World Class Fin Review: Exploring the Truth Behind Worldclassfin.com

The World Class Financial Intelligence (WCF) website identifies itself as a global leader in online trading. They are offering access to several cryptocurrencies, currency pairs, indices, and commodities. With promises of rapid execution, raw spreads, and high leverage of up to 1:200 on the MetaTrader 4 platform, WCF appears to be a lucrative option. Yet, a closer look reveals a different story. Despite claiming a global presence, WCF’s credibility is questionable. The main reason for that is their offshore location and lack of regulation.

Always avoid unregulated brokers like WCF or AFS-Equity. Read on to find out why!

World Class Fin Regulation

The Worldclass Financial Intelligence is an online trading brokerage that facilitates trading in commodities, indices, and crypto. Offering UI-friendly trading platforms and 24/7 customer support, it aims to provide a seamless experience. Yet, its headquarters in St. Vincent and the Grenadines raise concerns about its regulation. Despite the company’s claim of being “safe and reliable”, there is no financial regulation or transparency.

The following sections will give you an in-depth understanding of World Class Fin’s operations. Despite its claims, the company’s offshore location and lack of transparency undermine its legitimacy. Their lack of regulatory license raises suspicions, mirroring the questionable status of another offshore broker, BrokersPark.

| General information | |

| Name: | Worldclass Financial Intelligence LLC |

| Regulation status: | Unregulated Offshore Broker |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | worldclassfin.com |

| Active since | 2020 |

| Registered in: | St. Vincent and the Grenadines |

| Contact info: | [email protected] |

| Trading platforms: | MT4 |

| The majority of clients are from: | Thailand

United States Australia United Kingdom |

| Customer support: | Yes (24/7, Email, address, live chat) |

| Compensation fund: | No |

Trading Assets at World Class Fin: Variety and Risk

Worldclass Financial Intelligence LLC offers a wide range of trading options. These include commodities, indices, cryptocurrencies, and other CFDs. This variety lets traders diversify portfolios and seize potential gains in volatile markets. There are higher risks associated with these instruments since certain commodities and cryptocurrencies are notoriously volatile.

Careful risk management is vital, and specific instruments’ availability may vary due to regional rules. Therefore, it is important to research and understand the regulations of the region before trading. It is also important to have a clear understanding of the associated risks and develop a solid risk management strategy.

World Class Fin MT4: Pros and Cons

World Class Fin grants access to the acclaimed MetaTrader 4 (MT4) platform for desktop and mobile trading. MT4’s appeal lies in its UI-friendly design, advanced charts, and automated trading features.

Yet, the broker falls short in supporting other platforms like MT5. It offers limited customization and assets, impacting its flexibility. Traders who choose MT4 might face challenges accessing market data compared to alternative platforms. As a result, traders need to evaluate their preferences and the features they need from a platform before selecting it. For those who are comfortable with its features and limitations, it can be a great choice.

Exploring World Class Fin’s Trading Environment

Worldclass Financial Intelligence LLC strives to provide competitive pricing with low spreads and zero commission for Standard and VIP1 accounts.

The VIP2 account, however, incurs a $7 commission per lot, which may not suit all traders. While there are no deposit or withdrawal fees, the limited account options might not cater to every trader’s needs. Notably, the broker lacks transparency regarding swap rates, potentially impacting traders holding positions overnight.

