Limbo Finance Review: Unmasking the Suspicious Forex and CFD Broker

What is there to say about the Limbo Finance Forex scam? In online trading, where opportunities and risks abound, it’s crucial to choose a broker wisely.

Limbo Finance is a platform that touts an array of services and features. It also has an incredibly designed website. But is it a trustworthy partner or a potential scam? In this Limbo Finance review, we delve into the depths of Limbo Finance to uncover its legitimacy, offerings, platforms, accounts, fees, and more. Buckle up as we unveil the truth about this enigmatic broker.

| General information | |

| Name: | Limbo Finance |

| Regulation status: | Unregulated Broker |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | https://limbofinance.ltd/ |

| Active since | 2023 |

| Registered in | N/A |

| Contact info: | +31233690541, [email protected] |

| Trading platforms: | Web |

| The majority of clients are from | Germany Armenia CzechiaRomania |

| Customer support: | Email and phone |

| Compensation fund: | No |

Limbo Finance Legitimacy: The Risks

As we explore Limbo Finance, its elusive location raises eyebrows. While they boast an assortment of services, the absence of address and credible regulations leaves room for doubt. Please keep in mind that trading with Tier 1 regulated brokers is a much safer choice.

Regulatory bodies like FCA, ASIC, and CySEC provide the oversight necessary to protect traders. Unlike Limbo Finance and Volofinance, they prioritize transparency and security.

This broker scam seems to focus its targeting on specific countries, primarily Germany, Armenia, Czechia, and Romania. People from these places should be extra cautious when dealing with platforms like Limbo Finance.

Appealing Website Design

Limbofinance.ltd arises with a seemingly irresistible charm. They have an impeccably designed site that lures users into a potentially risky situation. The sleek interface, replete with modern graphics and UI-friendly features, may evoke trust and professionalism.

This can truly mask the lurking dangers beneath. This allure could easily trick users into ignoring crucial due diligence, such as verifying the broker’s regulatory status. Falling victim to this façade might expose users to financial exploitation, scams, or unauthorized transactions.

In a world where online financial transactions are increasingly common, it is crucial to exercise caution. While aesthetic appeal can indeed enrich the user experience, it should never substitute for rigorous research and skepticism. To protect your hard-earned money, always prioritize platforms with credible regulation and transparent practices, ensuring your trading journey is secure and successful.

Trading Assets Available: The Suspicion Lurks

Limbo Finance scam claims to offer a whopping 500+ assets across various classes. They are as follows:

- Forex pairs like GBP/USD, EUR/USD, and AUD/USD

- Stocks such as Apple, Google, Intel, and Amazon

- Indices including S&P 500, US 100, and Euro Stoxx 50

- Commodities ranging from Crude Oil and Gas to Metals, Coffee, Sugar, and Corn

However, the sheer volume of assets raises skepticism. Are these assets truly accessible, or is there more to the story?

Limbo Finance Platforms: The Uncharted Territory

Limbo Finance has boldly positioned its WebTrader platform as “award-winning,” but the untested nature of this offering casts doubts about its reliability. Unlike this questionable claim, verified and reputable brokers prioritize the best solutions like the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

These globally respected platforms are well-regarded in the trading community due to their track record of excellence. MT4 and MT5 offer a span of great features that contribute to a secure and efficient trading experience. Traders can enjoy the following:

- Customizable workspaces that cater to individual likings

- Browser-based trading for seamless accessibility

- One-click trading to capitalize on fast-moving markets

- Real-time data feeds that ensure informed decision-making

This stark comparison highlights the significance of opting for platforms with proven reputation rather than being enticed only by marketing claims. The trading arena demands reliability and platforms like MT4 and MT5, with their established history, deliver all that we need.

