Admiral Markets Review – Learn More About AdmiralMarkets.Com

Established in 2001, this magnificent online services provider has been offering their services in more than 40 countries in the world, serving millions of customers. Admiral Markets was first opened in the UK. Today they have offices around the world and are heavily regulated.

Attractive trading conditions that Admirals offer are paired with impeccable customer support and best trading technology solutions. Trading experts and professionals consider Admirals as a company best for learning about investing in CFDs and other markets through free webinars and various tutorials.

Adjustable leverage combined with most modern technology allows trading and profiting on thousands of financial products and instruments.

Let’s further explore the benefits of investing with this prestigious company throughout this Admiral Markets review.

Admiral Markets Pros and Cons

When a firm is as great and successful as Admirals, it isn’t easy to just list all the available services and offers. For that purpose we advise you to at least open a Demo account and try out some of the products from their palette.

Joining the site is easy and fast, while you have several account types to choose from, depending on the trading software you prefer. MT4 and MT5, as available software solutions. All that is followed by great pricing and low fees on most tradable assets categories, as well as varying leverage.

Traders still learning about the basics of Forex can advance their knowledge and skills quickly with comprehensive tools and free educational resources. For issues and investing insecurities, responsive customer support service offers 24/7 help.

One major disadvantage to being a customer at Admirals is the withdrawal fees and commissions applying to certain deposits. Besides charging that, there’s also an inactivity fee of $10 that applies after at least 24 months of not trading. Although not overly high, it still charges.

Furthermore, Admiral Markets doesn’t directly offer copy trading. You can still get this feature from EAs inside MetaTrader platform but not on the same level.

| Headquarters | UK |

| Foundation year | 2001 |

| [email protected] | |

| Phone | +44 20 8157 7344 |

| Regulation | ASIC, FCA, CySEC, EFSA, IIROC, JSC |

| Instruments | Forex, Index CFDs, Share CFDs, Bond CFDs, Commodity CFDs, CFDs on ETFs |

| Platforms | MT4, MT5, Admiral Markets mobile app |

| Demo Account | Available |

| Base Currencies | USD, EUR, GBP, CAD, AUD, CHF, JPY |

| Minimum Deposit | $1 |

| EUR/USD Spread | 0.8 pips |

| Education | Webinars, Articles, Tutorials |

| Customer Support | 24/7 |

Admiral Markets Awards

Many prestigious rewards that Admirals has won over the years witness the quality of service and brokers excellent performance. Some of the most admirable achievements in that sense we will mention in this Admiral Markets review:

- BrokerWahl’s Forex and CFDs Broker of the Year 2022

- “Best Forex Platform” at the ADVFN International Financial Awards in 2021

- “Best Forex Platform” award at the ADVFN International Financial Awards in 2019

- Global Banking & Finance Awards as the Best Forex Company Estonia 2019

How Safe is Admiral Markets? Regulation and Security

Legal directives deciding the course of a broker’s business are under control of jurisdictional regulators. Financial entities overseeing and supervising the way Admiral Markets conducts their business are ASIC, FCA, CySEC, EFSA, IIROC, JSC.

Every broker and trader knows how strict top tier regulators are about licensing brokerage agencies. First and foremost, there is an amount of capital an agency has to invest as evidence of their stability. This amount refers to £730 000 in the UK, €730 000 in the EU and AU$1 000 000 in AU. FCA, CySEC and ASIC then make sure the brokers keep clients’ investments in segregated bank accounts for best security.

Leverage is restricted to 1:30 by all three regulators and bonuses are banned. For ensuring the customers don’t lose more than their original investment was, negative balance protection is installed. On top of all that, brokers have to be fully transparent and report their transactions to the supervisors in due time and daily.

IIROC defines the regulatory regime in Canada. While segregated accounts and full transparency is obligatory, bonuses are allowed and maximum leverage is capped at 1:50.

EFSA and JSC are less demanding with their regulatory standards. That’s why you will see Admirals offering higher leverage to some traders while not others.

All in all, Admiral Markets is severely regulated and respects the legal directives in every country of service, so you can trade safely, knowing your funds are completely secure.

Admiral Markets Leverage

The leverage the broker offers is adjustable and it may vary up to 1:1000, but it’s subject to several standards. First one is certainly the regulatory framework present in the area where each trader is located.

