InvestixTrade Review: A Fishy Broker Targeting UK and French Investors

InvestixTrade, a platform that offers many services, has caused concern among traders.

Operating under the guise of being located in London, this broker has garnered attention for its dubious practices. In this comprehensive InvestixTrade review, we delve into the legitimacy concerns surrounding InvestixTrade. We will explore their claimed partnership programs and shed light on red flags that traders should be aware of. Let’s navigate through the web of deception and find out the truth behind InvestixTrade.

| General information | |

| Name: | Investix Limited |

| Regulation status: | Unregulated Broker |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | investixtrade.com |

| Active since | 2022 |

| Registered in | London, UK |

| Contact info: | Data is hidden |

| Trading platforms: | WebTrader |

| The majority of clients are from | the United Kingdom

France |

| Customer support: | Contact form |

| Compensation fund: | No |

InvestixTrade Regulation Claims

InvestixTrade asserts to have offices in the United Kingdom and France, which raises some questions. Despite these claims, a lack of proper regulations casts doubt on their credibility.

The platform alleges registration with SVG FSA, but it’s crucial to note that SVG FSA does not regulate forex trading, making this assertion misleading. Moreover, InvestixTrade falsely presents itself as FSCA regulated.

Traders should exercise caution and prioritize Tier 1 regulated brokers, such as those overseen by reputable bodies like ASIC and FCA. Interestingly, this fake broker seems to target individuals in the United Kingdom and France, a trend that adds another layer of suspicion.

Note: Protect your funds by avoiding unregulated brokers such as investixtrade.com and Palmer Finance. Your financial security is critical.

Trading Assets Available: A Fuzzy Picture of Offerings

InvestixTrade promises an extensive array of trading assets, including trading shares. However, upon closer examination, their website’s asset page appears broker, leaving traders unable to verify these claims.

We must approach their declaration of offering over 1800 instruments with skepticism. Their lack of clarity raises concerns about the legitimacy of these alleged offerings. Traders are advised to steer clear of platforms that withhold crucial information. Moreover, it’s wise to opt for regulated brokers to ensure safety and asset variety.

InvestixTrade Platforms: Misleading Claims

InvestixTrade’s trading platform claims, like “Deep Market Liquidity” and WebTrader, are concerning. Despite this enticing terminology, the platform lacks transparency. Keep that in mind.

To have a safe trading experience, pick brokers with trusted platforms such as MT4 and MT5. These platforms offer many useful tools for trading and have strong security measures. They also have a wide variety of options for customization. InvestixTrade’s false claims reveal the importance of trustworthy platforms for traders.

Note: Make sure to avoid unregulated FX firms like InvestixTrade and Margex. Keep your money safe.

Trading Environment – Fake Partnership Programs

InvestixTrade’s partnership program, promising lucrative commissions, should be viewed with skepticism. While their offerings may seem nice, the platform’s overall credibility is marred by its lack of regulatory oversight.

The array of commission plans (RevShare, CPA Affiliates, and Hybrid) may appear appealing. Yet, traders are cautioned against engaging with a broker that lacks proper regulation. The pursuit of genuine partnership opportunities is best served through established and regulated brokers. These brokers prioritize their client’s interests and adhere to transparent business practices.

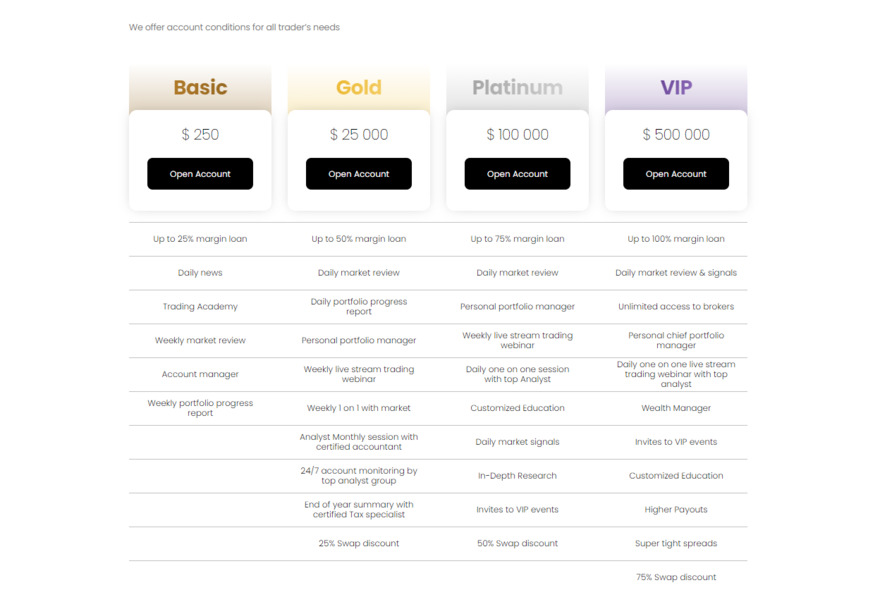

InvestixTrade Account Types: A Closer Look at Dubious Offerings

Here are the account types InvestixTrade claims to offer:

Basic Account – $250

- Up to 25% margin loan

- Daily news updates

- Access to Trading Academy

- Weekly market review

- Assigned account manager

- Weekly portfolio progress report

Gold Account – $25,000

- Up to 50% margin loan

- Daily market reviews

- Daily portfolio progress reports

- Personal portfolio manager

- Weekly live stream trading webinar

- Weekly 1 on 1 session with a market analyst

- A monthly session with a certified accountant

- 24/7 account monitoring by top analyst group

- End-of-year summary with Certified Tax Specialist

- 25% Swap discount

Platinum Account – $100,000

- Up to 75% margin loan

- Daily market reviews

- Personal portfolio manager

- Weekly live stream trading webinar

- Daily one on one sessions with a top analyst

- Customized Education

- Daily market signals

- In-Depth Research

- Invitations to VIP events

- 50% Swap discount

VIP Account – $500,000

- Up to 100% margin loan

- Daily market reviews & signals

- Unlimited access to brokers

- Personal chief portfolio manager

- Daily one-on-one live stream trading webinar with top analyst

- Wealth Manager

- Invitations to VIP events

- Customized Education

- Higher Payouts

- Super tight spreads

- 75% Swap discount

While these account types may sound appealing, it’s vital to consider InvestixTrade’s lack of proper regulation. There are many potential risks that come with trading through an unverified platform. That goes without saying.

Customer Support – Limited Support Channels

InvestixTrade’s customer support seems limited, relying solely on contact forms for communication. This lack of accessibility raises a major red flag. This is given that authentic brokers emphasize multiple support channels to address traders’ queries and concerns.

Accessible customer support is of the utmost importance. Traders and investors need a responsive and dependable avenue for seeking assistance. Genuine brokers recognize the significance of this support, as it directly impacts the trading experience and satisfaction.

Remember, a reliable and efficient customer support system is indicative of a broker’s commitment to its clients. Opting for brokers with comprehensive support channels ensures that traders receive timely guidance whenever needed.

InvestixTrade Withdrawal Terms: Suspicious Payment Options

The disclosed payment options are Visa, Neteller, and Mastercard. But InvestixTrade’s withdrawal terms raise suspicions about the platform’s transparency and legitimacy. Traders should be cautious when engaging with brokers that lack a diverse range of widely recognized payment options.

To ensure the safety of their funds, traders are encouraged to choose brokers that offer reputable and transparent payment methods. Some of them can include popular options like PayPal, Skrill, crypto, and bank transfers.

Trader Reviews on Trustpilot: A Sign of Suspicion

InvestixTrade’s Trustpilot rating of 3.3 stars, combined with a 33% 1-star rating, acts as a clear warning for potential traders. The large number of negative reviews raises doubts about the platform’s reliability and how satisfied customers are. In the trading world, reviews that are verified and positive hold a lot of value.

This shows whether a broker is trustworthy and capable to deliver good services. For your safety, it’s wise to choose brokers that have a strong history of happy customers. This not only keeps your money secure but also makes your trading experience much smoother and more successful.

Scam Broker Tactics: Protecting Against Shady Practices

In the trading world, it’s crucial to stay watchful for common scam broker tactics. Shady brokers like Athens Markets and InvestixTrade have many ways to trick people. These tricks often involve promising unrealistically high profits. These brokers also use aggressive marketing approaches and keep transparency in the shadows.

These tactics specifically target traders looking to increase their earnings. To steer clear of such traps, thorough research into brokers is a must. Prioritizing regulated options adds an extra layer of security. Also, exercise caution when facing offers that seem too good to be true. By taking these precautions, traders build a solid defense against dishonest maneuvers. This leads to a safer trading experience.

Long Story Short – InvestixTrade

To wrap up, the dubious claims and practices exhibited by InvestixTrade raise big concerns among traders. Yes, the trading world presents countless opportunities. But it remains crucial to focus on safety, legitimacy, and clarity when selecting a broker.

For aspiring traders, a strong piece of advice is to opt for regulated brokers that put their client’s interests first. Regulated brokers offer crystal-clear terms and unwavering customer support. Making smart investment decisions not only protects financial interests. It also plays a pivotal role in fostering a resilient and secure trading environment.

For expert guidance on selecting regulated brokers, don’t hesitate to reach out to us. We’re here to offer a free consultation and assist you in making informed choices.

FAQs

Is InvestixTrade Safe?

InvestixTrade's safety is questionable due to a lack of proper regulation and transparency.

Does InvestixTrade Offer a Demo Account?

InvestixTrade's support of a demo account is unclear, adding to the ambiguity.

What Is the Minimum Deposit with InvestixTrade?

InvestixTrade's minimum deposit requirement is $250.