OpoFinance Review: Find Out Why This Broker Is a Scam

This OpoFinance review will explain why even brokers with regulatory oversight should be avoided in some cases. Not everything that shines is gold. Although licensed by some authorities, they are still offshore scammers. How? Easy. The institutions that approved of them have no oversight themselves.

Keep reading to find out more about this curious case of OpoFinance. We will cover their conditions, account types, and other policies and give you some recommendations for reliable brokers.

| Company | OpoFinance |

| Website | https://opofinance.com/ |

| Address | CT House, Office 9D, Providence, Mahe Seychelles |

| [email protected] | |

| Phone | +447312763042 |

| Minimum Deposit | $100 |

| Leverage | 1:2000 |

| Bonuses | No |

| Regulation | FSA of Seychelles, Financial Commission |

| Warning | N/A |

Security and Compliance for OpoFinance

According to the information found in the footer of the OpoFinance website, OPO GROUP LLC is authorized in Saint Vincent and the Grenadines, but on the “Our Regulations” page, they state Opo Group LTD is registered in Seychelles.

They also announce that they are authorized by the Financial Services Authority of Seychelles, and that turns out to be true. However, it is not hard to get the FSA authorizations since the only thing a company or broker needs is a filled-out application form, a cover letter, and a $1500 fee.

The OpoFinance broker is also a member of the Financial Commission, but that is an independent regulator, which is not a reliable controlling body.

All the signs point to them being yet another offshore agent, but in a better package. OpoFinance’s license and authorization should not be taken into account since their regulators are untrustworthy. And let us not forget their Saint Vincent and the Grenadines location, the most famous location for scam brokers.

