Kiplar Review: Can You Trust Kiplar.com?

Upon visiting the Kiplar broker’s website, we immediately noticed that all the information was presented in Russian. It’s worth noting that the company is not officially affiliated with Russia, which raises questions about its origins and motivations. In this comprehensive Kiplar review, we’ll delve deeper into the matter and try to shed some light on the matter.

| Broker Status: | Unregulated Offshore Broker |

| Regulated by: | No Regulation |

| Operating Status: | Active |

| Scammers Websites: | Kiplar.com |

| Blacklisted as a Scam by: | AFM, CONSOB, FSMA |

| Broker Owner: | Kiplar Ltd |

| Headquarters Country: | Saint Vincent and the Grenadines |

| Foundation Year: | 2020 |

| Online Trading Platforms: | WebTrader / Kip / MT5 |

| Mobile Trading: | Yes |

| Minimum Deposit: | $250 |

| Deposit Bonus: | No |

| Crypto Asset Trading: | No |

| CFD Trading Option: | Yes |

| Available Trading Instruments: | Forex, commodities, indices, shares |

| Maximum Leverage: | 1:400 |

| Islamic Account: | No |

| Free Demo Account: | No |

| Accepts US Clients: | No |

| Site Grid: | No |

Kiplar – License and Fund Security

In the age of online trading, setting up a web page and claiming to be a broker is easy. We know for a fact that there is a number of broker scams such as Kiplar, Target Trading, and more. Yet, true legitimacy involves fulfilling specific requirements. Our investigation centered on whether Kiplar was a regulated and legitimate brokerage company.

There are some interesting things about them for sure! Kiplar Ltd, the company behind the brand, is based in Saint Vincent and the Grenadines, which lacks financial regulations. As a result, brokers should be registered in countries where they offer financial services.

We searched major Tier 1 registers like FCA, BaFin, and ASIC, but found no evidence of Kiplar regulation. Based on this, we can conclude that Kiplar is a fake broker, and traders should avoid it at all costs.

Note: People and businesses who sell trading systems, such as signal sellers or robot trading, may sell things that are not tested and do not make money.

Trading Platform Overview

Despite the many warning signs we mentioned earlier, it is still essential to review the Kiplar trading platform. This is even though trading with an unregulated offshore broker is strongly discouraged. Kiplar offers its proprietary WebTrader, the Kip trading platform, which closely resembles the popular MT5 and has most of its features.

Sadly, Kiplar’s leverage is unregulated and can go as high as 1:400, which is much higher than most Tier 1 regulated brokers. Moreover, the spread is higher than usual and exceeds 2 pips for the EUR/USD pair. This means traders are likely to face higher transaction costs.

In conclusion, while Kiplar may show a trading platform that resembles the popular MT5 platform, the lack of regulation, fake leverage, and high spreads make it an unattractive option. As such, it is highly advised to seek regulated brokers to ensure your funds’ safety and the smoothest trading experience.

Note: It is also wise to refrain from engaging with either NuxTrade or Market Giants broker scams.

