FxCitizen Review: A Close Look Into The Truth Behind the Broker

Finding a trustworthy alternative for a satisfying trading experience is difficult, therefore getting expert advice and conducting careful research is essential. You can decide whether to trust this broker after reading our FxCitizen review, which will reveal the truth about him.

We will examine their regulation, available payment methods, the traders they serve, and much more. You will also receive expert advice from our trading experts. You shouldn’t only look out for the broker FxCitizen. Noor Capital is a prime example of a regulated broker that needs to catch up.

Who Is FxCitizen? All About FxCitizen Platform

The broker FxCitizen offers trading in forex and CFDs. They started doing business in 2010 and it was surprising to see that there are no reviews for the broker considering they are operating for so long.

Similar to Northern Bits, they have a well-designed website, which at first glance may seem a bit too professional to some.

| General information | |

| Name: | FxCitizen – Universal Citizen |

| Regulation status: | Unregulated |

| Warnings from Financial Regulators: |

|

| Website link: | fxcitizen.com |

| Active since: | 2010 |

| Registered in: |

|

| Contact info: |

|

| Trading platforms: | MT5 |

| Majority of clients are from: | Malaysia

Brunei Indonesia United States South Africa |

| Customer support: | 24/5 live chat support |

| Compensation fund: | None |

Regulation Info

No financial regulatory body oversees FxCitizen. Regulated brokers are often expected to abide by particular standards and follow particular rules to protect their clients’ interests, therefore regulation is still an important factor to take into account when choosing a broker. Regulatory agencies aid in preserving the industry’s financial stability, transparency, and ethical business practices.

Furthermore, we come across a couple of warnings about FxCitizen from the Financial Commission and the Securities and Futures Commission (SFC). As they have received numerous instances of scams, they also advise avoiding the broker.

FxCitizen Broker Profile

Forex, indices, equities, shares, metals, and energies are all traded on FxCitizen. The FxCitizen MT4 platform was exchanged for the desktop- and mobile-compatible MT5. For Standard FxCitizen account types and ECN account types, respectively, the highest leverage available is 1:000 and 1:200.

| Account types: | Standard, ECN |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:1000 |

| Minimum Deposit: | $10-$100 |

| Commissions/bonuses: | Up to 35% bonus |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | N/A |

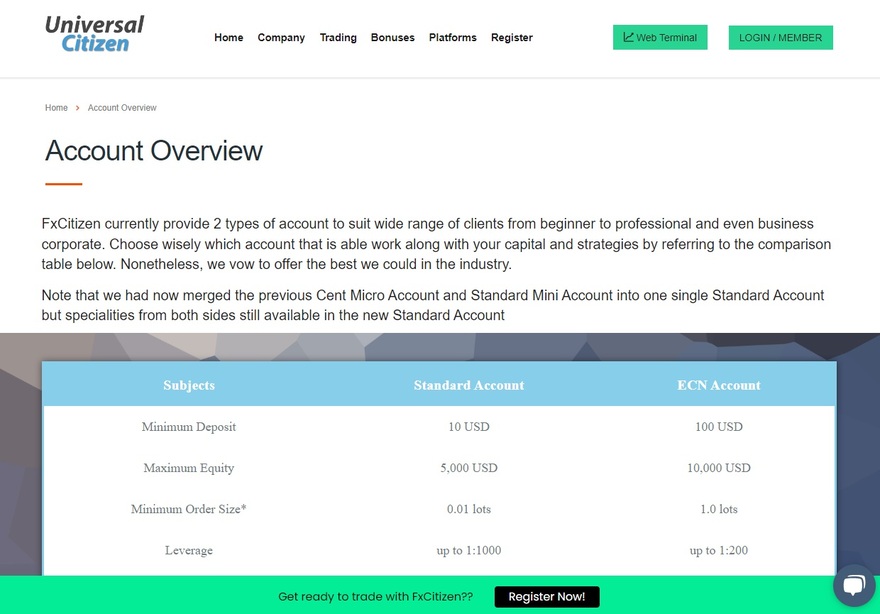

FxCitizen Account Types

There are two different account types available, and each one has its own advantages and possibilities. Leverage and spreads vary based on which no-swap account you select for the Standard account, which is an option. The available account types are:

- Standard Account: You receive an enormous leverage of 1:1000 with a $10 minimum deposit. The minimum lot size is 0.01 lots, with a $5,000 maximum equity. With this account type, bonuses up to 35%, cashback up to $10, no commissions, and fixed and floating spreads are all possible.

- ECN Account: You get 1:200 leverage, no bonus, no cashback, and no swap privilege for a $100 minimum deposit. The minimum order quantity is one lot, and the maximum equity is ten thousand dollars. It also applies a raw floating spread on top of the commission.

FxCitizen Bonus

A sign-up bonus of up to 35% is available from FxCitizen. When enrolling and selecting an account type, you can decide whether to receive the bonus. This bonus will boost your account’s margin and help you maintain it throughout trading activity. Deposit at least $100 USD, and a bonus will be given for each deposit made within 24 hours in accordance with the table below.

| Account’s Balance after Deposit (USD) | Bonus Percentage on new Deposit |

| 100.00 to 300.00 | 35% |

| 300.01 to 600.00 | 25% |

| 600.01 to 2000.00 | 15% |

| 2000.01 and above | 5% |

FxCitizen Cabinet

The “FxCitizen Cabinet” refers to a client portal or account management area provided by the forex and CFD broker FxCitizen. The cabinet is an online platform accessible to registered clients, allowing them to manage their trading accounts and access various account-related features and services.

