JP Markets Review – All About JPMarkets.Co.Za Broker

JP Markets Review, No one can deny that online financial trading is worthwhile. But with the rising number of bogus brokerage firms, it is more challenging. Beginners are especially vulnerable to various fraudsters.

Anyway, with forex providers like JP Markets, Forex trading is safe and sound. Reasons for this are that the JP Markets forex broker is verified and trusted, offers plenty of payment gateways, and holds numerous awards for service excellence.

Along with that, we strongly recommend that you read this analysis of licensed brokers at TIO Markets, Invast Global, and SVK Markets.

| Headquarters | South Africa (RSA) |

| Regulation | FSCA (FSP license) |

| Platforms | MetaTrader 4, a proprietary mobile trading app |

| Instruments | Forex, Crypto, Commodities, Metals, Futures, Indices, Stocks, Energies |

| Demo Account | Yes |

| Minimum Deposit | 0 USD |

| EUR/USD Spread | 2.0 pips |

| Base Currencies | ZAR, USD, GBP |

| Education | Total trader, forex trading education, economic calendar, blogs, online courses, FAQs, trading workshops, glossary, how-to documents |

| Customer Support | 24/5 |

JP Markets Regulation and Safety of Funds

Let’s begin this JP Markets broker review with the most important aspect of forex trading–the safety of funds, which is achieved and ensured by licensing and regulations. Remember, every brokerage service must be authorized by a respective financial market authority to operate legally.

As Africa’s largest FX broker, the broker is headquartered in South Africa—a jurisdiction regulated by the Financial Sector Conduct Authority (FSCA).

Complying with the RSA law, this company is licensed under FSCA and is fully legitimate, which indicates that your money is totally protected here. Also, this broker keeps your money in credible bank institutions such as Absa, FNB, Standard Bank, and Nedbank.

Not only that, broker implements a range of measures to lessen risks inherent in trading and maintain a secure trading environment.

For example, it provides negative balance protection (you can’t lose more than initially invested), segregation of funds (if the broker ceases trading, your money is not affected), reliable trading platforms, zero fees, convenient and safe funding/withdrawing methods, and dedicated customer support.

Although trading is a risky endeavor, with JP Markets, you are closer to success.

JP Markets Trading Instrument

Access to global markets and trading under favorable terms of exchange are what make JP Markets stand out from the rest. The JP Markets markets offer plenty of tradable assets across the following categories.

- JP Markets Forex includes majors, minors, and exotics: ZAR/USD, GBP/EUR, CAD/AUD

- Crypto: Bitcoin, Ethereum, Tether

- Commodities: wheat, rice, corn

- Metals: gold, silver, platinum

- Futures: aluminum futures, Dow Jones futures, crude oil futures

- Indices: S&P 500, Nasdaq 100, FTSE100

- Stocks: Tesla, Apple, Microsoft

- Energies: Brent crude oil, natural gas, gasoline.

Account Types Available

Apropos from trading accounts, there are two types available at JP Markets—ECN and STP. Both of them come with the same number of trading instruments and similar costs. But there is a slight difference in how you are charged for trading.

In other words, ECN is a commission-based account; traders are charged 10 USD per lot. Holders of the STP account are charged on spreads; for example, spreads start at 0.7 pips, whereas EUR/USD spread is 2.0 pips.

Trading Software Overview

Trading on the JP Markets forex broker markets is enabled through modern trading platforms. There is MetaTrader 4—which is among the best in class trading programs. It eases trading by having a customizable and user-friendly interface and providing cutting-edge tools such as stop loss and social trading. The former enables you to set buy/sell prices and limits the risk, while the latter allows you to copy the most successful traders.

Aside from that, MT4 is versatile and convenient, meaning it is accessible on different devices—desktop version, mobile app, and browser-based platform.

Also, this broker has its proprietary mobile trading application (JP Markets) for android and iPhone; it can be downloaded on Google Play and Apple Store—enabling trading on the move.

Deposits and Withdrawals Methods

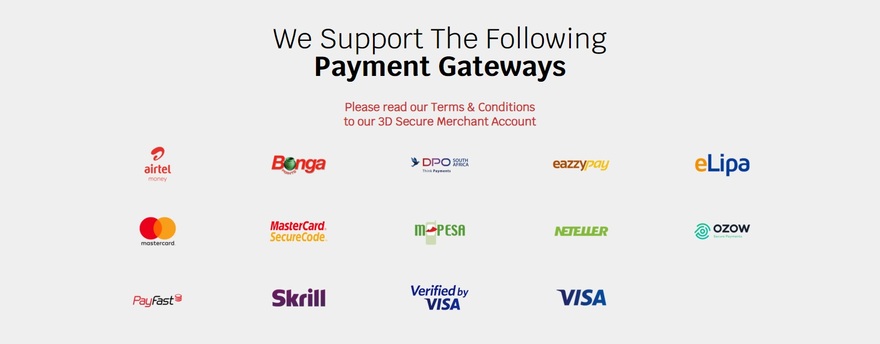

When it comes to the depositing and withdrawing process, JP Markets is unambiguous about that. That is to say, it is clearly displayed what payment methods are accepted.