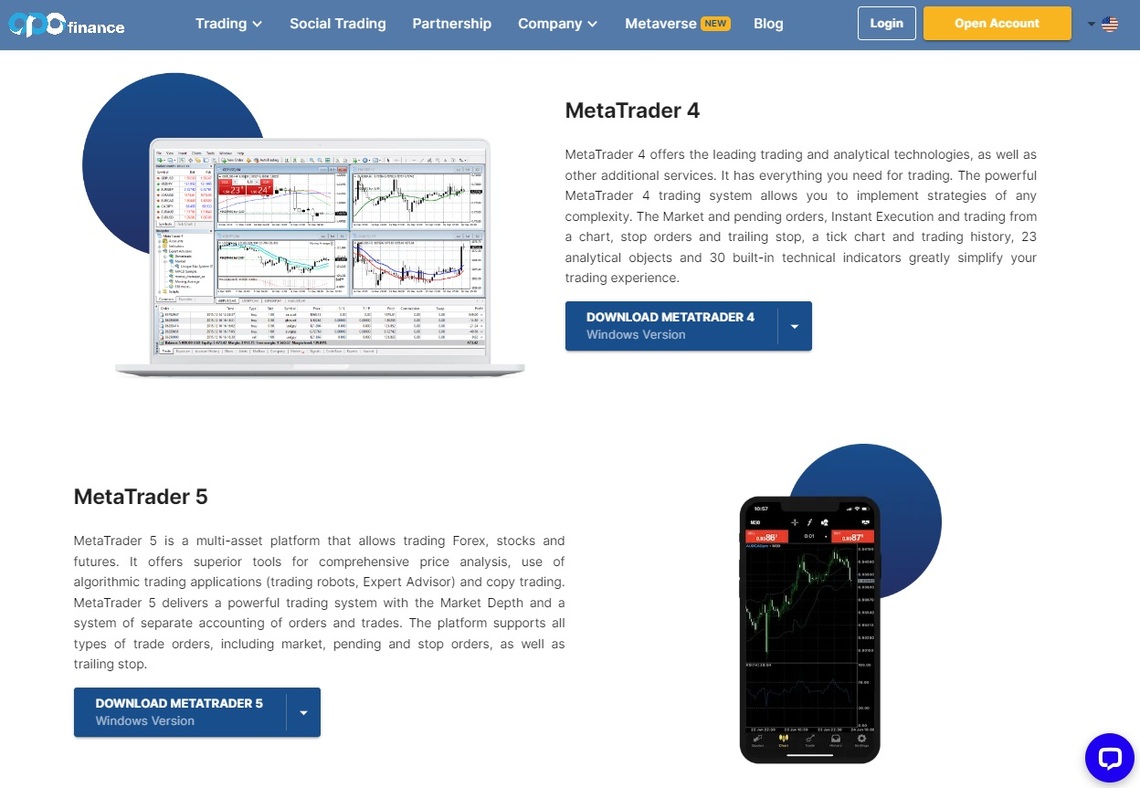

Website’s Trading Platform Overview

A smart move OpoFinance made was to include MetaTrader 4 and MetaTrader 5. Everyone knows these two are the top-tier trading platforms and the best in the industry. They contain exceptional and practical trading tools combined with a user-friendly interface appropriate for beginners and experienced clients. Additionally, they offer a web version of MetaTrader 5.

Even though this is perfect bait, be aware that this is a tactic used by many scam brokers. Just because they offer a good platform does not mean you should invest and put your funds in the hands of an unreliable company. OpoFinance might manipulate the software for its own gain, and more often than not, when downloaded from suspicious sources, files could be corrupted.

Account Types at OpoFinance

OpoFinance delivers four types of trading accounts and an option for a demo account. Regular selection is comprised of the Standard, ECN, Social Trade, and ECN Pro options. The minimum deposit varies from $100 to $5000, and every account has a leverage of up to 1:2000.

While Standard and Social Trade have no commissions, ECN and ECN Pro do have them. The maximum deposit for all of them is unlimited, and all of them offer MetaTrader 4, MetaTrader 5, and a web platform.

Deposit and Withdrawal for OpoFinance

Deposit and withdrawal methods OpoFinance endorses are rather diverse. They include cryptocurrencies, Advcash, UnionPay, Perfect Money, TopChange, Visa Card, Master Card, Local Bank Transfer, fasapay, and wire transfers. There is a possibility of transferring your money from one trading account to another.

Withdrawal requests are processed within 24 hours, according to the OpoFinance broker. Depositing funds into a shady business, especially via cryptocurrencies, is dangerous and risky. There is no way to follow the transaction, and in the case of a robbery, it is almost impossible to get your money back. Be cautious where you invest and abstain from using crypto payments if unsure.

How Did This Brokerage Perpetrate Fraud?

Investments scam can appear in many forms. OpoFinance example shows that even though a broker is authorized by some regulator, that does not mean that it is legit. In this case, the controlling bodies that authorized OpoFinance are neither trustworthy nor safe. Likewise, some companies use made-up entities to evoke a feeling of trust with their clients.

For these very reasons, it is crucial to check all the claims someone’s website makes. Address, license number, and virtually anything can be fake, so doing research is something you should always do, primarily if you are looking to invest or give out your personal information.

Scam brokers put a lot of effort into appearing legitimate and reliable; they present good conditions, easy earnings, bonuses, and much more, all to appeal to amateur traders with no experience on the market. Making a profit is never easy; it takes hard work and dedication, even in the trading world. Phony agents will try to get under your skin and make you believe everything they say, but the truth is, they only want to get to your wallet.

OpoFinance Summary

OpoFinance is not a trustworthy broker, they are offshore fraudsters looking to earn money by robbing their clients. Regulated by institutions that are not reliable, they lose every bit of credibility they try so hard to gain. Remember, it is not smart to invest and deposit when you do not have all the information.

Following the statements one website is providing is not enough. The trading industry is complex, so you should educate yourself before getting started. We hope this OpoFinance review was helpful.

FAQs About OpoFinance Broker

Is My Money Safe With OpoFinance?

Your money is not safe with OpoFinance. We can not assure you of it since they are scam brokers.

What Is The Minimum Deposit for OpoFinance?

The minimum deposit for an OpoFinance broker is $100, and there are many deposit options available.

Does OpoFinance Offer Demo Account?

There is a demo account offered by OpoFinance, alongside four other account types.