uBanker Review: Disclosing the Legitimacy and Credibility

In this uBanker review, we will thoroughly assess the legitimacy and offerings of this FX broker. With a keen eye for detail, we’ll delve into their registration details, available trading assets, platforms, the general trading environment, and withdrawals.

Besides, we’ll explore the importance of trader reviews on platforms like Trustpilot and Glassdoor and how they impact the reputation of a broker. Our ultimate goal is to provide you with accurate and comprehensive input. Stay tuned!

| General information | |

| Name: | Green Pole Ltd |

| Regulation status: | VFSC |

| Warnings from Financial Regulators: | CNMV |

| Website link: | https://ubanker.com/ |

| Active since: | 2017 |

| Registered in: | Cyprus |

| Contact info: | [email protected], +27104464226 |

| Trading platforms: | PROfit in Web and Mobile version |

| Majority of clients are from: | South Africa

Netherlands Colombia United States Nigeria |

| Customer support: | Email, form, phone |

| Compensation fund: | No |

uBanker Legitimacy

uBanker’s website ownership is attributed to Green Pole Ltd. What’s more, it is authorized by the Vanuatu Financial Services Commission with license number 14627.

Yet, it is necessary to note that the regulatory regime of the VFSC is relatively lax compared to the strict oversight found in the USA, European Union, Australia, and the United Kingdom.

The VFSC imposes a capital requirement of VUV 5 million (equivalent to roughly $50,000) for Securities License holders, while US-based brokerages must maintain a net capital of at least $20 million. This guarantees they are well-capitalized to protect people from adverse market events. Similarly, Australian brokers need to maintain a minimum net capital of AUD 100,000, and those in the UK and EU require EUR 730,000, nearly 20 times the VFSC’s requirement.

Adding to the intricacy, the broker’s website footer mentions another entity, Rehoboth Ltd, with registration number 370840, located at 73 Arch. Makarios III Avenue, CY1070 Nicosia, Cyprus. This prompted us to check the Cyprus Securities and Exchange Commission (CySEC) database, which revealed no record of Rehoboth Ltd or Green Pole Ltd. The absence of any registration under these names raises concerns about the broker’s legality and transparency.

Also, we found that the Spanish financial watchdog, the Comisión Nacional del Mercado de Valores (CNMV), issued a warning against the broker earlier this month. Such warnings should not be taken lightly. They advise careful consideration before engaging with this brokerage.

Exercising Caution While Evaluating the Broker’s Trading Assets

uBanker claims to offer a vast range of trading assets to users. They aim to build a strong and diversified trading experience. Namely, these assets include major and exotic currency pairs, precious metals like silver and gold, and highly volatile crude oil.

Yes, the availability of such a broad range of assets is appealing to traders looking for nice opportunities. Still, we advise potential clients to approach this with caution due to the concerns raised about the broker’s legitimacy. As we discovered earlier, the lack of records with reputable regulatory authorities and the CNMV warning should be considered when evaluating uBanker’s claims.

Similarly, we must highlight that credible and regulated brokers typically offer a broad selection of assets while maintaining strict adherence to regulatory guidelines. This is the unwritten rule. Traders need to prioritize safety and transparency when choosing a brokerage, as the markets can be unforgiving.

Trading Platforms Available

uBanker provides its clients with two primary trading platforms: WebPROfit and mobile PROfit. The WebPROfit platform is web-based and accessible through a browser. On the other hand, mobile PROfit caters to Android and iOS users. It offers tremendous flexibility and convenience on the go.

However, we must emphasize that both platforms have received mixed reviews from traders and professionals. While uBanker promotes its platforms with flashy names, we found that they fall short of the professional standards set by established industry venues such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

These respectable platforms, particularly MT4, have gained massive popularity among traders worldwide. Namely, over 80% of users prefer it for its modern interface, mind-blowing charting, and analysis tools, and features like copy and auto-trade options.

MT5, MT4’s successor, delivers some advantages. For example, there’s the ability to execute trades across varied financial markets through a single account and a hedging option. Both platforms are available as desktop applications and apps for both iOS and Android devices.

Note: Stay away from Deluxe Royals since they are not regulated by any regulatory agency. It’s advisable to avoid brokers like them for safer trading. You can always reach out to us for a free consultation. We aim to provide you with top-notch brokers on the market.

Trading Basics: A General Overview

A crucial aspect of any brokerage is the trading environment it provides. This includes factors like spreads, leverage, and risk management criteria. Assessing the trading environment allows traders to calculate the overall safety of the broker’s services.

When reviewing uBanker’s spread for the widely traded EUR/USD currency pair, we observed a spread of 3 pips. This spread is notably wider than what most reputable brokers offer, which typically ranges from 1 to 1.5 pips for EUR/USD. A wider spread can result in higher transaction costs, potentially reducing their profitability. Keep that in mind.

Note: It is essential to avoid offshore brokers like Demaxis as they don’t have any honest intentions.

Leverage

Another crucial reflection is the broker’s leverage. uBanker advertises a leverage ratio of 1:200 for FX trading. That allows traders to control larger positions with smaller initial investments. While this may attract some traders looking for bigger profits, it also comes with significant risks, especially for inexperienced traders.

