FXTM Review – All About Forextime.Com Brokerage

FXTM has received wide recognition, not only from its clients but the industry itself. It boasts more than three million clients across the various iterations of the broker and a plethora of prestigious awards.

In 2021, the FXTM brand received the World Finance Best Trading Experience reward. On top of that, the company has received that very award every year since 2019 without fail.

All in all, FXTM broker has everything for everyone. Whether you are a beginner or an experienced and savvy professional, this is a good place for you.

So, sit back, relax and read this FXTM broker review to learn why they are the best in business and why you should invest with them.

FXTM Pros and Cons

FXTM is an award-winning broker that gives you access to trade a great range of over 250+ financial instruments. They provide you with very competitive trading conditions and powerful yet user-friendly trading platforms. On top of that, the broker also has a range of educational materials and free demo accounts for beginners.

But even with all of that said, there are still some pros and cons of working with an FXTM broker. Here we will list them.

Pros:

- Over 250 financial instruments

- Multiple payment options are available

- Tight spreads

- Regulated company

- Minimum deposit of 10$

- Advanced trading tools

- Zero commissions

- Good support team

- Various live account types are available

Cons:

- Inactivity fees

- Clients from the USA, Japan, and Canada cannot be accepted

- No managed accounts

- No FIX API solutions

| Headquarters | 35, Lamprou Konstantara, FXTM Tower, 4156, Kato Polemidia, Limassol, Cyprus |

| Regulated | Yes |

| Year Established | Since 2011 |

| Execution Type | ECN |

| Minimum Deposit | $10 |

| Trading Platforms(s) | Web, mobile and desktop |

| Signals | Yes |

| US Clients Accepted? | No |

| Islamic Account | Yes |

| Segregated Account | Yes |

| Managed Accounts | No |

| Support Hours | 24/5 |

| Customer Support | Yes |

| Demo Account | Yes |

Is FXTM Safe? Security and Regulation

As an industry-leading brokerage, FXTM takes a very strict approach to its regulation. The company has been on the market since 2011 and it has continued to strive for higher safety for its clients by obtaining various licenses around the world.

Regulation is a very crucial aspect when it comes to forex brokers, and we have outlined the basics of the regulatory regimes FXTM follows.

They are regulated by the following:

- Extinity UK Limited; is regulated by the Financial Conduct Authority (FCA)

- ForexTime Ltd; is regulated by Cyprus Securities and Exchange Commission (CySEC)

- ForexTime Limited; is regulated by Financial Sector Conduct Authority (FSCA)

- Extinity Limited; regulated by Financial Services Commissions Mauritius (FSCM)

With such a high number of licenses, it is clear that the broker is operating with strict governmental oversight. It is also a member of FinaCom, a Hong Kong-based NGO whose main purpose is resolving disputes from the forex markets around the world.

In addition, FXTM is a member of the Investor Compensation Fund that compensates in case of the company insolvency, as well as protected by the negative balance protection and other requirements that are audited on a regular basis by the authority.

It’s safe to say that FXTM broker is one of the most secure brokerages out there that offers amazing products and possibilities.

FXTM Leverage

FXTM offers access to some of the best trading conditions out there. The broker takes special care to provide its clients with only the best leverage, and the lowest spreads and commissions possible.

It’s important to note that the various branches of FXTM have various different services available. High-leverage trading is a rather contentious issue. There are a lot of clients who are just not able to deal with the higher risks of such a trading mode. But there are also experienced traders who make great use of it to multiply their investments.

