Vital Markets Review: Why You Should Avoid Vital Markets

When we look at their outstanding website design, Vital Markets may seem like a tempting choice. We must admit that!

Offering a range of options, low initial deposits, and an attractive website, it catches the eye of many investors. Still, as we dive deeper, the lack of transparency becomes clear. In this Vital Markets review, we will expose the truth behind Vital Markets and why it’s crucial to stay away from such fake brokers.

| General information | |

| Name: | Vital Markets |

| Regulation status: | Unregulated Broker |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | vitalmarkets.com |

| Active since | 2014 |

| Registered in | Dominica |

| Contact info: | Data is hidden |

| Trading platforms: | MT5 & MT4 |

| The majority of clients are from | United States South Africa BelgiumUnited Kingdom Nigeria |

| Customer support: | Contact form and chat |

| Compensation fund: | No |

Vital Markets: Basic Details and Legitimacy

So, is Vital Markets regulated? Vital Markets works under the laws of the Commonwealth of Dominica, an offshore country with a loose licensing authority, FSU.

A search in FSU’s database gave no results, indicating a lack of proper regulation. Even Tier 1 license providers like FCA, ASIC, BaFin, and CONSOB do not recognize Vital Markets, raising huge concerns about its legitimacy.

While the broker may seem nice with its low deposit requirement and trading platform choices, it falls short in providing fund protection. Tier 1 regulated brokers, on the other hand, offer substantial guarantees, making them a safer choice for traders.

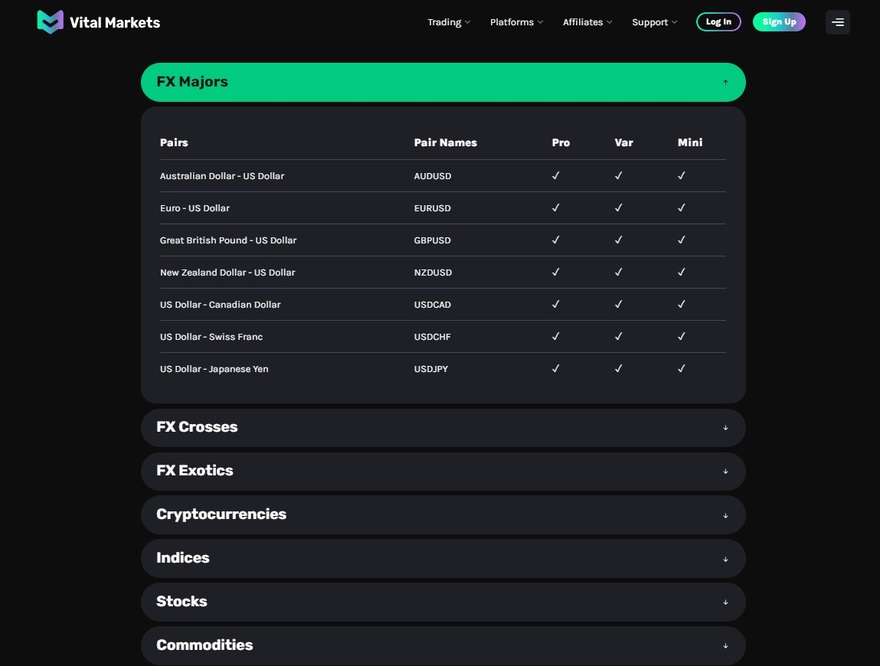

Trading Assets with Vital Markets

The Vital Markets broker claims to include a variety of trading assets across different markets. Clients can invest in Forex pairs like GBP/SEK, USD/NOK, indices such as SPX 500, BE 20, and AUS 200, commodities like Gold, Corn, and Natural Gas, stocks including Nike, Amazon, and Volkswagen, and crypto coins such as DASH, USDT, and BNB.

However, try to remember that choosing Tier 1 regulated brokers is a safer and more reliable option. This goes without saying.

Trading Platforms: Vital Markets MT4 & MT5

Is it true there are Vital Markets MT5 and MT4 platforms? Despite Vital Markets’s controversial reputation, its trading platform stands out. Clients have access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), favored by 80% of retail traders for their modern interfaces and support for various trading strategies.