So, traders can transfer money to and from JP Markets accounts through credit and debit cards, bank wire transfers, and a range of digital wallets (Skrill, Neteller, Ozow, eLipa, EazzyPay, DPO, Bonga, Airtel).

Deposits are not charged by the company; transaction fees depend on the selected payment gateway. Also, it takes up to one business day for your funds to become available/visible on your account.

Regarding withdrawals, this brokerage firm doesn’t levy any fees concerned with payoffs, but a payment institution might incur transfer costs (check it with your bank). The processing time is quick, up to several hours.

However, you must comply with the JP Markets security procedure. That means that before drawing funds out, you must validate your identity by uploading relevant documents (ID card, bank account details, proof of residence).

JP Markets Offers Bonuses and Promotions

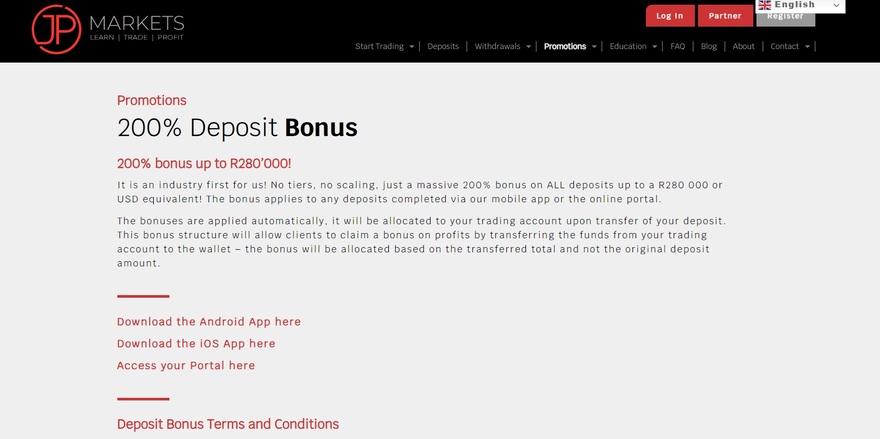

Speaking of JP Markets promotions, there are several options—a welcome bonus, a JPM card, and earning interest.

The JPM welcome bonus is a 200% deposit bonus awarded to your account automatically; it applies to all deposits up to 280,000 ZAR or 16,000 USD.

The JPM MasterCard allows you to manage funds online and ATM withdrawals; all holders of JP Markets’ live trading accounts with at least a 300 USD balance are eligible to apply for the card. However, it can be used only in South Africa.

With reference to interests, JP Markets enables traders to make profits from their account balance and returns. The interest rate is 7.2% annually and is distributed weekly.

Education and Resources

JP Markets provides access to a broad spectrum of learning materials, enabling traders to learn the ropes of trading and hone their trading skills. Its total trader, forex trading education, and glossary are resourceful introduction tools helping beginners to better understand forex trading.

Also, an economic calendar and blogs keep you up to date with recent developments in the global markets. In addition, you can book an online course and attend nationwide workshops.

Finally, the FAQ section and how-to documents equip users with all the relevant information.

Customer Service

As with all other features, customer support is great at JP Markets. It is available 24/5, and clients get support through different channels such as web form, email, and phone. The JP Markets website is well designed and easy to navigate through pages and find anything you are interested in. The complaints section enables customers to contact the compliance department regarding any issues.

JP Markets Overall Summary

In the conclusion of our JP Markets forex broker review, let’s go through the main advantages of trading at JP Markets. First and foremost, it is a licensed and regulated brokerage firm, authorized by the South African financial market regulator (FSCA) to provide forex trading services.

Also important, this broker enjoys a high reputation for providing prosperous trading conditions, advanced platforms, transparent deposit and withdrawal methods, lots of educational resources, and professional customer support.

Overall, we highly recommend this forex broker to all traders, especially those based in South Africa and within the African continent.

FAQs About JP Markets Broker

Which Method Can I Use to Withdraw Funds at JP Markets?

You can use credit/debit cards, bank transfers, and many e-wallets (Skrill, Neteller, etc.).

Do JP Markets have Negative Balance Protection?

Yes, it does, along with segregated funds.

Which Platforms Does JP Markets Offer?

It offers MT4 and its proprietary mobile trading app.

Is JP Markets Regulated?

Yes, it is authorized by the South African financial authority (FSCA).

Does JP Markets Offer Demo Account?

Yes, it does, which allows you to practice real-life trading for free.