Here are the leverages that FXTM offers in different branches:

- FXTM UK

The maximum leverage amount allowed for retail clients is 1:30

The maximum leverage amount allowed for professional clients is 1:2000 - FXTM EU

The maximum leverage amount allowed for retail clients is 1:30

The maximum leverage amount allowed for professional clients is 1:2000 - FXTM South Africa

The maximum leverage amount allowed for retail clients is 1:2000

The maximum leverage amount allowed for professional clients is 1:2000 - FXTM Mauritius

The maximum leverage amount allowed for retail clients is 1:2000

The maximum leverage amount allowed for professional clients is 1:2000

The distinction between a retail client and a professional one is another part of the regulatory regime of the Union and the UK. A professional client is one that has a certain amount of money in their portfolio, which is over €500 000. It is also possible to become a professional trader if you achieve a trading volume of over 10 lots annually with the broker.

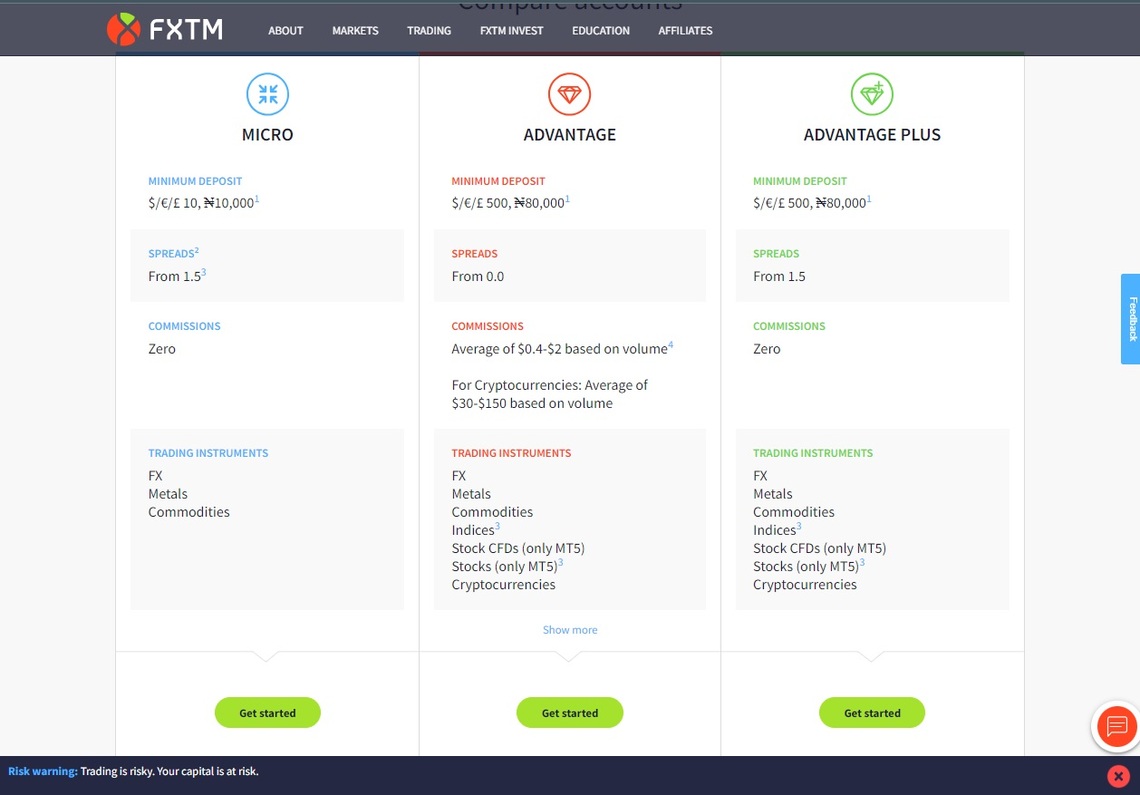

FXTM Accounts Types Available

FXTM offers separate accounts for forex trading and invest accounts. Then there is a further split to your preference of the trading transactions, instrument, and the trading size, which all in all offers you 3 account types.

- Micro trading account

- Advantage trading account

- AdvantagePlus trading account

- Demo account

Trading Instruments at FXTM

FXTM offers a good range selection of markets and account features among the industry brokerage offerings.

