UniGlobal Assets Review – Stay Away From This Broker

Cyber security experts advise traders to be very careful when investing money due to the rising number of online scam brokers. A classic example of a fraudulent broker is UniGlobal Assets that we are going to analyze today.

We will start our UniGlobal Assets review with who is behind this unscrupulous broker. After doing thorough research, we couldn’t find any relevant information about this company. That leads to the conclusion that the UniGlobal Assets broker operates anonymously, which raises a red flag. Not-transparent brokers are the most dangerous since they are 100% involved in fraudulent trading activities.

| Leverage | 1:100 |

| Regulation | No |

| Headquarters | n/a |

| Minimum Deposit | n/a |

| Review Rating | 1/5 |

| Broker Type | Forex broker |

| Platforms | Browser-based platform |

| Spread | n/a |

Online trading is risky, and you should think twice before taking any risks while investing money. However, with professional guidance and open-source resources, such as this article, you can minimize trading risks and avoid cyber fraud. Therefore, continue reading our detailed and honest review for more information on why you should steer clear of UniGlobal Assets.

Is UniGlobal Assets Broker a Safe Place to Put Your Money?

Forex trading is a closely controlled industry; every broker must be authorized by a respective financial market regulator to operate legitimately. In terms of regulation, UniGlobal Assets is an unauthorized brokerage, working illegally. That is to say that your money is at the highest risk if invest with this not legit company.

Legitimate firms, regardless of their jurisdictions, are regulated by one or more supervising bodies. Broker’s licenses issued by British FCA, Cyprus CySEC, Australian ASIC, and Swiss FINMA, to name a few, carry considerable weight in this business. A forex provider must meet demanding licensing requirements to become certified, which protects the interests of traders. For instance, FINMA demands operating capital of a minimum of 1,5 million CHF.

Licensed brokers are also insured. For example, in the case of a broker’s bankruptcy, CySEC compensates a trader for up to 20,000 EUR, FCA indemnifies up to 85,000 GBP, and ASIC covers up to 100,000 AUD.

However, the worst-case scenario is not likely to happen because regulated businesses implement risk management measures to minimize trading risks. For example, they provide segregated funds (investor money is kept separate from a broker’s capital; in the event of a broker’s insolvency, investors are not affected) and negative balance protection (you can’t lose more than initially invested).

All of the benefits regarding accredited forex providers are not possible with an unlicensed brokerage such as UniGlobal Assets. Therefore, for the sake of your financial safety, avoid investing money unless you are 100% sure that an online financial trading company is approved by a relevant supervisory authority.

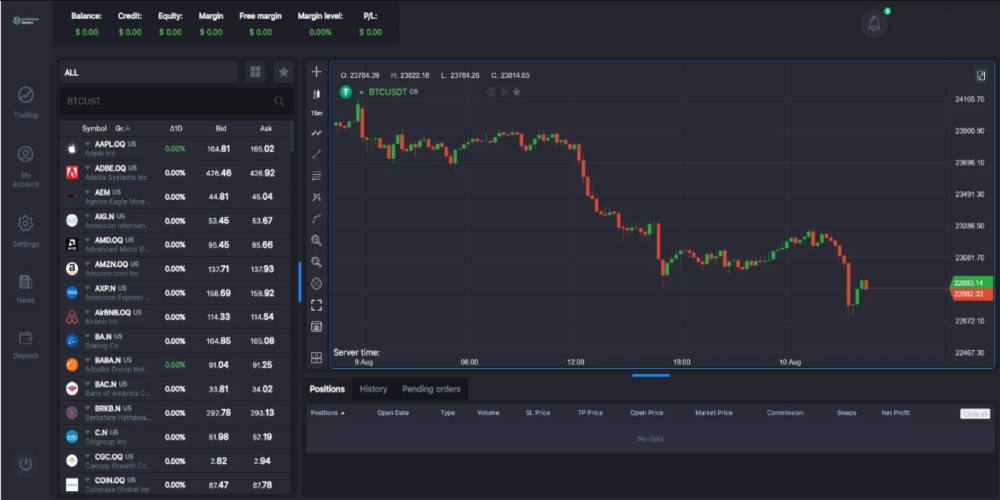

What Trading Platforms Are Available?

A trading platform is one of the most important segments of online trading. Your effectiveness depends on it. So, if a broker provides poor trading software, your trading will suffer. As it goes with a shady brokerage like UniGlobal Assets, it offers an insufficient trading program that can’t hold a candle to modern trading platforms provided by genuine brokers.

For instance, MetaTrader4 (MT4), MetaTrader5 (MT5), Sirix, and cTrader are some of the most advanced platforms coming with outstanding tools such as stop loss, automated trading, copy trading, expert advisors, and economic calendars. On top of that, these programs are available in different versions, i.e., as a mobile trading app, a downloadable program, or an internet-based trading platform.

Overall, aside from ripping you off, trading on the UniGlobal Assets platform will give you nothing but a headache. Thus, please avoid similar companies and trade only with proven and tested forex providers.

UniGlobal Assets Account Types Offered

UniGlobal Assets tries to fraudulently imitate one of the legitimate-looking websites by offering a diverse account selection with allegedly favorable trading conditions and plenty of trading instruments.

In reality, this financial swindler is just trying to take money from unsuspecting victims with its manipulative trading software. Thus, since it is an outright investment scam, if I were you, I would not even bother to take into account what live trading accounts are available with UniGlobal Assets.