Another element that defines the possible leverage is the financial instrument itself. Admirals goes in depth explaining how every asset class can limit or allow the leverage and you can find this information on the site.

Here are some of the examples:

- Leverage on major currency pairs can go up to 1:1000

- On Stock CFDS up to 1:20

- Exchange-Traded Funds (ETF) CFDs up to 1:20

Admiral Markets Account Types Offered

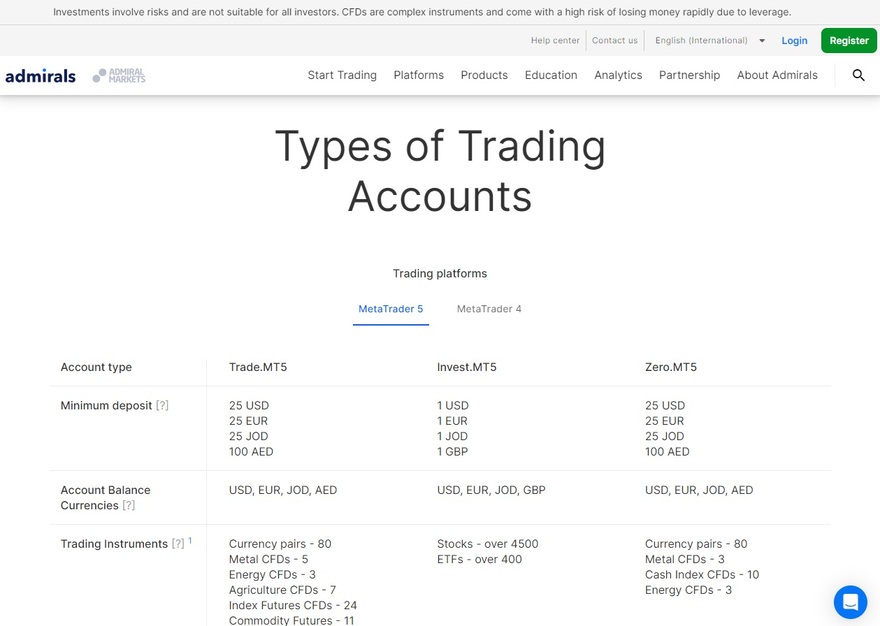

The two trading platforms available at Admiral Markets define the account types.

MetaTrader 5 account types are:

- Trade.MT5 – Minimum deposit of $25, leverage on FX up to 1:1000, spreads from 0.6 pips, islamic account available, signals, EA’s, hedging, 1-click trading, single share & ETF CFDs commission.

- Invest.MT5 – Minimum deposit of $1, spreads from 0 pips, signals, 1-click trading, no islamic account, no hedging, no negative balance protection, commission on stocks & ETFs.

- Zero.MT5 – Minimum deposit of $25, leverage on FX up to 1:1000, spreads from 0, hedging, no islamic account, EA, 1-click trading, commissions on FX, metals, cash indices and energies .

On the other hand, there are two choices for MetaTrader 4 accounts:

- Trade.MT4 – Minimum deposit of $25, leverage on FX up to 1:1000, no islamic account, signals, hedging, 1-click trading, commissions on ETF CDFs.

- Zero.MT4 – Mostly the same options as Trade.MT4 except the commissions are on FX, metals, cash indices and energies.

Trading Instruments Offered by Admiral Markets

With an adjustable leverage and spreads from 0 pips, you can trade thousands of instruments on most advanced trading terminals. Below we list the assets groups and some major instruments that traders mostly choose to buy and sell at Admiral Markets:

- CFDs on 50 currency pairs (EUR/USD, USD/GBP, CAD/NZD, EUR/PLN, CHF/EUR, USD/CAD)

- CFDs on 6 energies and metals (Brent crude oil, natural gas, WTI crude oil, gold, silver)

- CFDs on 12 cash indices (AUS200, FRA40, GER40, HK50, JP225, SPA35)

- CFDs on 2585 stocks (Airbnb Inc, Adobe, Intel, Kforce, Nvidia, Poshmark, SunOpta)

- CFDs on 21 digital currencies (Cardano, Algorand, Cosmos, Bitcoin, Dash, Polkadot)