MT5, as an advanced version, offers even more indicators and elements. Also, mobile trading apps for both Android and iOS ensure that traders can access these platforms on the go. Still, it’s recommended to use MT4 or MT5 with a reputable broker for steadfast trading experience.

Trading Environment – Accounts, Bonuses, and More

Vital Markets offers some account types: $0 Commission, Micro, VIP, and Fixed Spread accounts, each with a fixed leverage of 1:500. While high leverage may seem solid, it significantly increases the risk for traders. Beware of that!

Regulated brokers are subject to stricter leverage caps, providing a safer trading environment. Again, traders should choose brokers with Tier 1 regulations to avoid scams and financial losses.

Tip: What about UOP Capital? This forex broker’s regulatory status is debatable. It’s clear it is not regulated by any reputable financial authority.

Vital Markets Spreads and Fees

The broker boasts relatively low spreads, particularly 0.1 pips for EUR/USD pairs.

However, fees vary depending on the account type. There is $6 per lot for VIP accounts and $5 per lot for Fixed Spread accounts. This is important to remember.

Note: While PRCBroker is a fully regulated broker, there are some issues. For instance, keep in mind that they have a clone that may not be so fair.

Withdrawal Rules

Vital Markets’s withdrawal policy may promise effortless withdrawals and fund security. Yet, it offers only cryptocurrency as a withdrawal option.

This limitation can be problematic for traders seeking transparent payment options like PayPal, Skrill, Google Pay, Advcash, bank cards, or other cryptocurrencies.

Note: What about the Vital Markets demo account? This company claims they offer a trading account for testing!

Vital Markets Withdrawal Issues

In addition to the withdrawal limitations, many Vital Markets reviews suggest that the company asks customers to pay upfront fees for wallet confirmation.

After transferring the requested amount, traders often find their accounts suspended, and communication with the firm ceases. This is a typical tactic of a broker scam!

Trader Reviews on Trustpilot

What is there to know about the fact that this broker has 0 Trustpilot reviews? The lack of Trustpilot reviews for Vital Markets is worrying. When there’s no feedback, it can make traders uneasy. In such cases, it’s best to be careful and opt for well-established brokers with high ratings (4.5 stars or more).

These brokers have a track record of offering a safer trading experience, providing more peace of mind for us.

Staying Safe from Risky Brokers

You know, dealing with scam brokers like Vital Markets and Concept Markets can be rather risky. They often slap on huge fees, sometimes even gobbling up to 20% of your money. That can eat into your profits and, worst of all, lead to losses.

What’s sneaky is that some of these people create fake websites, making you think you’re dealing with a legitimate firm when you’re not. To keep your money safe, it’s crucial to understand how these fake brokers operate. They might throw tempting deals your way, but they often lack the oversight that guarantees fair trading.

Another problem traders run into is trouble withdrawing their funds or suddenly getting their accounts shut down (this is exactly what happens at Vital Markets). Remember that this can result in some serious financial hits.

To sum it up, offshore and scam brokers come with their fair share of risks, mainly due to their lack of regulation, sky-high fees, and the potential for stealing. To play it safe, it’s best to opt for legitimate brokers with clear fee structures and proper regulations in place. That way, you’re less likely to get burned in the world of trading.

Can I Make Money From Online Trading?

Switching gears, you should know that we offer free consultations tailored for you! Also, we prepared our new AI Analysis Bot to simplify your investigation. Namely, the first 100 people who sign up can enjoy a free 14-day trial. We aim to ease the trading experience and encourage traders to make wise judgments with the help of our clever tools.

Last but not least, Vital Markets’s lack of regulation, fishy practices, and limited fund protection make it a risky option for FX trading. To enjoy your trading fully, please go for Tier 1 regulated brokers with a proven track record of safety and reliability. Your security should always be a top priority in the world of trading.

FAQs

What is Vital Markets?

Vital Markets is an unregulated broker, lacking approvals and fund protection.

What is the minimum deposit for Vital Markets?

The minimum deposit amount for the micro account is $10.

How do I withdraw from Vital Markets?

Withdrawals from Vital Markets are limited to crypto.