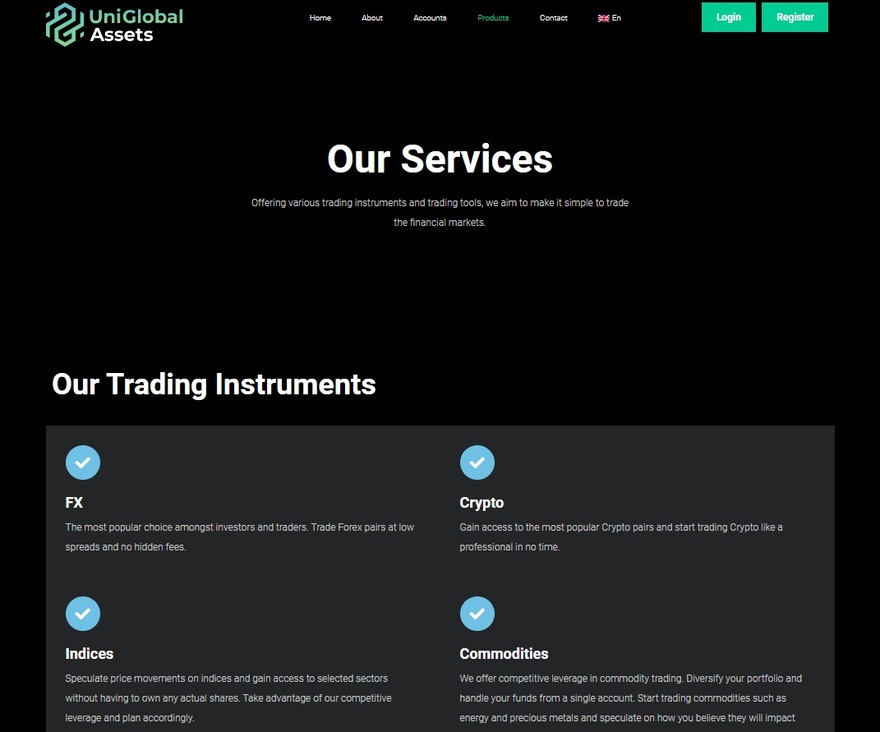

Trading Instruments Overview

This dishonest scam broker claims it offers a broad spectrum of tradable assets, including the following ones.

- 65+ currency pairs: USD/EUR, EUR/CHF, GBP/USD, USD/JPY, USD/CAD, etc.

- Crypto: Bitcoin (BTC), Ethereum (ETH), Zcash (ZEC), Litecoin (LTC), Stellar Lumen (XLM), etc.

- Commodities: crude oil, natural gas, gold, wheat, silver, etc.

- Indices: Dow Jones, FTSE 100, S&P 500, DAX 30, NASDAQ 100, etc.

Yet, I wouldn’t take any statement from UniGlobal Assets for granted due to many scam allegations against this bogus brokerage. If you want a profitable and safe trading experience, you better stick with a proven and tested multi-asset broker.

Deposit and Withdrawal

Before going forward with UniGlobal assets funding methods, you should be aware that there are no money withdrawal guarantees with fraudsters. So, as caution is the parent of safety, you should refrain from depositing your hard-earned money with this phony broker.

As for means of payments, UniGlobal Assets claims it accepts credit/debit cards. But in fact, you can deposit money only through crypto wallets. Now, cryptocurrency payments are also supported by legal brokers, but they also accept other means (e.g., credit/debit cards, bank wire transfers, and e-wallets).

In the case of UniGlobal Assets, accepting only crypto payments is one of the malicious tactics preferred by untrustworthy brokers since it is hard to trace back and reimburse crypto payments. One more reason to stay away from the UniGlobal Assets scam.

How Can I Get a Refund If UniGlobal Assets Scammed Me?

In order to know what to do if be defrauded, you should understand how a broker scam works. A bogus broker entices victims with lucrative investment opportunities and generous bonuses (note: they are banned in most jurisdictions due to misuse). They also offer unreasonable and unfavorable trading conditions (e.g., high leverage, despite the fact the leverage is limited to 1:30 in most entities for retail traders). When con artists succeed in roping you to invest, they will vanish, and you will hardly even see your money again. Also, they might reappear as a new brand and offer to help you with claiming back your money; but it will be just the same trading scam but rebranded. Therefore, be careful about easy earnings.

If UniGlobal Assets scammed you, don’t feel embarrassed about reporting the scam to the relevant authorities. You should act fast and also leave negative UniGlobal Assets reviews on the web so that others won’t become a victim of the same online trading scam.

UniGlobal Assets Summary

To sum up our UniGlobal Assets review with the following key takeaways:

- UniGlobal Assets is an anonymous, not trustworthy, and illegal broker running a sophisticated scam.

- There are too many complaints against the broker (mainly regarding withdrawal issues).

- If we disregard the fact that it is an illicit broker known for unlicensed business and fraudulent projects, UniGlobal offer is below the standard embodied in an inadequate trading platform, unfriendly terms of exchange, and inappropriate customer service.

FAQs About UniGlobal Assets Broker

What Is the Minimum Deposit for UniGlobal Assets Broker?

Since it is a non-transparent broker, UniGlobal Assets doesn’t reveal this information. As we can assume, it probably requires a deposit that is higher than the industry average.

How Long Do UniGlobal Assets Withdrawals Take?

According to its website, the processing time of withdrawals depends on the withdrawal method. But, I am skeptical that it is even possible to make withdrawals.

Is My Money Safe with UniGlobal Assets?

No, it is not safe; it is the opposite, i.e., your funds are at the highest risk of being lost if invested with this fraudster.