Lirunex Review: Unraveling the Broker’s Reputation and Much More

We are all aware of the fact that finding the right broker today can be a daunting task. However, with Lirunex, a Cyprus-based forex brokerage, and investment firm, your search for a reliable and top-notch broker might just be over. Lirunex has gained a global presence. Also, it is dedicated to providing world-class services with its CySEC supervision.

While Lirunex also operates an offshore office, it is important to note that the mix of its European operational standards and CySEC supervision makes it a safe broker. In this Lirunex review, we’ll delve deeper into various aspects of Lirunex to understand why it stands out in the competitive market.

| General information | |

| Name: | Lirunex Limited |

| Regulation status: | Regulated by CySEC |

| Warnings from Financial Regulators: | N/A |

| Website link: | https://lirunex.eu/ (lirunex.com is likely a clone) |

| Active since | 2019 |

| Registered in | Larnaca, Cyprus |

| Contact info: | Tel: +357 2469 4888 (Monday to Friday)

Fax: +357 2469 4889, [email protected], [email protected] |

| Trading platforms: | MT4 |

| The majority of clients are from | Malaysia

Thailand Singapore Indonesia Vietnam |

| Customer support: | email, chat, live support, and contact form |

| Compensation fund: | Yes |

Lirunex Legitimacy: A Secure and Regulated Broker

When it comes to choosing a forex broker, legitimacy and regulation are highly important. Fortunately, Lirunex ticks all the right boxes in this aspect.

As a trading name of a Cypriot Investment firm authorized by the Cyprus Securities and Exchange Commission (CySEC), Lirunex operates transparently. It is constantly overseen by the regulatory authority. This means that any violations are met with strict fines or potential termination of its activities, ensuring that the client’s interests are protected.

In addition to its CySEC regulation, Lirunex is also allegedly regulated in the Marshall Islands. However, it is worth mentioning that registering under offshore entities carries higher risks of capital loss. More on this later on!

Because of this, traders should opt for the CySEC-regulated options whenever possible. Tier 1 licenses like CySEC or FCA provide an added layer of security and ensure that brokers adhere to stringent financial rules. This truly offers traders a sense of confidence and peace of mind.

Remember: Lirunex is a licensed broker regulated by CySEC and offering investment services internationally.

Marshall Islands

There are two websites, www.lirunex.com and www.lirunex.eu, and while the latter is regulated by CySEC, the former claims to be registered offshore (Marshall Islands) with an office in Malaysia.

The information provided on www.lirunex.com is not present on www.lirunex.eu, leaving uncertainty about their connection. As a precautionary measure, it is advisable to stick with the website regulated by CySEC, www.lirunex.eu. Do this to ensure a reliable and secure trading experience.

Note: LeaderFinancing is an unregulated brokerage firm that operates without a valid license. Try to avoid them.

Trading Assets Available: Diversifying Your Portfolio

Lirunex is a good broker that offers a competitive range of trading instruments with low fees. It truly suits traders worldwide. However, the broker primarily focuses on Forex and CFDs instruments, which might be a drawback for those seeking a more diverse asset selection.

Brokers that provide a full array of trading instruments offer the cool opportunity to fully diversify your portfolios. This is crucial in managing risks effectively. Diversification helps spread risks across different assets. Also, it reduces the impact of any single asset’s poor performance.

Therefore, brokers that include various financial products like stocks, commodities, indices, and crypto in addition to FX and CFDs provide people with more opportunities to earn on market movements. Keep that in mind.

Trading Platforms: A User-Friendly Approach

Lirunex understands the importance of providing a good trading experience. Thus, that’s why it offers the MetaTrader 4 (MT4) platform as its primary software. MT4 (and MT5) is truly renowned for its UI-friendly and modern interface, powerful charting tools, and terrific order execution. As one of the most widely used platforms globally, MT4 enjoys a large user base. This means more liquidity and better trade execution for Lirunex clients.

Sadly, Lirunex does not offer MetaTrader 5 (MT5). What does that mean? Well, this could further expand the trading opportunities for experienced traders. MT5 comes with additional features like more timeframes, technical indicators, and the power to trade a broader range of instruments. We know that this makes it an excellent choice for people with specific trading preferences.

General Trading Environment at Lirunex

In the general trading environment of Lirunex, there are several crucial aspects that we must note. These include the broker’s fees, spread offerings, client support, and educational aids. By understanding these elements, traders can make smart decisions and optimize their full experience with Lirunex. Let’s explore each aspect in detail. This will help us gain a general view of the broker’s overall trading environment.

Lirunex Fees

Lirunex adopts a fee structure that is either built into spreads or based on commissions. Namely, this depends on the chosen account type. To get a thorough understanding of the fees involved, take a look at the basics!

- Trading fees. Trading with Lirunex will involve fees starting from $4

- Commissions: Lirunex includes commission-free trading

- Account maintenance fees: There is no specific input available about account maintenance fees for Lirunex

Besides, it’s crucial to be aware of funding and inactivity fees. These can have an impact on overall trading costs. Moreover, overnight fees, also known as swap fees, should be considered as they vary counting on the individual instrument being traded.

Note: LCM FX is an unregulated broker that has been flagged by several financial watchdogs for its lack of proper authorization. This puts traders at risk of potential deception or misconduct.

