Noor Capital Review: Is NoorCapital.Ae Reliable Broker

Noor Capital broker is owned by Noor Capital P.S.C, based in the United Arab Emirates. It is one of the rare brokers that are offering their services with adequate licensing.

The company has existed since 2005 and they are providing their services for clients in the UAE but also in Turkey and UK. But in order to provide services in the UK they need to hold a license from the FCA, which they don’t. More on that later.

Since UAE regulatory bodies are very strict, we will check that first in our detailed Noor Capital broker review.

| Broker Status: | Regulated broker |

| Regulated by: | SCA Abu Dhabi, DED Abu Dhabi |

| Operating Status: | Active |

| Scammers Websites: | https://noorcapital.ae/ |

| Blacklisted as a Scam by: | None |

| Broker Owner: | Noor Capital P.S.C. |

| Headquarters Country: | UAE |

| Foundation Year: | 2005 |

| Online Trading Platforms: | WebTrader and MT4 |

| Mobile Trading: | Yes |

| Minimum Deposit: | $100 |

| Deposit Bonus: | N/A |

| Crypto Asset Trading: | Yes |

| CFD Trading Option: | Yes |

| Available Trading Instruments: | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Maximum Leverage: | 1:500 |

| Islamic Account: | Yes |

| Free Demo Account: | Yes |

| Accepts US clients: | No |

Noor Capital Pros and Cons

Noor Capital is owned and operated by Noor Capital PSC, which is a private joint stock company incorporated under the law of UAE with a registered office in Abu Dhabi.

The company is registered with the Department of Economic Development of Abu Dhabi and is authorized and regulated by the Central Bank of the United Arab Emirates to conduct banking, financial investment, and consultancy as well as financial and monetary intermediary business.

This is a huge plus when working with any legitimate broker. But on the other hand, leverage is as high as 1:500. We were offered that when we opened our demo account and that leverage is currently available only with offshore brokers regulated in markets like the United Arab Emirates, South Africa, and New Zealand.

In most other major markets including the European Union, the U.S., Canada, Japan and now even Australia, the financial regulators have imposed strict leverage restrictions, in a coordinated effort to reduce investment risks.

Another red flag that we have found with Noor Capital is that after we tested a demo account, the benchmark EUR/USD spread floated about 2 pips – 2,1 pips. Bear in mind that spreads are usually considered attractive only when they start below 1,5 pips with a standard account and no trading commissions.

As a final red flag and the source of many Noor Capital complaints, we will list negative balance protection. EU and UK regulators with licenses provide negative balance protection to ensure that customers won’t fall into debt to the trading firm. The firm has no such guarantee, meaning that you can lose more than you invested unless you close the trade when it comes to zero.

What are the Available Accounts at Noor Capital?

The broker offers 6 different account types starting with the following ones:

- Standard investment account

- Premium investment account

- VIP investment account

- Institutional investment account

- Multi-model Investment Account

- Islamic investment account

Of course, the more you invest the better are conditions. As a result of adding more funds, clients decide to go with MAM or PAMM trading models where the broker is trading with the combined funds of many traders. Based on the amount deposited, profits are split between investors.

The first three are regular account types bringing in more perks with higher investments. An Institutional account gives clients FIX API based on the FIX 4.4 Protocol, designed for algo-trading.

As there are many account types available, we hope that with these basic details, you will know which one is most suited to you. The best thing to consider is the style of trading, strategy, amount of money you are willing to risk, and your level of expertise.

Noor Capital does offer a demo account. However, note that real issues start with real deposits. Besides the fact that this firm has no negative balance protection, your funds will be exposed to too much leverage. The EU, UK, US, and Australian regulators have a strict limit of 1:30 or 1:50, while the broker enables up to 1:500. If you can’t handle the leverage, don’t even bother testing this platform.

Noor Capital Trading Platform Overview

We were expecting something more advanced. But the availability of Web Trader and MetaTrader 4 is enough. Even though MT4 is only available for Forex trading we find it as a good option. However, if you want to switch between assets and check multiple options, you will have to check two different platforms.

MT4 is a trading standard for most Forex traders. It offers very good trading tools, indicators and advanced features. Besides that, it’s available for any mobile device whether Android or iOS. On top of that, they also offer MetaTrader4 on desktop, which is always desirable.

Noor Capital Trading Instruments

The broker offers a very solid group of financial assets.

Starting from:

- Forex – USD/JPY, EUR/SGD, GBP/NOK

- Commodities – oil, natural gas, gold

- Indices – Dow Jones, FTSE100, AU20

- Shares – Apple, Microsoft, Tesla

- Cryptocurrencies (only 4) – BTX, ETH, LTC, XRP

Just have in mind that Forex is available on MT4, while other CFD assets are available on the Web trader. Since maximum leverage goes up to 1:500, be careful trading those assets. Overall, the trading instruments are good but don’t forget that the maximum leverage is 1:500, which is too high.

Deposits and Withdrawals Methods

According to the FAQ section on Noor Capital’s website, funds must be withdrawn using the same method you used for the deposit. They accept the following methods:

- Debit/credit cards

- Wire transfers

- E-wallets

However, the Noor Capital withdrawal request should be submitted through the Private Cabinet portal. And there are no further specifications on how long this process should take.

