IC Markets Review – Learn More About Broker

Unlike most of the firms we encounter nowadays, IC Markets review will show you that this is a legitimate broker company. This entity is a global trading company founded in 2007 and based in Australia. They are authorized and supervised by relevant financial regulators. Many positive reviews and customer recommendations are what we think when we pronounce the name IC Markets. IC Markets is primarily a forex broker, but it also provides some CFDs.

Keep reading this article to learn all of the right reasons for going with this intermediary. Things like industry-standard platforms, segregated accounts, negative balance protection, and demo accounts, are just the tip of the iceberg. They offer everything you can think of.

IC Markets Pros and Cons

IC Markets has low forex fees. Also, the account opening process is easy and fast, finished within one day. Things like depositing and withdrawals which are free and user-friendly are very valuable. They have a pretty good selection of platforms those being MetaTrader 4, MetaTrader 5, and cTrader, with options to pick web-based, desktop, or mobile versions of this software.

Their customer support is free and available 24/7, with various options to contact them. Their educating section is great, with a bunch of learning possibilities through webinars, blogs, videos, etc.

Overall, it’s a great choice for a broker company that has many great things about it.

| Country of Regulation | Cyprus, Australia, Seychelles |

| Trading Fees Class | Low |

| Inactivity Fee Charged | No |

| Withdrawal Fee Amount | 0$ |

| Time to Open An Account | 1 day |

| Minimum Deposit | 200$ |

| Deposit with Bank Card | Available |

| Depositing with Electronic Wallet | Available |

| Number of Base Currencies Supported | 10 |

| Demo Account Provided | Yes |

| Products Offered | Forex, Indices, Shares, Commodities, Stocks, Bonds, Cryptocurrencies |

Security and Regulation of IC Markets

IC Markets is regulated by several financial authorities globally – the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Supervisory Authority (FSA), and the Australian Securities and Investments Commission (ASIC). A license and regulation from ASIC, which is one of the strictest and most demanding financial regulators, is the strongest evidence that IC Markets is a legitimate broker.

Also, IC Markets provides negative balance protection for retail customers. This means that you can’t lose more money than what is on your account, i.e. you won’t owe any money to your broker. This is an important type of protection.

What are Available Accounts at IC Markets?

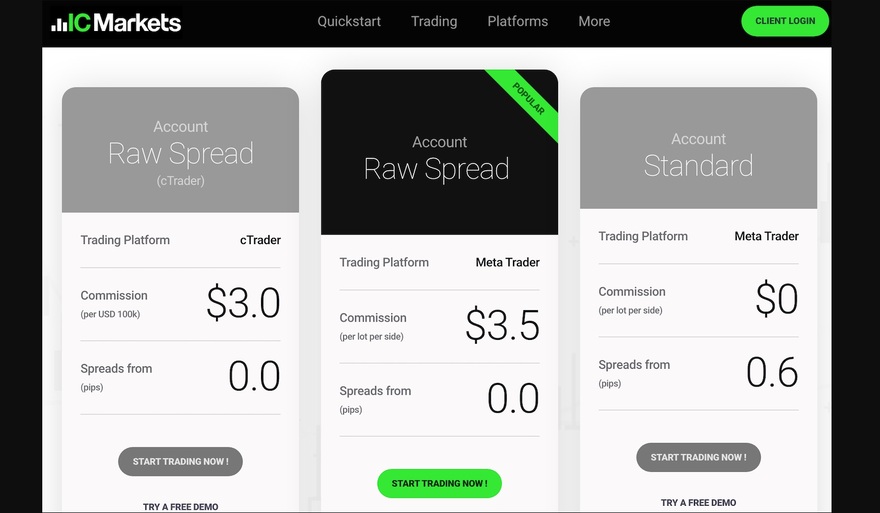

IC Markets offer three different account types:

- cTrader

- Raw Spread

- Standard

They differ in their fee structure and the available trading platform – cTrader and MetaTrader. The two first accounts offer raw spread condition and commission charge per trade, offering either MT4 platform or cTrader.

Opening an account on the IC Markets is very easy, and the estimated time for finishing the online application is about 15 minutes. After that, the account approval takes one business day.

Like most of the legitimate broker companies provide demo accounts, so does the IC Markets. Demo accounts are great for training, especially to start with the broker. The accounts are available in multiple currencies and are fully segregated from the company’s funds, and are supported by a multilingual customer team.