General Trading Conditions: A Closer Look

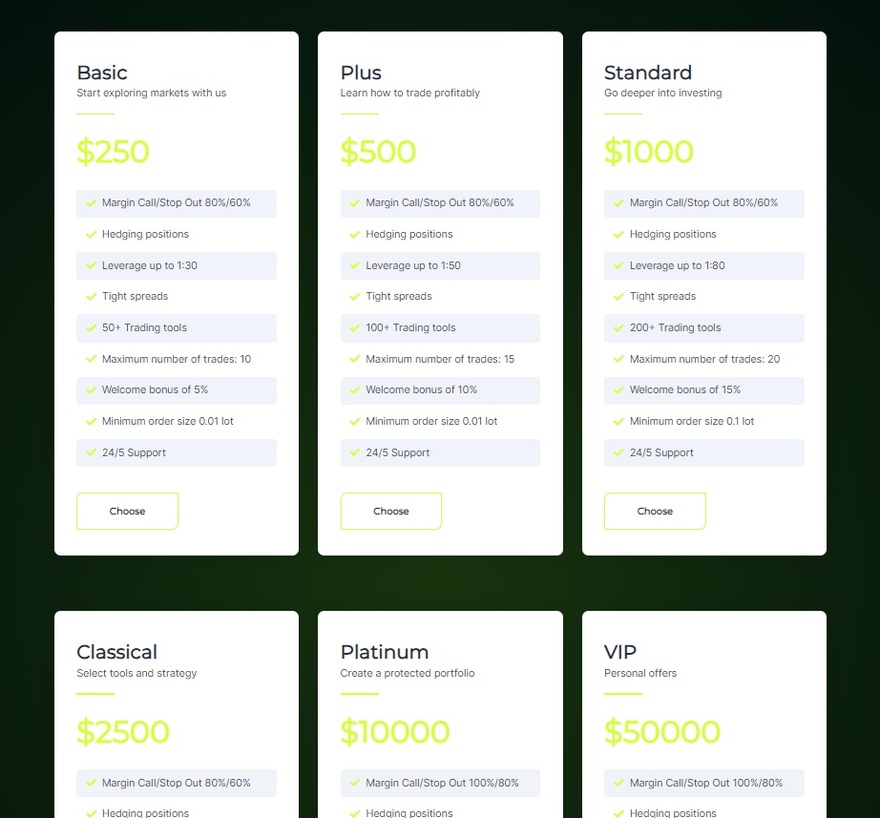

Now, what about the Limbo Finance accounts and other offerings? Limbo Finance attempts to lure traders with various account types:

- Basic: Starting at $250, it offers 50+ trading tools, tight spreads, and limited trades.

- Plus: Priced at $500, it features 100+ trading tools and a 10% welcome bonus.

- Standard: At $1000, it boasts 200+ trading tools and a 15% welcome bonus.

- Classical: For $2500, enjoy 300+ trading tools and leverage up to 1:150.

- Platinum: A $10000 investment unlocks 400+ trading tools and a 20% welcome bonus.

- VIP: A significant $50000 investment provides 500+ trading tools and a 25% welcome bonus.

Are you wondering about the specific Limbo Finance fees? The broker had nothing to say about them. So, we can just wonder.

Limbo Finance Support: A Glimmer of Contact

Limbo Finance has shared ways to get in touch, like a phone number (+31233690541) and an email ([email protected]). It might seem like they’re easy to reach and help is at hand. But, it’s important to be careful and not jump to conclusions.

Just because they have contact details doesn’t automatically mean they’re trustworthy. Being smart with money means looking beyond the surface. Trusted brokers go further – they’re regulated and follow rules that keep you safe. So, don’t let the shiny promise of contact info trick you. Choose brokers that play by the rules and have your back if things go wrong.

Remember, you can always contact us for a free consultation. We will do our best to advise you on the safest trading platforms out there.

Warning: W2W Capital FX broker works secretly and without proper rules, making people wonder if it’s real or not.

Limbo Finance Deposit & Withdrawal

Limbo Finance’s way of handling deposits and withdrawals is raising some concerns. They only mention a minimum deposit of $250. Yet, they don’t say how you can actually deposit the money. This lack of clear information is worrying. It’s a good reminder that trustworthy brokers usually tell you upfront about different ways to pay, like using PayPal, Skrill, bank cards, or even digital currencies.

These options are like different doors you can choose to enter through, and they usually come with some safety and protection. When you’re looking at online investing, it’s smart to go with brokers who are open about how you can give them your money and get it back. This helps avoid problems down the road.

Trader Reviews on Trustpilot: Silence Raises Mistrust

Curiously, Limbo Finance has zero reviews on Trustpilot.

In an age where opinions flow freely, the absence of any feedback is conspicuous. Could Limbo Finance be concealing something? While not definitive, this silence could signify an effort to downplay unfavorable aspects.

When evaluating brokers, transparency matters. Traders rely on reviews to make informed choices. Limbo Finance’s lack of Trustpilot reviews raises questions about its commitment to openness and customer experience. In the end, traders deserve full transparency and unbiased insights to navigate the complex world of online trading.

How the Deception Works

Fraudulent brokers employ various tactics to trick you. They commonly create complications during money withdrawal or when you ask questions. They might also add unusual and excessive fees.

These fees can be extremely high, sometimes going over 20%. Moreover, they could use different names for them, like “withdrawal processing charges.” Besides, they often request an upfront payment, saying it’s for your future profits. Please remain vigilant about this.

Another warning sign is the offering of unrealistically high profits. This is a common strategy too. Scammers always promise huge, definite earnings. However, exercise caution, as trading with tools like leverage can be risky. Don’t fall for a scheme that guarantees significant profits in a short timeframe.

Warning: WasixCap is another broker that seems shady and not regulated, making people question if it’s trustworthy.

Long Story Short: Limbo Finance

In the realm of online trading, caution is key. Limbo Finance raises numerous red flags, from its elusive location and untested WebTrader platform to vague payment options and lack of user reviews. The lesson here is clear: opt for regulated brokers with proven track records, transparent offerings, and a commitment to trader security.

As you navigate the world of trading, remember that legitimate platforms prioritize your success and safety. Choose wisely to safeguard your investments and embark on a journey of financial growth. We’re here for a free consultation!

FAQs

Is Limbo Finance Regulated?

No. This suspicious FX trading company lacks proper regulations.

What Is Minimum Deposit with Limbo Finance?

This shady broker mentions a minimum deposit of $250.

How Much is Limbo Finance’s Withdrawal Fee?

They did not disclose any information about the withdrawal fees.