As for the minimum deposit, Noor Capital requires at least $100 for their standard account. Although this is considered a bit high in comparison to other regulated brokers, who will let you start as little as $5, you shouldn’t be afraid of this.

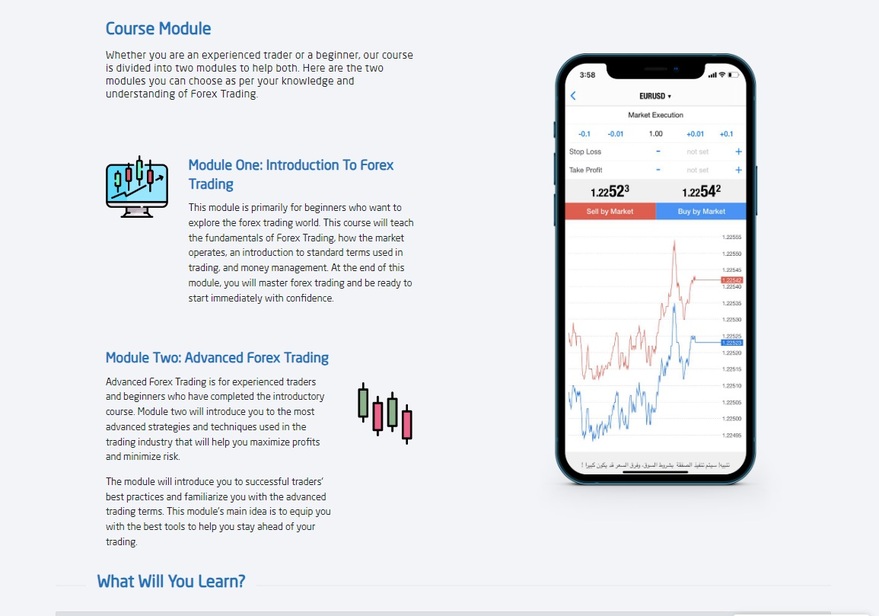

Trading Education at Noor Capital

This broker offers many different forms of educational materials including:

- Articles

- eBooks

- Video tutorials

- Webinars

You can easily access all of this material under the Noor Academy and Trading tools tab on their website.

This is great, especially for all of those who are new to trading and may be hesitant to ask many questions. Compared to the other brokers on the market, the level of analysis this broker provides is quite good.

Both beginners and advanced traders will find the information easy to grasp and very useful in making trading decisions.

On top of that, once you deposit and start your trading journey, you will be provided with an account manager that is designated to help you learn and as well help you make as much profit as possible.

Customer Service

As part of our Noor Capital Markets review, we review customer service options, response times, and problem resolution effectiveness on the Noor Capital Markets trading platform.

The Noor Capital Markets trading platform supports multiple languages, which include English, Spanish, Czech, Chinese, German, French, Italian, Polish, Portuguese, Romanian, Slovenian, Hindi, Hebrew, Arabic, and Russian.

Based on our experience, we have given Noor Capital Markets a D grade for customer support. We encountered some slow response times or Noor Capital Markets queries that were left unanswered.

Compared to other brokers, Noor Capital Markets offers fewer customer support features. They do not provide live chat support, and their phone and email support can also be slow.

Overall, the customer service is good but there is still a lot of room for improvement. We do hope they will update their customer service options since it will bring a much better trading experience for many of their already existing and future traders.

Noor Capital Overall Summary

In this Noor Capital review, we talked about this established UAE broker. It is regulated by the two regulatory bodies which are SCA Abu Dhabi, and DED Abu Dhabi. With this broker, you will get access to multiple trading platforms you can choose from depending on your preferences. They also offer a mobile app to make your trading even easier to monitor.

As for accounts, they offer 6 different types and the maximum leverage on any of them is set at 1:400, which is quite high for a regulated firm.

Noor Capital also offers a demo account, dedicated customer service, and various types of educational material which can all help you make your trading journey as smooth as possible. However, the fact that they have many customer complaints should never be overlooked.

Just like with any other broker, whether being a regulated or unregulated one, you should always think twice before investing, especially online. You want to make sure that you are working with a good and reliable broker that will help you earn money and teach you something along the way.

Always think twice before taking any risks while investing money and choose brokers that haven’t violated any terms and conditions to ensure your funds are in good hands.

FAQs About Noor Capital Broker

Does Noor Capital Offer Live Chat?

Yes, Noor Capital does offer a live chat option for their clients.

Is the Broker at Noor Capital Trustworthy?

Noor Capital is a trustworthy broker as they are regulated but many people had bad experiences with them.

How Long Does It Take to Withdraw from Noor Capital?

Unfortunately, on the broker’s website it isn’t stated how long does the withdrawal process take.

What Trading Platform Does Noor Capital Use?

Noor Capital uses two different trading platforms, which are: WebTrader and MT4.

Does Noor Capital Have a Mobile Application?

This broker does offer a mobile application so this should make your trading much easier to follow.