The trading markets include 1000+ financial instruments and forex products with over 50 currency pairs. This includes attractive FXTM CFDs on cryptocurrencies such as bitcoin, ETH, litecoin, and ripple.

Also, you may select spot metal CFDs, share CFDs on over 170 major companies, CFDs on commodities, and CFDs on indices.

Overall, there is plenty to choose from and there are available options for both beginners and advanced traders.

FXTM Trading Platforms Overview

FXTM provides access to two of the best trading platforms out there. The company has a distribution of both Metatrader4 and Metatrader5.

It’s important to note that clients from the UK can only make use of the Metatrader4 platform, as FXTM does not offer MT5 to them. However, there is nothing wrong with MT4. In fact, the platform still has a higher number of accounts open on it than the two.

MT4 allows access to automated trading, which is quite beneficial for an inexperienced retail client. It is done with “expert advisors”, which are trading bots that can be purchased from the vibrant marketplace the platform has available. And the successor of the platform, MT5 has taken the winning MT4 formula and refined it further.

FXTM Deposits and Withdrawals Process

FXTM accepts various payment methods but the availability of them depends on the branch of the company you aim to trade with.

Deposit methods:

- FXTM UK

Credit card

E-wallets

Wire transfer - FXTM EU

Credit card

E-wallets

Wire transfer - FXTM South Africa

Credit card

E-wallets

Crypto

Wire transfer - FXTM Mauritius

Credit card

E-wallets

Crypto

Wire transfer

The minimum required deposit for you to start is 10$. You might also be wondering what additional costs these payment methods incur, and while that depends on the payment provider, FXTM covers the costs of deposits. This means that you can pick payment methods like e-wallets and wire transfers that are quite often associated with hefty fees and use them to pay FXTM free of charge.

FXTM withdrawal options are widely available including wire transfers, e-wallets, and cards. The withdrawal fee varies from one option to another. As an example, credit card withdrawal features a 3$ fee, while a wire transfer will cost 30$, and WebMoney will charge 2% above the requested amount.

However, these withdrawal fees are still considered to be on a low level compared to other industry offerings. Applied to some of the payment methods, while others may be provided with 0% commission.

Education and Resources

FXTM hosts regular educational events in various cities around the world while satisfying the demand to start the trading journey and supporting with learning material for everyone who would like to engage in trading.

They offer the following educational materials:

- Webinars

- Seminars

- Platform tutorials

- Trading tools

- Research tools

- Superb glossary

- Forex news

- Economic calendar

- Market outlooks

- Analysts

Customer Support

Another good point in its client-oriented philosophy of FXTM operation is competent customer service that is available through various sources including

- Online live chat

- Phone

- Messenger application

Apart from the positive and high regard from the clients in terms of its good reputation, FXTM also supports a great range of languages, so you always may count on help whenever you need it.

FXTM Overall Summary

In this FXTM review, we talked more about this award-winning broker. FXTM has grown into one of the global leading trading brokers with over 1 million registered accounts, continuing to focus on improving its products and services to keep up to date with the latest trading technologies.

The broker provides traders with convenient access to trade the markets, including CFDs on forex, stocks, cryptos, and commodities. On top of that, they have favorable trading conditions including tight spreads, fast execution speeds, and advanced trading tools whilst providing you with additional risk protection and security as a globally licensed and regulated brokerage firm.

As per the name, the company values time as the most precious commodity above all. Client needs come first, with helpful, skilled, and multi-lingual support, always on hand to assist you every step of the way.

FAQs About FXTM Broker

Are my Deposited Funds Protected at FXTM?

They absolutely are. They are a regulated and licensed brokerage company.

Where Can I View FXTM Legal Documentation?

You can view them on their website, they are fully transparent and available for everyone.

What Bodies Are FXTM Regulated Under?

They are regulated under four regulatory bodies; CySEC, FCA, FSCA, and FSCM.