- CFDs on 351 ETFs (iShares MSCI, Vanguard Growth, Invesco Senior Loan)

- Over 3300 Shares (Apple, Adeia, Neoncode, Office Depot, Okta, Vaxcyte)

- Over 600 ETFs (iShares Asia 50, Globalx Clean Tech, First Trust Capital Strength)

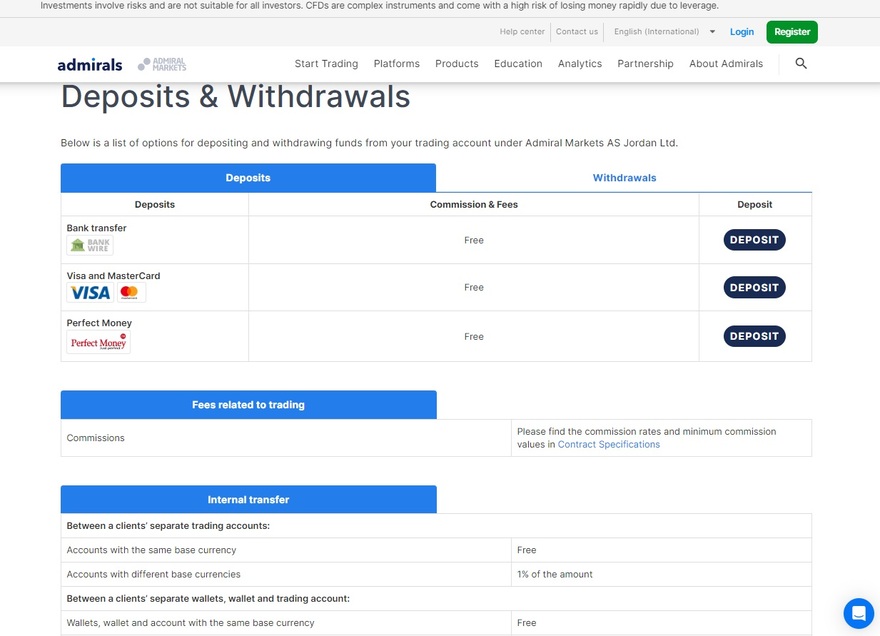

Funding Methods at Admiral Markets

Admiral Markets has made funding extremely easy, fast and safe. The highly responsible and well-trained staff diligently processes all requests for deposits and withdrawals within the period of 24 hours after a client submits them.

The broker introduces several funding methods that do include fees but only under some circumstances:

- Bank wire transfers – Deposits are free if over $1000 if its less then $25 fee applies. There is one free monthly withdrawal and after that min $50 fee follows.

- Credit and debit cards (Visa, MasterCard, Maestro) – Always free deposits with instant transfer. Withdrawal is free once per month after which $5 commission applies.

- E-wallets (Skrill, Neteller, Perfect Money) – Instant deposits without charge. Withdrawals are charged min 1-2 USD.

- Cryptocurrencies (Bitcoin, Litecoin, Ethereum, Ripple, Tether) – Transfers execute immediately and are fee-free. One free withdrawal request per month, after which every next one has a commission of 1% on it.

Admiral Markets Trading Platforms Overview

Most of the retail traders and professionals world wide choose MT5 as their preferred platform for a number of reasons. This premium software solution facilitates trading of Forex, CFDs, exchange-traded instruments and futures with its advanced charting and comprehensive tools.

MetaTrader 4 clients favor the user-friendly interface which is highly responsive, safe and completely customizable. Multi-language support is handy for customers from all around the world, because MT4 certainly brings together millions of traders. Advanced charting capabilities and automated trading make MT4 an exceptional technological solution.

Admiral Markets adds to their offer a trading app for mobile devices. It was designed by professional developers at Admiral Markets and is characterized by simplicity, speed and reliability.