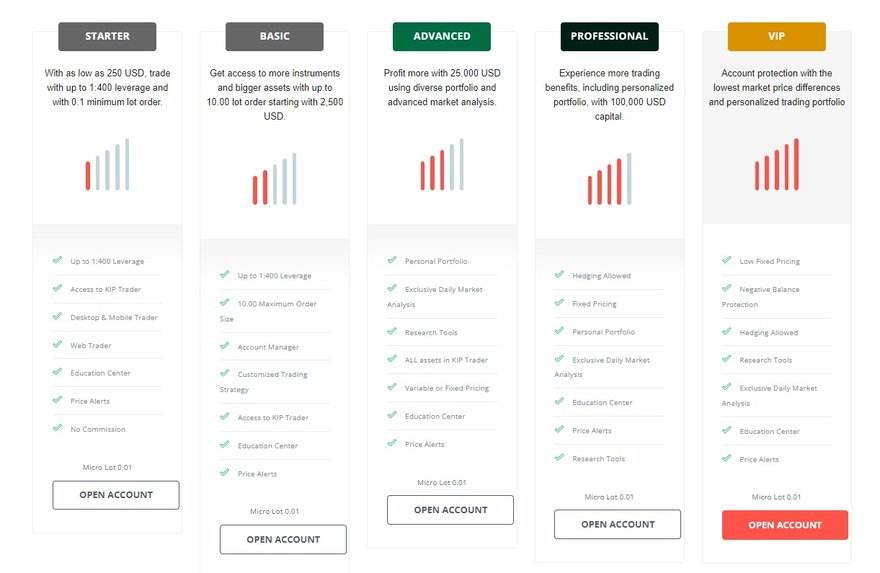

Kiplar Account Types

Kiplar offers 5 different account types:

- Student Account (Starter) – Requires a minimum deposit of $250.

- Advanced Account (Basic) – Requires a minimum deposit of $2500.

- Specialist Account – Requires a minimum deposit of $25,000.

- Professional Account – Requires a minimum deposit of $100,000.

- VIP Account – Includes negative balance protection.

Each account type differs in the amount required for deposit and the services offered to clients.

Here are some extra details about the account types:

- Account manager assistance is only available for the Advanced account and higher.

- Specialist Account offers both fixed and floating spreads.

- VIP Account provides professional hedging and negative balance protection.

So, the account type you choose depends on your needs and investment goals.

Deposit and Withdrawal

If you’ve come across Kiplar and its withdrawal and deposit methods, be cautious! It’s a broker scam, and they’re not to be trusted. Here are the payment methods they claim you can use to activate your account:

- Visa

- MasterCard

- Amex

- Diners

- JCB

- Discover

- Neteller

- Wire transfer

They also claim you can use the same methods for withdrawals. However, hold on a minute, something seems fishy here. We couldn’t find any information about commissions or fees for these actions. It’s imperative to remember that this kind of scam often uses these tactics to lure in victims. So, be sure to do your research and stay vigilant.

How Is the Con Carried Out?

It’s important to know the number of tactics that scammy brokers use to deceive you. One red flag to watch out for is experiencing withdrawal issues. You may also notice odd fees that seem out of place. Beware of bogus high fees that can go above 20%. They may be labeled as withdrawal processing fees, but they’re just another way for fraudsters to take advantage of you.

Another common tactic is the profit fee. Scammy websites will try to convince you to pay this fee in advance. Don’t fall into this trap.

One of the most popular deception methods used by fraudulent brokers is making unreasonable assurances of returns. Be cautious of any broker that promises you massive guaranteed returns. Remember, leverage carries substantial risks, and no broker can guarantee a 100% return.

To avoid being scammed, always try to use brokers that are regulated. This is the unwritten rule of trading online. So, do your research, stay vigilant, and protect your hard-earned money.

Kiplar Summary

Kiplar is a Russian-language brokerage company not officially affiliated with Russia. The lack of regulation is a warning sign and Kiplar is not licensed by any real regulatory authority. Kiplar’s proprietary trading platform, Kip, is similar to MT5, but leverage and spreads are high, and transaction costs are higher. Kiplar offers 5 account types, each with varying minimum deposit amounts and services offered.

The Student Account requires a minimum deposit of $250, while the VIP Account includes negative balance protection. Moreover, Kiplar’s withdrawal and deposit methods should be approached with caution as they offer no info on commissions or fees.

Scammy brokers use various tactics, such as unreasonable return assurances, withdrawal issues, and bogus fees. It is essential to conduct detailed research, stay attentive, and use regulated brokers to ensure a safe trading experience.

FAQs

Is Kiplar Good for Beginners?

No, this is a bogus broker that has nothing to offer that is decent.

Is Depositing with Kiplar Safe and Secure?

It is not safe. This broker is suspicious and unregulated.

How Long Will It Take to Process My Withdrawal Request?

Withdrawals can take forever with this broker scam. Be aware of that.