Overview of Trading Platforms

IC Markets doesn’t have a self-developed trading platform. They are using the industry standard platforms – cTrader and MetaTrader 4 and 5. These are the most commonly used software for a very simple reason. They are the best. MetaTrader 4 is the most widely used, and available in a very large number of languages. Also, MetaTrader 5 is available, which is an improved version of its ancestor. It has a lot of new features.

IC Markets platforms are ranked pretty high with an overall rating of 9 out of 10 compared to over 500 other brokers. With the web, desktop, and mobile versions, we can say they thought of every user.

The broker offers social trading through ZuluTrade. ZuluTrade allows you to identify successful traders, and follow their trades, which are then translated into real trades in your broker account.

IC Markets Funding Methods

When it comes to available currencies, IC Markets offers EUR, USD, GBP, AUD, SGD, NZD, JPY, CHF, HKD, and CAD. This kind of variety is great because you can skip the conversion fees.

With IC Markets, there is the possibility to deposit and withdraw funds using next methods:

- Credit and Debit Cards

- PayPal

- Neteller and Neteller VIP

- Skrill

- UnionPay

- Wire Transfer

- Bpay

- FasaPay

- Broker to Broker

- POLi

- Thai Internet Banking

- Rapidpay

- Klarna

- Vietnamese Internet Banking

When it comes to the minimum deposit, IC Markets requires 200$. Some trustworthy brokers set a lower amount, but that doesn’t mean that IC Markets is not a reliable one. Everything we’ve seen about this trader looks very convincing.

Also, IC Markets does not charge additional fees for deposits and apply a 0$ fee for withdrawals.

Research and Education

IC Markets has great research tools, including trading ideas based on technical tools, quality news, and good charting tools. IC Markets provides various trading ideas based on technical tools like indicators and price levels. There are some good charting tools, but the problem is that they do not offer fundamental data.

Also, IC Markets puts a strong point of education on its users. They are explaining the general concepts of the Forex market, some of its basic benefits, and the benefits of trading Index CFDs.

The broker provides general educational videos, platform tutorial videos webinars, quality educational articles, and a lot more things they think beginners need. Let’s not forget the demo account which is a great option for learning.

Keep in mind that this is a trading company founded in 2007, that they are very experienced and know exactly what their customers need. This is the right approach for every intermediary.

Customer Support

IC Markets strives to offer not only the best technological solutions but also to understand the necessity of high-quality customer service and support. The broker provides 24/7 bilingual customer support. You can contact them by:

- Live chat

- Phone

IC Markets has great phone support. We were connected to the customer service representative within a couple of minutes and we received relevant answers.

The email support also works very well. We have sent a couple of emails and got answers within a day to all of them. The answers were helpful and relevant. We also liked that they asked for feedback about the support service.

On the negative side, its live chat is not the best quality and is a little bit slow. But they are improving this area of their customer support constantly.

They are doing everything they can to obtain their current customers, and obtain new users.

IC Markets Overall Summary

IC Markets is a broker company that every customer should be happy with. They are an experienced trading company that’s providing a lot of great benefits for its users.

Its forex fees are low and opening an account is fast and easy. Deposits and withdrawals are free of charge and the process is user-friendly. Industry-standard platforms, demo accounts, and a bunch of funding options are all that their customers expect and also get.

The best evidence of how much they care about their users is their 24/7 customer service, as well as their education. They are giving everything they’ve got to get satisfied customers. Our advice is to go with this intermediary without any doubt. You won’t regret it.

FAQs About IC Markets Broker

Are my Deposited Funds Protected at IC Markets?

Your deposited funds are completely safe at IC Markets, since this is an authorized broker company, with years of track record, and a bunch of positive reviews.

Does IC Markets Offer Demo Account?

Just like most of the other legitimate brokers do, so do IC Markets provide demo accounts. They are great for beginners.

What is the Minimum Deposit at IC Markets?

The minimum deposit at IC Markets is 200$. There is a variety of depositing options.

What Are the Benefits of Becoming an Affiliate?

There are many benefits like highly competitive, volume-based payments, fast profit withdrawals, zero sign-up fees, fast executions, and much more.

What Bodies Are IC Markets Regulated Under?

IC Markets is regulated under the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Supervisory Authority (FSA), and the Australian Securities and Investments Commission (ASIC).