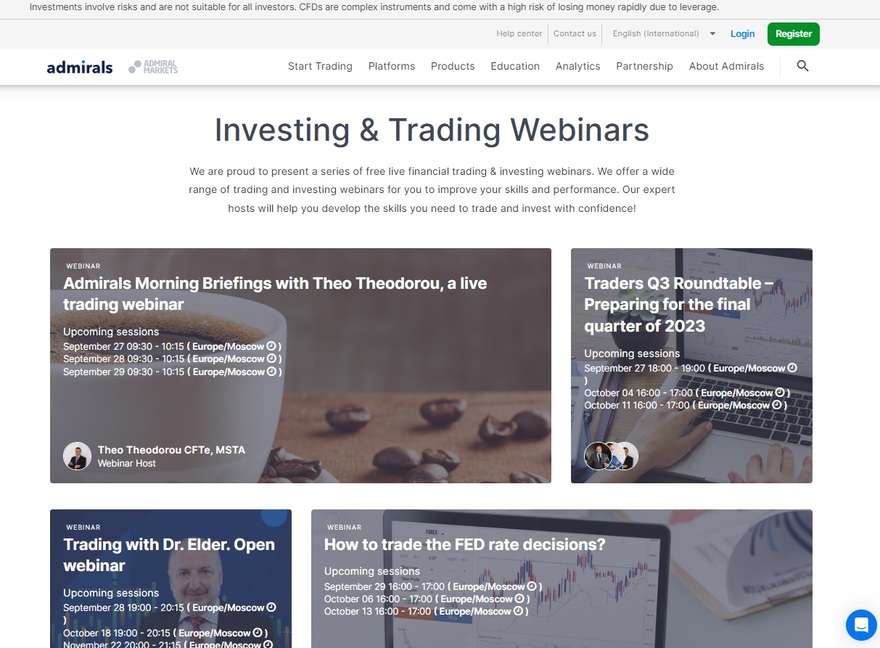

Educational Tools

Reputable brokers are aware their profit revolves around the skillfulness of their customers. The more competent they help their traders become, the broker’s income significantly increases.

To help out their users progress quicker and develop their trading skills, Admiral Markets has provided several educational resources:

- Webinars – live financial trading lessons on various subjects but can also be re-watched as the broker publishes all previously held lectures and guarantees free access.

- Articles and tutorials – expanding everyone’s level of knowledge, regardless of the previous level of skill through detailed articles on all subjects from Forex basics to advanced MT features.

- Forex and CFD live seminars – a series of comprehensive video lessons for all Admiral Markets users covering a range of subjects.

- Traders Glossary – a dictionary of most relevant trading phrases and keywords for Admiral Markets clients to better understand and become more fluent in brokers lingo.

Customer Support

Team of professionals running Admiral Markets is well aware how frustrating minor or major trading or technical problems can be. To spare the customers from dealing with various issues alone, customer support is at your disposal 24/7.

Channels of communicating with the helpful and exceptionally polite agents are the following:

- General email at [email protected] or email addresses for every area where the broker is present.

- Calling +44 20 8157 7344 for English and Russian as primarily supported languages, but there are also phone numbers for every country of service.

- Live chat on the site for instant answers.

Admiral Markets Overall Summary

Admiral Markets is an indeed well known, regulated, and award-winning broker with outstanding online financial services and products to offer. Fully licensed, professional and helpful towards all their clients, the broker has made their way to the top of the industry.

If you are still in doubt, feel free to open a Demo account with this brokerage. It’s a great opportunity to learn about everything this magnificent company can offer you. At the same time you can get a gist of trading, investing, platforms and perfect your existing knowledge.

This Admiral Markets review has listed numerous advantages that trading with this broker could give you. Be sure to keep them in mind, it will be helpful for further comparison or just informational purposes.

FAQs About Admiral Markets Broker

What Account Types are Offered at Admiral Markets?

Several account types are offered, depending on the trading platform you prefer. Whether it’s MT4 or MT5, Admirals have you covered.

Is Admiral Markets Broker Good for Beginners?

Admiral Markets is a good broker for beginner traders as they offer demo accounts and rich educational services to expand your knowledge.

What Is Admiral Markets Minimum Deposit?

Although depending on the area and account type, the minimum deposit could be as low as $1.

Does Admiral Markets Charge Fees?

There are some fees regarding withdrawals but they vary in accordance to the payment method. There’s also a $10 inactivity fee after 24 months of not trading.

How Long Does it Take to Withdraw Money From Admiral Markets?

Withdrawing requests take no more than 48 hours to process.