It is vital to understand that trading on leverage amplifies both potential gains and losses. While higher leverage allows for more substantial profits, it also increases the likelihood of significant losses. What’s more, these can exceed the initial investment. This risk is especially pronounced for non-professional traders, prompting regulatory authorities in many regions to impose leverage caps.

For instance, in the USA, the Commodity Futures Trading Commission (CFTC) restricts leverage to 1:50. Also, brokers licensed in the EU and the UK must cling to maximum leverage of 1:30. The Australian Securities and Investments Commission (ASIC) also introduced a leverage cap of 1:30 for major currency pairs from March 29, 2021, in line with the aim of safeguarding traders.

Managing Your Funds: uBanker Withdrawal Process

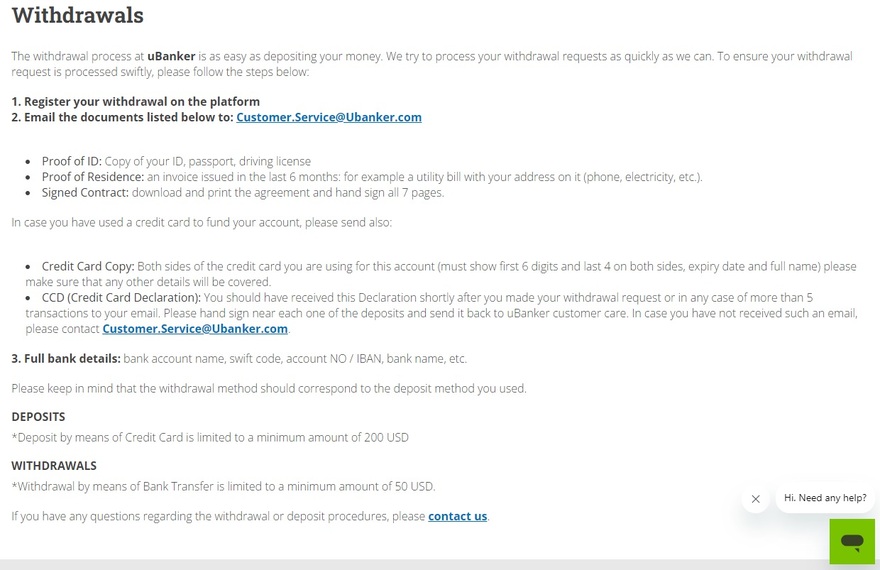

uBanker gives us varied payment methods for funding and withdrawals. Standard options like credit/debit cards and wire transfers are available for users seeking customary methods.

Besides, the broker offers electronic wallet (e-wallet) options, including EFTpay, Skrill, and Neteller, which are commonly used for quick and convenient transactions. However, we advise potential clients to approach the earning and withdrawal process with caution, given the concerns raised about uBanker’s legitimacy. While these payment methods may be familiar and widely accepted in the industry, it is crucial to ensure that the broker adheres to strict security measures and regulatory guidelines when handling clients’ funds.

Traders should prioritize the safety and transparency of the broker’s financial operations. This goes without saying. Reputable brokers use rigid security protocols and adhere to regulatory prerequisites to protect client assets.

Note: DeltaFx is not regulated by any agency or recognized regulatory authority. Avoid brokers such as this one.

Trader Reviews

What is one striking aspect of assessing a broker’s reputation? Namely, it is to consider the experiences shared by other people who have used their services. Online platforms like Trustpilot and Glassdoor are valuable resources for reading authentic reviews and gaining insights into the overall performance and customer satisfaction of the broker.

However, our investigation revealed a startling result: uBanker lacks any reviews on Trustpilot and Glassdoor. The absence of trader reviews raises concerns about the credibility of the broker. Reliable firms typically have a history of reviews from clients. They offer potential users valuable information about the quality of services, the reliability of the platform, and the overall experience.

Trader reviews play a crucial role in guiding traders toward reputable brokers. They serve as a testament to the broker’s commitment to customer satisfaction and can provide useful insights into potential issues raised by previous clients. The scarcity of reviews leaves potential clients in the dark, making it challenging to evaluate the broker’s track record.

Long Story Short – uBanker

Generally, uBanker’s legitimacy is questionable, considering the lax regulation of the Vanuatu Financial Services Commission. The lack of records with reputable authorities and the warning from the Spanish financial watchdog raise further concerns.

While uBanker claims to offer an eclectic range of trading assets and platforms, they fall short compared to established industry standards. The wider spreads and higher leverage may attract some traders seeking larger profits, but they also expose traders to significant risks, especially for inexperienced individuals.

Similarly, the absence of trader reviews on platforms like Trustpilot and Glassdoor makes it tricky to assess uBanker’s track record and reputation among its clients. For these reasons, we recommend exercising caution and prioritizing transparency and safety when regarding uBanker as your forex broker.

Are you looking for respectable FX brokers? If that is a yes, feel free to contact us today!

FAQs

How does uBanker work?

uBanker operates as a forex broker, offering trading services on various assets.

Is uBanker legit?

While uBanker is authorized by the Vanuatu Financial Services Commission, its regulatory regime is less stringent. How to close a uBanker account?

How does uBanker work?

uBanker operates as a forex broker, offering trading services on various assets.