Spreads

The spreads offered by Lirunex are determined by the account type chosen. Note that higher-grade accounts typically have much better trading rules. The broker offers variable spreads with no commission charges across all account types.

For instance, the Standard account boasts spreads starting from 1.5 pips, while the Advanced, Premium, and Pro accounts offer spreads starting from 0.7 pips, 0.5 pips, and 0.3 pips, respectively. Traders should choose the account type that aligns with their trading style and preferences.

Customer Support

Lirunex prides itself on providing outstanding customer support. This means that traders have access to assistance whenever needed.

The broker includes various contact options during market hours. This includes phone, email, live chat, and an online resource center filled with helpful FAQs and educational materials.

Reliable customer support is crucial for traders, as it ensures prompt resolution of queries and issues. This truly boosts the overall trading experience.

Lirunex Education

While Lirunex offers commendable customer support, the educational section is relatively limited. What do we mean exactly? Well, available materials are primarily accessible via the Lirunex FAQ section.

A robust educational offering can greatly benefit traders, especially newcomers to the forex market. Brokers with extensive educational resources, such as webinars, tutorials, and market analysis, empower traders to make wise decisions and improve their skills.

Note: Kot4x is an unregulated forex broker that has been operating without oversight from any reputable authority. This raises worries about the safety of traders’ funds and the transparency of its operations.

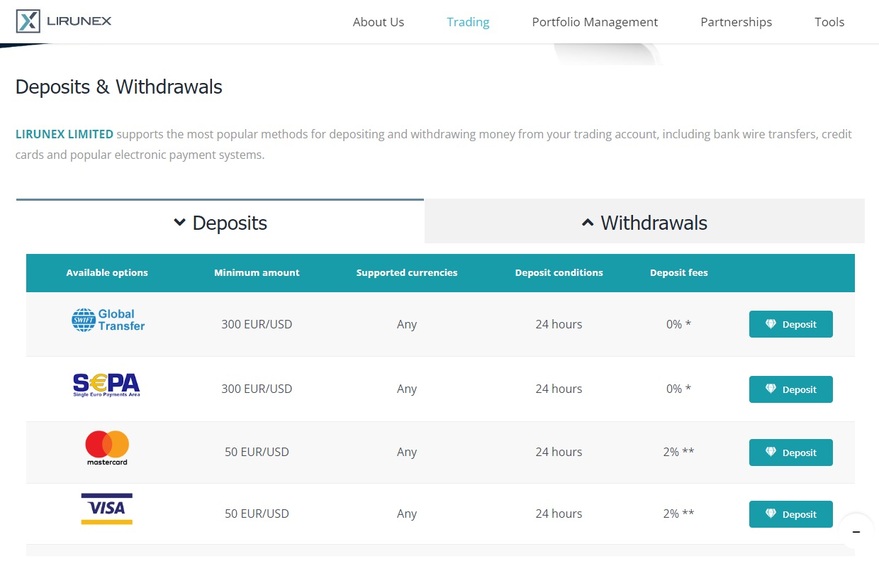

Earning & Withdrawal: Hassle-Free Transactions

Lirunex strives to provide convenient and secure payment methods for both deposits and withdrawals. At the time of this review, the broker offers card payments and bank transfers as payment options. Besides, Lirunex plans to add more options, such as Neteller, Skrill, and China UnionPay, to further enhance its clients’ payment flexibility.

The minimum deposit required varies based on the account type chosen, with the first-grade account demanding a minimum deposit of $500. Higher-grade accounts might require larger deposits but come with better trading conditions. This provides traders with choices that suit their financial capacities and trading preferences.

When it comes to withdrawals, Lirunex offers different options, with bank wire withdrawals being free of charge. However, card payments incur a 1.5% charge, which is essential to consider before initiating any withdrawals. It is advisable to review the broker’s policies and verify any additional fees that payment institutions or providers may apply due to international policies, ensuring a seamless transaction process.

Trader Reviews

Interestingly, Lirunex has 60 reviews on Trustpilot. Notably, this may raise eyebrows in the FX industry. Trustpilot reviews are essential for brokers as they act as a reflection of their service quality and customer satisfaction.

Positive reviews can instill confidence in potential clients, while negative reviews can indicate areas for improvement. As a reputable platform for authentic customer feedback, Trustpilot reviews are often considered by traders when choosing a broker.

Long Story Short: Lirunex

What can we conclude from this Lirunex review? Lirunex proves to be a reliable and legitimate forex broker with its CySEC regulation. It offers a decent range of trading instruments, but a more diversified asset selection could further enhance its appeal. The choice of MT4 as the primary trading platform ensures a UI-friendly experience, and its customer support services are commendable. This broker may not be as great as the popular ones, but it truly is amazing!

Do you need help choosing reputable forex brokers? If the answer is positive, contact us for a free consultation now!

FAQs

Is Lirunex regulated?

Yes, Lirunex is regulated by CySEC, ensuring a safe trading environment with oversight.

Is Lirunex a good broker?

Lirunex is a good broker with world-class services, though primarily focused on Forex and CFDs.

What are the Lirunex platforms?

Lirunex offers MetaTrader 4 (MT4) as its primary platform, known for its modern interface and powerful tools.