Mekness Review: Uncovering the Truth Behind This Odd Forex Broker

Mekness is a suspicious FX broker with a notorious location. It is owned and operated by Mekness LLC in St. Vincent and the Grenadines. Yet, concerns arise about its legitimacy and compliance with prominent regulations.

Offshore jurisdictions like SVG can be attractive bases for dubious brokers due to the lack of regulatory oversight. In this Mekness review, we’ll discuss Mekness’ legitimacy, assets, platforms, and more. Know that investment involves risk. So, choosing licensed brokers, regulated by reputable institutions such as ASIC, FCA, or CySEC, is crucial. These institutions offer enhanced trade protection.

Mekness Regulation: Navigating the Gray Areas

Mekness is allegedly incorporated into St. Vincent and the Grenadines legislation, and the existence of such a company has been verified. However, their website claims to be a “globally regulated broker,” a statement that lacks substantiation. The Financial Services Authority (FSA) of St. Vincent and the Grenadines does not regulate brokerage firms, and they even warned about this issue. These circumstances raise serious concerns about Mekness’ legitimacy.

Likewise, the absence of legal documentation and a generic privacy policy on their website further erodes their credibility. Additionally, our investigations have revealed that Mekness’ website bears striking resemblances to that of another suspected scam broker, IDealTrade, further casting doubts on Mekness’ originality.

When investing in financial instruments, ensure that you are dealing with licensed brokers. Licensed brokers offer essential protections, such as negative balance protection and client funds segregation, which helps mitigate potential risks.

| General information | |

| Name: | Mekness LLC |

| Regulation status: | Unregulated Offshore Broker |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | https://mekness.com/ |

| Active since | 2020 |

| Registered in | SVG, Malaysia |

| Contact info: | Phone: +971 54 719 9005 +971 43 88 4268 |

| Trading platforms: | MT5 |

| Majority of clients are from | France

Morocco Pakistan Spain Italy |

| Customer support: | Yes (24/5 [email protected]) |

| Compensation fund: | No |

Trading Assets Available: Exploring Mekness’ Offerings

Mekness advertises forex, commodities, and index trading as its primary offerings. Yet, it’s essential to consider the limitations of this broker’s regulation and legitimacy when investing in these assets. Mekness is not regulated by any government in any country. It is not a member of any financial regulatory body and does not provide any direct protection to investors. So, investors should exercise caution when considering investing with Mekness.

Various trading assets have many advantages for brokers. Firstly, it enhances the appeal to a broader spectrum of traders, catering to different risk preferences and investment goals. By offering a broad selection of assets such as stocks, FX, cryptocurrencies, commodities, and indices, brokers create options for clients to diversify their portfolios effectively. But remember, always choose to trade with regulated brokers.

Available Trading Platforms

Mekness uses the popular MetaTrader 5 (MT5) trading platform. It is accessible across Windows, Android, and iOS operating systems. While MT5 is widely used in the industry, it’s smart to opt for regulated brokers offering MT5 or MT4. These brokers are known for their customization options, automated trading, and backtesting trade strategies. Remember they are backed by a reputable brand.

Likewise, MT5 also provides an enhanced charting environment. The same goes for faster order execution speeds and support for more time frames compared to its predecessor, MT4. Thus, many traders prefer to use MT5 for their trading activities.

Prevailing Trading Environment at Mekness

This broker includes four trading account types.

Mekness account types are – Standard, Universal, Pro, and VIP, all with a minimum deposit requirement of 10 USD. Yet, we found the spreads and commissions for Standard and Universal accounts disadvantageous compared to industry standards. Traders should consider these factors before committing to a specific account type.

Mekness offers the Trading Account Copier! If you handle multiple trading accounts and wish to synchronize open/close orders across them all, Account Copier is your top-notch solution, they say. Simply fill out the form, and they will replicate your source account. Yet, is the Mekness login secure? Not really. If you manage multiple accounts, think twice about using this service. Be cautious about potential risks and stay informed and safe!

Leverage: Understanding Risk and Reward

Mekness allows maximum leverage of 1:500 for all accounts. Namely, this is higher than what licensed brokers typically offer.

While high leverage can amplify profits, it also increases the risk of significant losses. Regulated brokers usually offer lower leverage to protect retail traders from extreme risks.

Mobile Trading App: Stay Connected on the Go

Mekness provides a mobile trading app. This one allows traders to access their accounts and execute trades from anywhere.

Mobile platforms are convenient and useful for traders on the go. Yet, it’s essential to ensure app security and stability to safeguard your funds and sensitive data.

Demo Account: Trading Risk-Free

Demo accounts are valuable tools for traders, especially newbies.

With a demo platform, they can practice and test strategies without risking real money. Regulated brokers often offer demo accounts to help traders hone their skills and gain confidence before venturing into live trading.

Special Bonuses: An Attractive Offer or a Potential Red Flag?

Mekness offers a 10% deposit bonus for clients, providing more funds to trade with. Yet, deposit bonuses are not cashable and have specific terms and conditions.

Such bonuses may restrict withdrawals and trading options. This potentially leads to many issues down the line. Keep that in mind.

