has it all.

You can choose from the following:

- MetaTrader 4

- MetaTrader 5

- WebTrader

- Iress

The MetaTrader platforms give users an interface that they can customize to fit their style. It also has one-click trading, live-streamed prices, and many chart types. You can even open an FP Markets demo account if you want to try out these features before actually committing to an account.

Both MT4 and MT5 are available for use across all devices. Mobile device users can get FP Markets to download for iOS or Android and those who trade on the go can access it from their browsers as WebTrader. In case you prefer to be at a terminal, you can also download it and install it on your PC.

MT4 and MT5 are essentially the same, with key differences in some features. For instance, on MT5, you will be given a stunning 61 pending order types, market depth, and automated trading using Expert Advisors, and tools from the MQL5 community.

As for the Iress platform, you will get many of the same features that MetaTrader has.

For example, you can trade straight from your browser without installing or downloading the software and install it into your device.

The prices offered on the exchanges are genuine, while providing you with access to market depth. There are 59 technical trading indicators to aid in analysis, with over 50 tools just for drawing to enhance the analysis further.

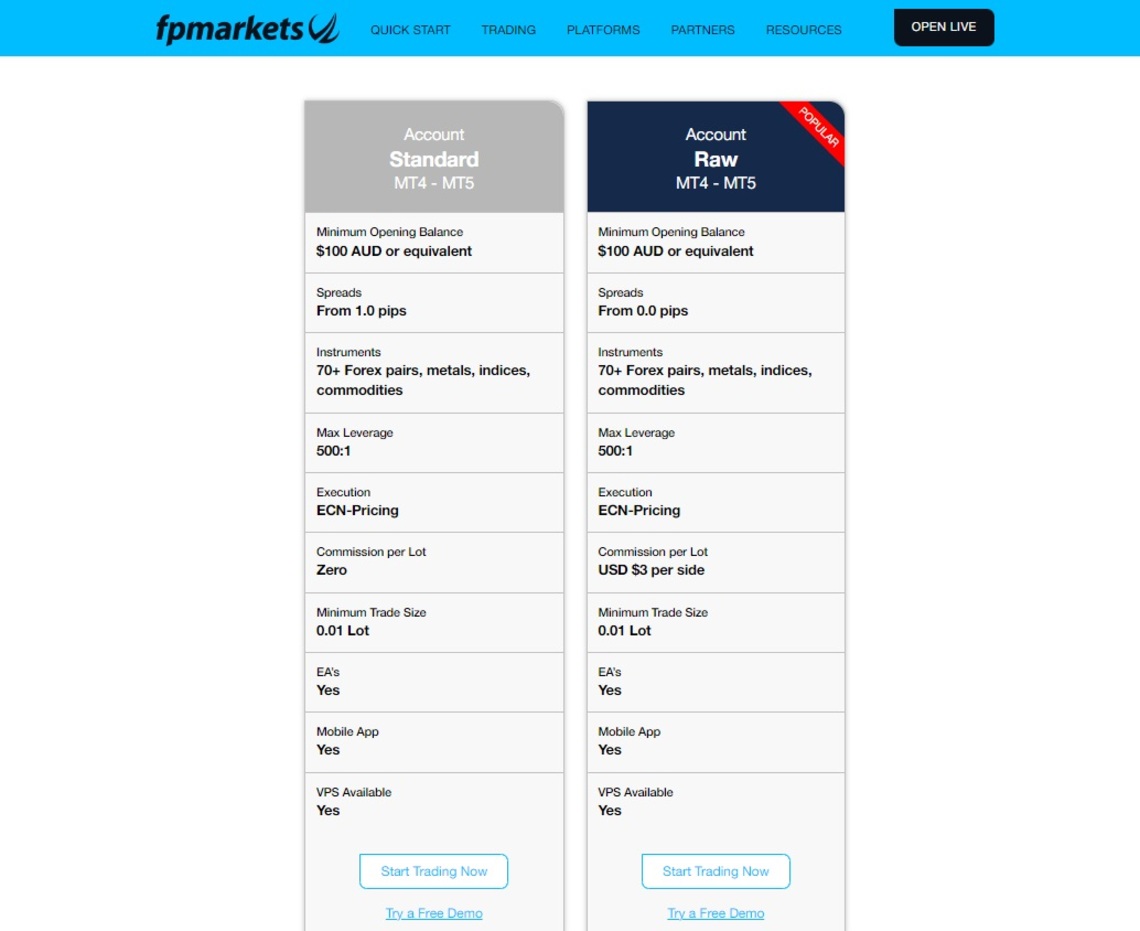

Available Account Types at FP Markets

There are two major FP Markets account types you can choose from when using the MetaTrader platform. They are:

- Standard,

- Raw.

For a standard account, spreads start from 1.0 pips and there is no commission. The minimum deposit is $100 AUD or an equivalent in your preferred base currency. And the maximum leverage is 1:500.

As for the raw account, spreads start from 0.0 pips and the commission is $3.5 USD. There is also the same minimal deposit requirement and maximum leverage.

On the Iress platform, you can choose between three account types:

- Standard,

- Platinum,

- Premier.

Standard account offers AUD 10 min and 0.1% commission per lot. The minimum deposit is $1,000 AUD and equity CFD margin rates start from 3%. Lastly, FP Markets’ base rate is +4.0%

Platinum Account has AUD 9 min and 0.09% commission per lot. Equity CFD margin rates start from 3% and the base rate is +3.5%. The minimum deposit is set at $25,000 AUD

Premier Account has no min and 0.08% commission per lot. Equity CFD margin rates start from 3% and the base rate is +3.0%. FP Markets also has a minimum deposit of $50,000 for this account.

