IFC Markets Review – All About Forextime.Com Brokerage

IFC Markets was established in 2006 and has since expanded its services while focusing on innovative trading approaches. IFCM Cyprus Limited, IFC Markets, and NetTradeX Limited are all part of the IFCM Group, which has been active for 14 years. IFC Markets prioritizes transparent and trustworthy client relationships.

Clients trade with the highest bid and ask prices on each financial instrument in the trading terminal, ensuring orders are executed at the best price. What’s more, IFC Markets provides its diverse trading offerings to over 120,000 clients. The IFCM group is also involved in developing financial tech projects in compliance with international regulations. Let’s dive into more by reading this full IFC Markets review.

| Headquarters | 4th floor, 3020, Limassol, Cyprus |

| Regulated | BVI FSC, CySEC |

| Year Established | 2006 |

| Execution Type | ECN/STP |

| Minimum Deposit | $1 |

| Trading Platforms(s) | NetTradeX, MT4, MT5 |

| Signals | Yes |

| US Clients Accepted? | No |

| Islamic Account | Yes |

| Segregated Account | Yes |

| Managed Accounts | Yes |

| Support Hours | 6:00 – 19:00 |

| Customer Support | 24/5 |

| Demo Account | Yes |

IFC Markets Pros and Cons

Pros of IFC Markets:

- Regulated by respected financial regulatory authorities, providing the safety of your funds

- A wide range of trading instruments, including forex, CFDs, and commodities

- Offers competitive spreads and low minimum deposit requirements

- Provides access to advanced trading platforms, including its proprietary platform

- Offers multiple account types to cater to diverse trading styles

Cons of IFC Markets:

- Limited customer support options

- Limited educational resources for newbie traders

- Limited research and analysis tools compared to some other brokers

Is IFC Markets Safe? Security and Regulation

IFC Markets is subject to regulation, governance, and management by respected financial regulators. These are BVI FSC and CySEC.

There is More

Trading with a regulated broker is crucial for ensuring the safety of your funds, as well as maintaining the integrity of the financial markets. A regulated broker is a company that has obtained a license from a regulatory authority to operate as a financial services provider. This license is only granted after the broker has met certain requirements and standards.

A few of these measures include having adequate capitalization, implementing proper risk management procedures, and adhering to strict rules and regulations.

What happens when you trade with a regulated broker? You can have confidence that your funds are held in segregated accounts, separate from the broker’s operating funds. This means that even in the unlikely event, your money will remain safe and available for withdrawal.

What’s more, legit brokers must adhere to strict standards of conduct and are subject to regular monitoring and supervision by the regulators. This oversight helps to ensure that the broker operates fairly and transparently. It also helps to ensure they are not engaging in unethical practices that could harm their clients or the financial markets.

IFC Markets Leverage

Traders’ leverage levels are set by IFC Markets according to the country where they reside and the regulatory restrictions in place.

The maximum leverage level is 1:400. Leverage is a tool that allows traders to increase their potential returns by maximizing their initial balance. However, traders who invest large sums of money face an increased risk of significant losses. You should keep this in mind.