Understanding Mekness Payouts: Transparency and Concerns

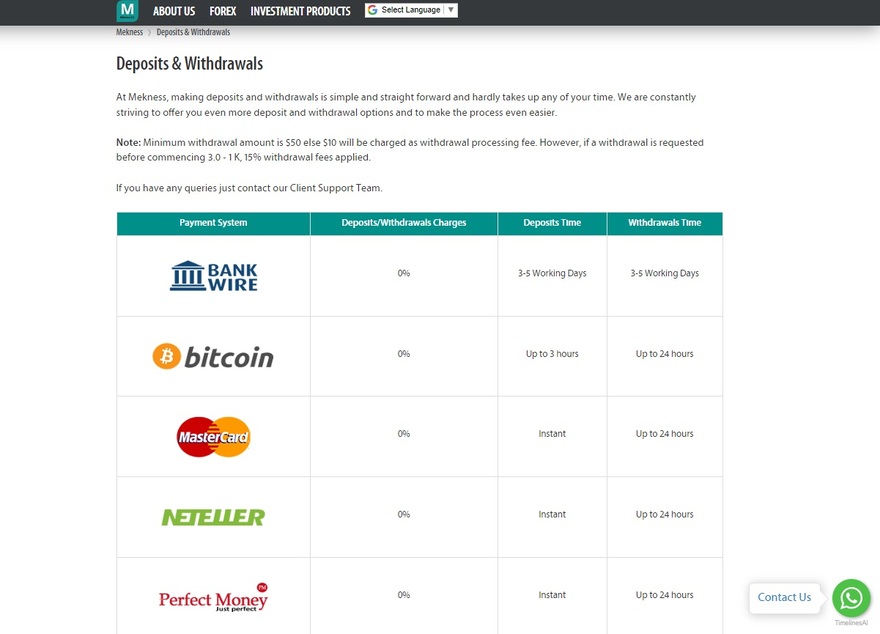

Mekness claims to offer straightforward withdrawals and deposits. Yet, there are contrasts between the advertised payment methods and the actual options available. The smallest withdrawal amount stands at $50, with potential fees for withdrawals below this threshold. This raises big concerns about the withdrawal process.

Moreover, a vague minimum trading volume requirement further adds to the confusion. Lack of transparency in the financial industry can deter potential traders, as fuzzy information about the minimum trading volume and fees creates mistrust. This lack of clarity may suggest that the platform is unreliable and fraudulent. Overall, the Mekness payout process appears to be confusing and may need improvement to inspire trust among its users.

Customer Support: Reach Out for Assistance

You can contact Mekness customer service by phone at +1 631 892 6178 or +1 631 892 6179, or by email at [email protected]. The broker is also on Facebook, Twitter, Instagram, YouTube, and WhatsApp.

Company address: First Floor, First St. Vincent Bank Ltd. Building, James Street, Kingstown, VC0100 St. Vincent and the Grenadines. Mekness provides customer support via phone, email, and social media channels. Yet, its legitimacy raises concerns about its efficiency and reliability.

Trader Reviews

Genuine user reviews can offer valuable insights into broker performance, reliability, and customer satisfaction. Yet, the lack of publicly available reviews for Mekness makes it challenging to gauge its reputation.

As such, it is important to take extra precautions when considering opening an account with Mekness, Innovation Markets, or any other dubious broker. It is advisable to research customer reviews on independent websites. Also, make sure to review the terms and conditions of the broker before investing.

Unveiling the Cunning Tactics of Broker Scams

As the financial world becomes more interconnected, so does the lurking danger of broker scams. These cunning schemes are designed to prey on investors, employing a range of deceptive methods. One common tactic is the promise of extraordinary returns with little to no risk. They lure in victims with enticing prospects.

Moreover, these fraudulent brokers often use high-pressure sales tactics to rush their targets into making impulsive decisions. Besides, they may display a façade of credibility by using fake testimonials or credentials. Vigilance is paramount; Verifying a broker’s authenticity can safeguard against these deceitful traps. It can protect hard-earned investments from falling into the hands of scammers.

Long Story Short – Mekness

Mekness, an offshore forex broker based in St. Vincent and the Grenadines, has potential legitimacy concerns. Its lack of comprehensive legal documentation, discrepancies in payment methods, and vague fee structures raise suspicions. Considering the risks associated with fake brokers, investors are better off choosing regulated brokers. That will ensure enhanced protection and peace of mind in their trading journey.

In conclusion, while Mekness might seem alluring at first glance, traders must exercise caution. They should prioritize safety and security when choosing a forex broker. By opting for regulated brokers with established track records, traders can navigate the financial markets with confidence and minimize potential risks. Remember to thoroughly research and gather information from reputable sources before making investment decisions. Be cautious and well-informed to avoid unregulated brokers like Mekness or INNO Trade.

If you’re interested to learn more about regulated brokers, contact us for help! There is no obligation to use our services, and our consultation is free.

FAQs

Is It Safe To Trade With Mekness?

No, they are not safe at all. They are unregulated and suspicious.

What Are The Mekness Platforms?

Mekness offers MetaTrader 5 (MT5) trading platform.

Are Funds Safe With Mekness.com?

Your funds are not safe with mekness.com. Avoid this company.