Jalatama Review: A Limiting Broker With Serious Concerns

If someone asked us to point to an example of a limiting broker, we would only look at Jalatama. As a result of this broker’s narrow range of services, we struggled to come up with content for this review.

And that we find both frustrating and indicative of the broker’s legal standing. Jalatama does not meet basic standards and cannot be taken seriously. Please read the review to find out why this broker is not worth investing in.

Jalatama Legitimacy: Indonesian Regulation and Its Limitations

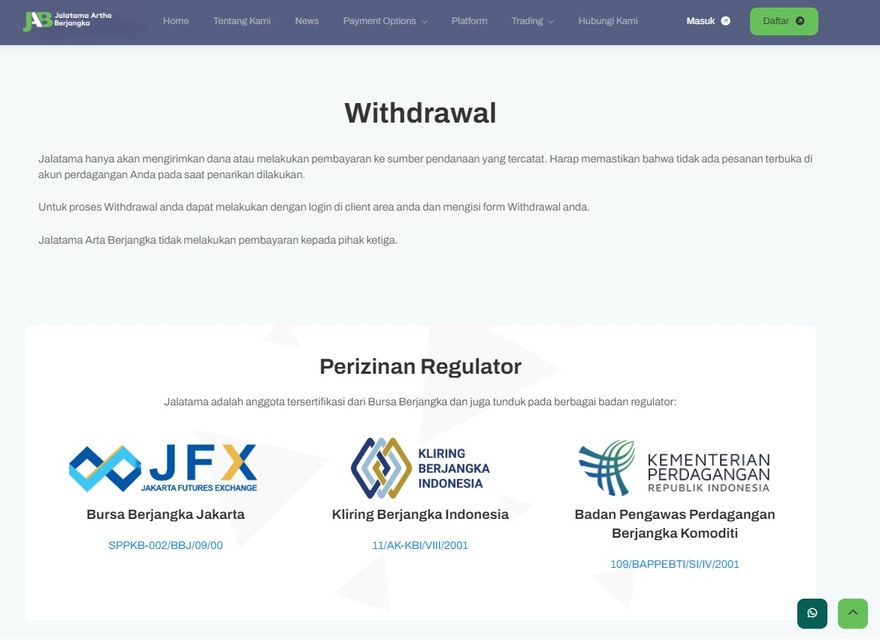

Let’s look at how the Indonesian regulatory system works first. We should do that so we can determine whether Jalatama Artha Berjangka’s claims of full regulation spectrum are valid.

All Indonesian forex brokers fall under Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) regulations.

Also, BAPPEBTI operates under the Indonesian Ministry of Finance’s supervision. Jalatama Artha Berjangka has a registered office in Jakarta, Indonesia. We have verified its BAPPEBTI registration and membership on the Indonesia Commodity & Derivatives Exchange.

Yet, it’s essential to note that Indonesia’s regulations lag behind world financial hubs like the UK and EU. This limited regulatory supervision raises concerns for investors from more regulated jurisdictions. Consequently, Indonesia suffers from a lack of capital investment from these jurisdictions. This lack of investment limits the growth potential of the Indonesian economy and the ability to generate sustainable returns.

Note: Investors, beware! The Securities Commission Malaysia (SC) has issued a warning against the Jalatama broker. Exercise caution and stay vigilant in your financial decisions. In addition, the Central Bank of Malaysia has also issued a warning against the Jalatama broker. It’s vital not to ignore this.

| General information | |

| Name: | Jalatama Artha Berjangka |

| Regulation status: | Regulated by BAPPEBTI Indonesia |

| Warnings from Financial Regulators: | SC, the Central Bank of Malaysia |

| Website link: | https://jalatama.co.id/ |

| Active since | 2000 (2004 for domain age) |

| Registered in: | Indonesia |

| Contact info: | email at [email protected]. |

| Trading platforms: | MT5 |

| The majority of clients are from: | Indonesia

Malaysia Ethiopia United States India |

| Customer support: | email at [email protected]. |

| Compensation fund: | No |

Jalatama’s Trading Assets Available: A Skeptical Offering

Jalatama trading company claims to provide a wide variety of financial instruments, including Forex, Gold & Silver, and Stocks. Yet, their website offers very limited information on trading conditions. This lack of transparency is a red flag for investors. Their claim of having tight spreads is unconvincing due to the absence of average figures and important trading details.

Investors should be wary of investing in Jalatama due to a lack of key information. It is wise to look for other brokers who can provide more detailed information on their trading conditions.

Yet, they assert that clients’ funds are kept in segregated accounts in reputable Indonesian banks, which is encouraging. More on this later on!

Jalatama: Trading Platforms Available

Jalatama offers the MetaTrader 5 platform for both PC and mobile devices, providing ease and convenience in trading. Also, Jalatama mobile app comes in many languages including English, Arabic, French, German, Italian, Japanese, Russian, Spanish, Chinese, and Turkish.