IFC Markets Accounts Types Available

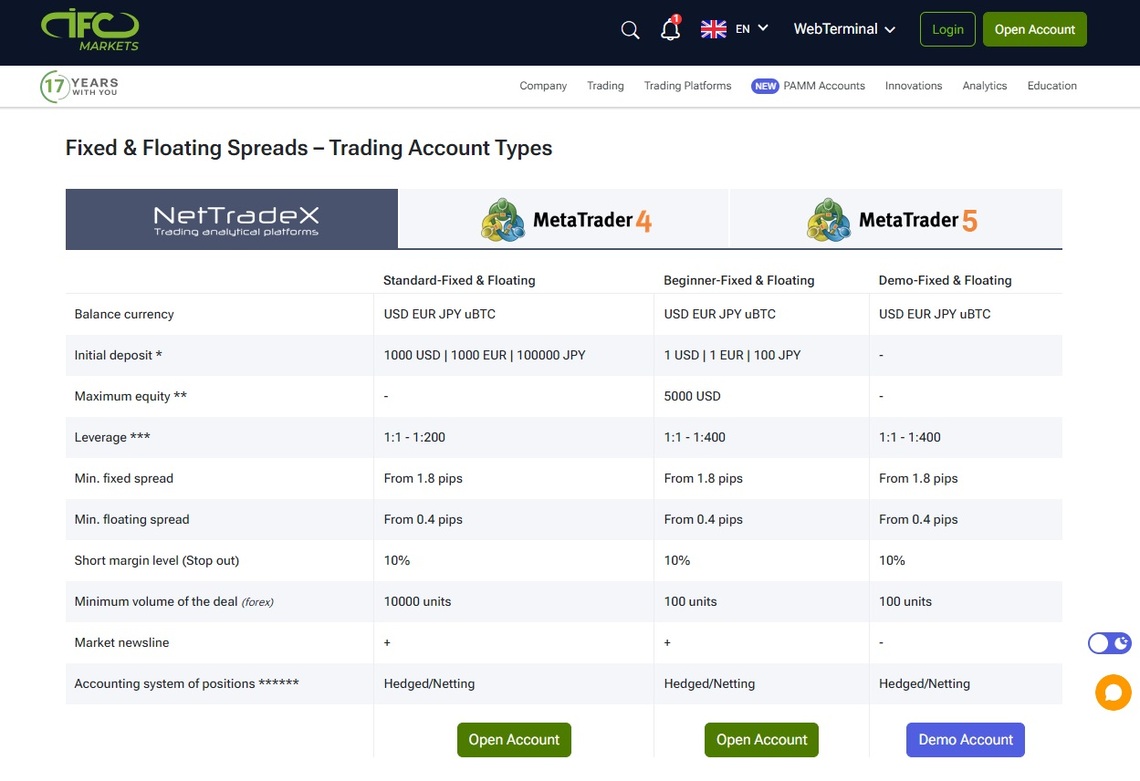

IFC Markets provides various trading account options with both fixed and floating spreads for each of its trading platforms. This includes NetTradeX, MetaTrader 4, and MetaTrader 5.

Clients can choose from 3 currency options for their online CFD and Forex trading account: USD, EUR, and JPY, with the additional option of uBTC (1 uBTC = 0.000001 Bitcoin) for NetTradeX.

In addition to real trading accounts, which allow clients to fund and trade with real money, the company also offers free demo accounts that operate with virtual funds. These demo accounts are designed for studying the functionality of trading platforms and testing trading strategies.

Trading Instruments at IFC Markets

What about trading instruments at IFC Markets? Know that different entities under the IFC Markets Brand may offer various trading instruments. This is due to regulatory restrictions. The trading instruments available may also vary based on your country of residence and the entity that holds your account. Furthermore, the trading instruments offered by IFC Markets may differ depending on the trading platform selected.

With IFC Markets, you can choose from a wide selection of over 143 instruments to trade. For those seeking to trade currency pairs on the global Forex markets, IFC Markets provides a diverse range of currency pairs.

IFC Markets Trading Platforms Overview

IFC Markets provides a choice of 3 trading platforms, including the well-known MetaTrader4 and MetaTrader5, and the in-house developed NetTradeX.

MT4 has been a popular Forex trading platform since its launch in 2005. It’s available on PC, iOS, Mac OS, and Android. Recently, IFC Markets has introduced WebTerminal to the list of applications, which has quickly become popular among traders due to its speed, and easy accessibility without the need for downloads or installations.

For clients who need to work on multiple accounts at once, MultiTerminal is specifically for them. Traders who prefer automated trading can use the MQL4 program language, integrated into the MT4 trading platform. This one enables them to create trading bots and advisors.

In recent years, MetaTrader 5 has gained popularity among traders. Compared to the popular MT4 platform, the new MetaTrader 5 provides traders with an extended list of tech indicators and a large number of intervals for charts. IFC Markets also offers the benefits of its own professional trading terminal, NetTradeX, alongside the most popular trading platforms, MetaTrader 4 and 5.