Is FxCitizen Safe To Trade With?

Since FxCitizen is not regulated, the lack of adequate regulation is troubling because it does not give the same level of protection and supervision that registered brokers do. FxCitizen has had problems with transparency. Lack of effective regulation may result in ambiguous practices and inadequate client disclosure of the broker’s business operations

Like Nippy Trade, FxCitizen caters to traders of all levels, but the lack of proper regulation and transparency could impact the overall trading experience. Traders might prefer brokers that provide a more robust and reliable trading environment.

Dealing with an unlicensed broker entails dangers. Without regulatory control, clients may only have limited options if they have problems or disagreements with the broker. It’s best to cross FxCitizen off your list if it was on there. We are here to assist you because we understand how important it is to have a safe and dependable trading experience. Finding a reliable broker can be difficult, whether you are a novice or an experienced trader. If you get in touch with us, we’ll greatly simplify your path.

A Look at FxCitizen’s Traders They Serve

The affiliate program for FxCitizen has been crucial to extending its reach. The broker rewards people and organizations for referring new customers to their platform by working with affiliates. Through the trading activity of the clients they refer, affiliates can make lucrative commissions, building a relationship that benefits both parties.

Traders from many nations, including Malaysia, Brunei, Indonesia, the United States, and South Africa, are catered to by FxCitizen. FxCitizen aims to establish a global community of traders with a variety of backgrounds and trading preferences by making accessible trading services available to customers in these areas.

Concerns about FxCitizen’s openness and respect for industry norms are raised by the fact that the company is not authorized to operate in any nation. We can assist you in locating a reputable broker who is licensed in your area if you need someone by your side. Our top objectives are your security and peace of mind, and we are dedicated to helping you make wise selections when it comes to selecting a reputable broker for your trading requirements.

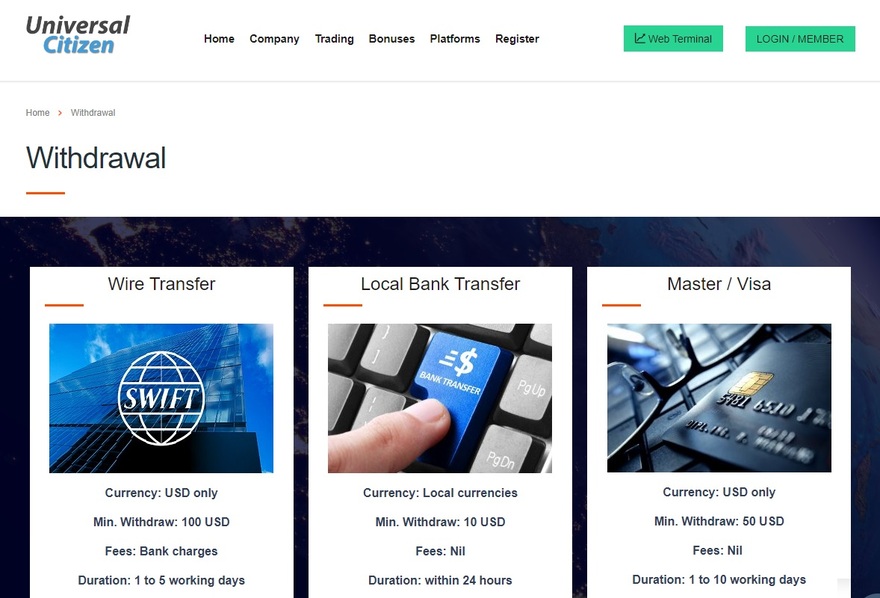

Deposits and Withdrawal Methods

Both deposits and withdrawals can be made through local or wire transfers, Master/Visa cards, cryptocurrencies, and e-wallets such as Skrill or Neteller. In the case of a wire transfer, you can expect your withdrawal within 1-5 working days, while for local transfers it is processed within 5 minutes. There are fees applied for each payment method and they are all different.

- Master/Visa cards: USD only, $50 minimum deposit

- Cryptocurrencies: Fee of 20ERC, floating exchange rates, and 5 minute process time

- E-wallets: $10 minimum deposit, 5 minutes process time, and no exchange rates

FxCitizen Pros and Cons

| Pros | Cons |

|

|

Long Story Short – FxCitizen

Our trading professionals thoroughly examined FxCitizen and discovered several elements that cast doubt on its dependability. We are on the fence about recommending this broker because of several factors, including the absence of regulation and possibly hidden costs. Even while FxCitizen’s use of MT5 is advantageous, there are still drawbacks that we must ignore.

Our experts advise looking into alternative more reputable and licensed brokers for a safer and more satisfying trading experience because they understand how important transparency, investor protection, and a secure trading environment are.

Are you prepared to trade with assurance and comfort? Our team of professionals is here to point you in the direction of reputable, licensed brokers who place a high value on openness and client happiness. Contact us right away to learn more about the best solutions for your needs and don’t compromise on your trading experience. Together, let’s create a prosperous trading environment!

FAQ Section

Is FxCitizen Regulated?

No, FxCitizen is not regulated by any financial authority. Finding a regulated broker is a must due to the safety of your investments.

How To Contact FxCitizen?

FxCitizen is available 24/5 through live chat support, web form, facebook, phone number, or email.

How much is the FxCitizen withdrawal fee?

Depending on the chosen payment method, withdrawal fees vary. In the case of a wire transfer, there are only bank charges, for cryptocurrencies the fee is 20ERC, and for e-wallets, it is $10.