As there are many account types available, we hope that with these basic details, you will know which one is most suited to you. The best thing to consider is the style of trading, strategy, amount of money you are willing to risk, and your level of expertise.

Educational Resources

This broker offers many different forms of educational materials including:

- Articles

- eBooks

- Video tutorials

- Webinars

- Podcasts

You can easily access all of this material under the recourse tab on their website. They also have a YouTube channel full of tutorials that show you how to navigate the platforms provided.

This is great, especially for all of those who are new to trading and may be hesitant to ask many questions. Compared to the other brokers on the market, the level of analysis this broker provides is nothing short of impressive.

Both beginners and advanced traders will find the information easy to grasp and very useful in making trading decisions.

Customer Service

Customer support is available 24 hours a day, 5 days a week. You can reach them via phone, email, or through live chat on their website. They offer support in English, Chinese, Thai, German, Portuguese, Italian, French, and many other languages.

There is also a comprehensive FAQ section where you would most likely get answers to many of your questions. Additionally, you can reach FP Markets via social media on Facebook, Twitter, LinkedIn, and YouTube.

FP Markets Overall Summary

In this FP Markets review, we talked about this well-established Australian broker. It is regulated by the ASIC and has many security measures to ensure a safe trading environment. With this broker, you will get access to multiple trading platforms you can choose from depending on your preferences.

FP Markets also offers a demo account, dedicated customer service, and various types of educational material which can all help you make your trading journey as smooth as possible. The broker also won several awards for having both the most satisfied traders and the best customer support.

FAQs About FP Markets Broker

Is FP Markets a Regulated Broker?

Yes. FP Markets is a licensed broker regulated by both ASIC and CySEC.

How Do I Contact FP Markets Support?

You can contact customer support by calling +44 28 2544 7780, or via e-mail at [email protected].

When Was FP Markets Founded?

FP Markets was founded back in 2005 by Matthew Murphie in Sydney.

What Trading Accounts Are Available at FP Markets?

There are two account types available – standard and raw which offer different spreads and commissions.

What Are FP Markets Fees?

The only fees that FP Markets charge are commission fees on CFD instruments and they depend on financial assets.