IFC Markets Deposits and Withdrawals Process

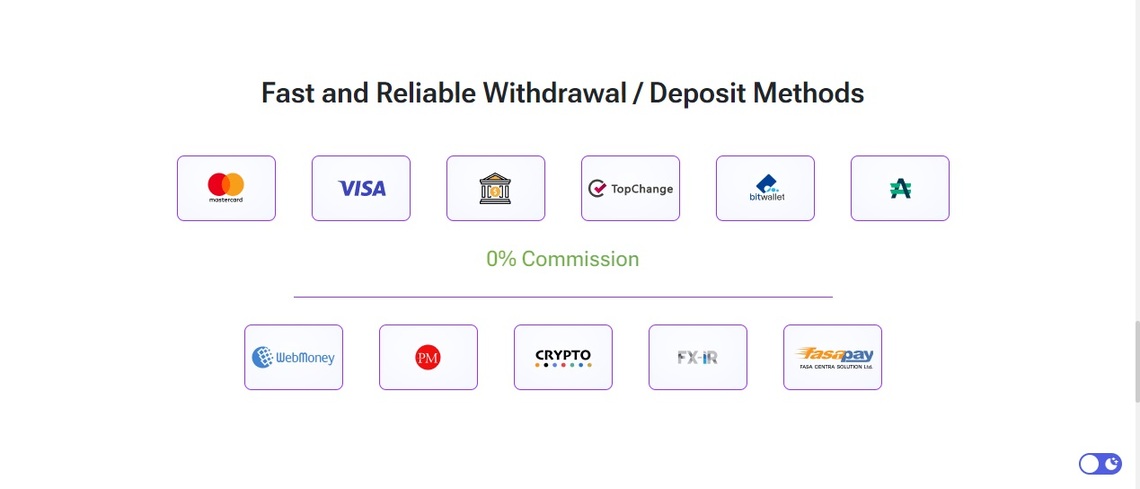

The company offers a wide range of payment methods including Bank Transfer, Perfect Money, Visa or MasterCard, CashU, Bitwallet, TCPay, WebMoney, Bitcoin, Unistream, and others. Deposit minimums and fees vary by funding option.

There are some deposit and withdrawal fees covered, but traders should check with customer service for differences by country of origin. Withdrawal options and fees are the same as the corresponding deposit method.

Note: The availability of multiple payment methods is essential for a broker. It enables clients to fund their accounts and withdraw earnings quickly. Offering many payment options also makes it easier for traders from other parts of the world to access the platform. Besides, using many payment methods enhances transparency, reduces the cost of transactions, and draws more clients to the broker.

Education and Resources

To trade effectively with IFC Markets, it’s crucial to fully understand their trading tools and the markets. Use all available education tools, both from IFC Markets and external sources. IFC Markets offers a variety of educational resources, so take advantage of them.

Learn how the markets move, how your trading platform works, and how to manage investment risk. It is imperative to have an analytical approach and think systematically and logically about the markets. This may be a new skill set, but it’s necessary for successful trading. This is critical to remember.

Customer Support

What is there to know about customer support? To succeed with IFC Markets, you should fully understand that there is always someone to assist you. IFC Markets provides highly qualified customer support in 18 languages. Traders can get in touch with IFC Markets through email, Live Chat, phone, Skype, WhatsApp, Telegram, and the trading desk. Also, it’s helpful to know that customer support is available 24/5.

The FAQ section is split into 4 sections and all questions not listed here can be directed to support representatives using any of the above contact methods.

Customer support is a focal point of the trading experience when it comes to FX brokers. Forex trading is a complex and dynamic field. So, you should know that it requires significant expertise and knowledge. As a trader, you may encounter a variety of issues or questions during your trading journey.

Having access to responsive customer support can help to ensure that your questions are answered, your queries are addressed, and any issues that arise are resolved promptly. This can help to minimize downtime and avoid any negative impacts in general.

In addition, customer support can also provide valuable educational resources. Think about tutorials, webinars, and market analyses, for instance. These resources can help you improve your trading skills and keep up-to-date with the latest market trends. This is critical, by all means.

IFC Markets Overall Summary

IFC Markets left us with a lasting impression. They are a well-established group of companies that provide access to a wide range of instruments, including FX and CFDs, as well as new markets and a broad portfolio. Its business model focuses on building transparent and trustworthy relationships with clients through STP execution, a proprietary platform, and multiple platform options.

With tight floating and fixed spreads from market liquidity providers, IFC Markets ensures the best possible choice of ask and bid prices. Moreover, the broker provides support in various languages, education, and multiple account options.

FAQs

Are my Deposited Funds Protected at IFC Markets?

Yes, your deposited funds are protected at IFC Markets. IFC Markets needs to keep your funds in segregated accounts as a legit broker.

Where Can I View IFC Markets Legal Documentation?

What Bodies Are IFC Markets Regulated Under?

It is regulated by the British Virgin Islands Financial Services Commission (BVI FSC) and the Cyprus Securities and Exchange Commission (CySEC).