Clients can enjoy one-click trading, adjustable leverage, and automated trading features. It offers accessibility and flexibility for traders on the go. Clients can also access the latest market news and analysis, view real-time quotes, and access over 50 technical indicators.

All these features make the Jalatama MT5 platform an ideal choice for traders. Even so, you should be aware of the potential risks associated with offshore brokers or suspicious clone companies like Medco Finance.

Trading Environment: Incomplete Information Raises Concerns

Jalatama Artha Berjangka lacks sufficient details about their trading conditions. Crucial information such as offered leverage, spread, minimum deposit requirement, and types of accounts is missing. Legitimate brokers openly disclose such information, raising a red flag for potential investors. Without average figures to back their claim of tight spreads, Jalatama’s credibility is questionable.

On a positive note, they state that clients’ funds are kept in segregated accounts at reputable Indonesian banks (BCA, CIMB Bank, and BNI). This segregation prevents the broker from using clients’ funds for their purposes.

It’s worthwhile to note that UK and EU brokers also offer client account segregation. They offer that along with additional protections like negative balance protection and participation in compensation schemes.

Jalatama’s Offerings: Types of Orders Explained

Jalatama provides various types of orders for clients to manage risk and open new positions in financial instruments trading:

- Limit Order: Allows clients to conduct orders when the market reaches a predetermined level. It permits buying below the current market price and selling above it. Buy Limit executes when the market falls, while Sell Limit executes when the market rises.

- Stop Order: Enables clients to buy below the current market price or sell above it. The Stop-Loss Order is commonly used to limit losses when the market moves against the customer’s expectation.

Note: Stop orders cannot be executed without an existing open position. The Jalatama Stop Loss is intended to limit any further potential losses. It is used to lock in a position by buying or selling when the market price reaches a certain level.

Can I Earn & Withdraw From Jalatama?

Jalatama Artha Berjangka only accepts wire transfer payments, without the chargeback option available with credit/debit card payments. This limitation may concern traders seeking flexible payment options.

Unlike many legitimate brokers that accept multiple payment methods, Jalatama’s narrow selection is another indication of its limited and questionable services.

Note: Choose a regulated broker authorized by the FCA, like Medifinance Limited, to guide you on your financial journey.

Jalatama’s Withdrawal Process

Jalatama provides minimal information about its withdrawal process. There is no mention of a minimum deposit requirement, but the lack of detailed withdrawal conditions raises suspicions. Fake brokers often use vague withdrawal terms to their advantage, causing significant concerns for potential investors.

Jalatama should provide more detailed information about its withdrawal process to avoid doubt. Investors need to know the withdrawal requirements and timeline before investing. Transparency will also protect investors and ensure legitimate transactions.

Customer Support: A Missing Piece

Jalatama lacks a robust customer support system. The absence of any information regarding customer support options on their website raises questions.

It mainly raises questions about the broker’s commitment to assisting clients when needed. Keep this in mind.

Note: Due to a lack of transparency, we highly recommend avoiding this broker, as well as any similar ones, such as MEX Atlantic.

Trader Reviews: Beware of the Risks

As we delved into Jalatama’s operations, we had many things to see. We came across numerous negative reviews from traders who had unfortunate experiences with the broker.

Complaints ranged from difficulties with account registration and deposit to rejection of withdrawal requests. These reviews emphasize the risks associated with Jalatama investing.

Exposing Sneaky Broker Tactics

Broker swindles are cunning and employ various tactics to deceive people. Here’s a simple breakdown of their tricks:

- Fake websites. They create professional-looking websites to appear legitimate.

- Unrealistic promises. They lure victims with promises of guaranteed high returns.

- Pressure tactics. They use aggressive sales tactics to rush decisions.

- Phantom riches. They claim hidden opportunities to entice investments.

- Disappearing acts. They vanish once the money is invested, leaving victims in the dark.

Beware of these tricks to protect yourself from broker deceptions!

Long Story Short – Jalatama

All in all, our review of Jalatama points to significant concerns and risks associated with this offshore broker. Limited transparency regarding trading conditions, restricted payment options, and poor customer support are clear warning signs.

We strongly advise against investing with Jalatama, as the potential risks outweigh any perceived benefits. Instead, opt for globally recognized brokers that adhere to stringent regulations, ensuring your funds’ safety and security. Always conduct thorough research and due diligence before engaging with any online trading platform, including Jalatama.

If you need help choosing the right broker that fits your trading style and preferences, contact us today! We have experience in helping clients choose the best broker for their needs. Our team of experts can help you make an informed decision to ensure your investments are protected. Get in touch with us today to learn more.

FAQ Section

Is Jalatama Regulated?

Jalatama regulations are very weak. Jalatama claims to be regulated by Bappebti, and we have confirmed its registration.

What Is the Minimum Deposit with Jalatama?

That information was not disclosed. We don’t know the Jalatama minimum deposit requirement.

How much is the Jalatama Withdrawal Fee?

There is no information available regarding withdrawal fees or any other fees.