World Class Fin Account Types

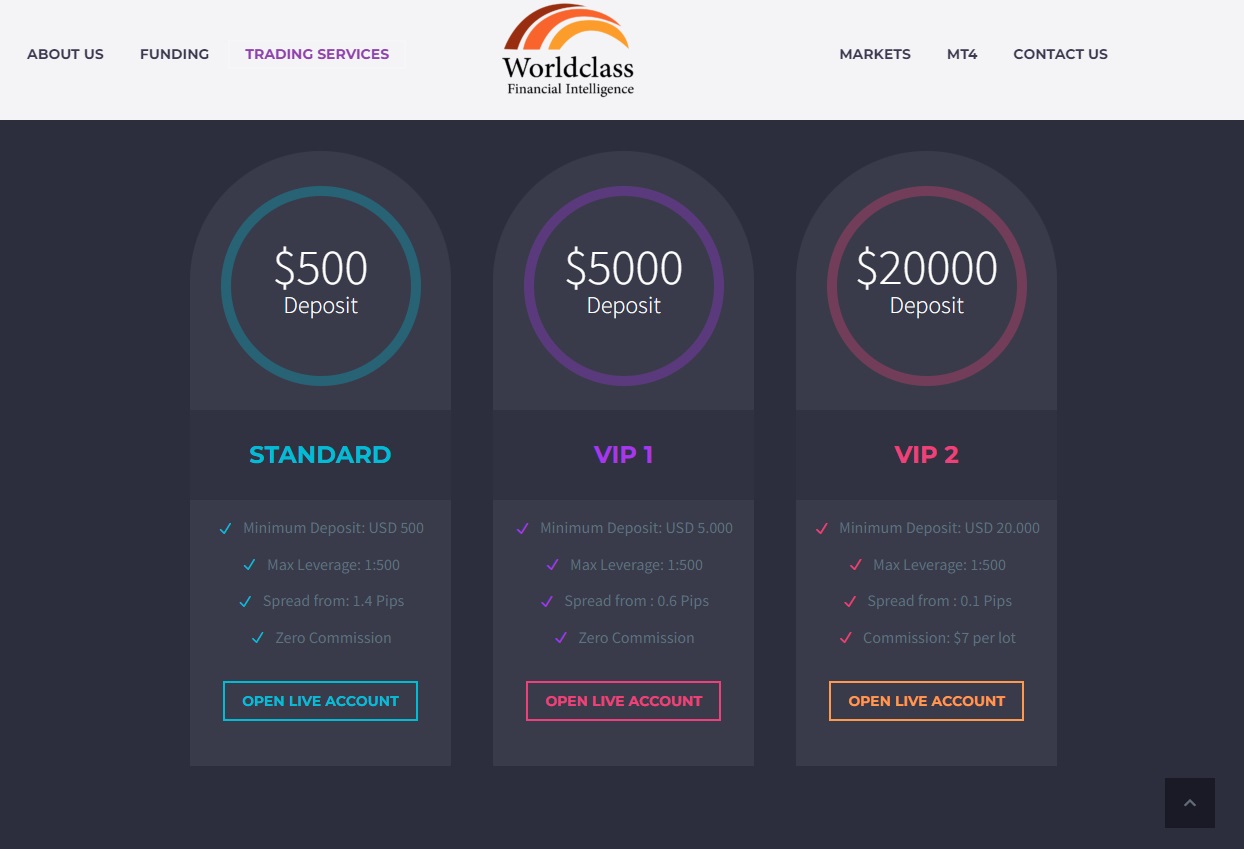

The World Class Fin account types are as follows:

- Standard Account: Minimum deposit: $500, Max Leverage: 1:500, Spread from: 1.4 Pips, Zero Commission

- VIP 1 Account: Minimum deposit: $5,000, Max Leverage: 1:500, Spread from: 0.6 Pips, Zero Commission

- VIP 2 Accounts: Minimum deposit: $20,000, Max Leverage: 1:500, Spread from: 0.1 Pips, Commission: $7 per lot.

Leverage: Balancing Risk and Reward

Worldclass Financial Intelligence offers maximum leverage of up to 1:500. High leverage like this enables traders to amp up profits with smaller capital.

Yet, this comes with the caveat of higher risk, necessitating strict risk management to prevent significant losses. While high leverage can enhance returns, it can also lead to margin calls and account liquidation. Some regulated regions impose limits on high leverage to protect traders from excessive risk exposure.

World Class Fin Mobile App: Convenience and Caution

MetaTrader 4’s mobile versions for Android and iOS devices offer traders the ability to trade on the go.

With access to trading functions, analytical tools, and charts, these platforms provide convenience. But, skepticism is a must. They operate without a license just like Innovation Markets.

World Class Fin Withdrawing Process

Worldclass Financial Intelligence provides clients with multiple payment methods for deposits and withdrawals.

With various options like local transfers, crypto methods, and credit cards, clients can choose their preferred method. But, hidden charges and exchange rate fluctuations can impact transactions. Keep that in mind. Withdrawals are accessible through the client’s office, but the absence of minimum deposit information raises further suspicions.

Customer Support: Navigating Limited Support Options

Worldclass Financial Intelligence offers decent customer support through live chat and email, available 24/7. However, the lack of phone support and physical locations in major financial hubs may inconvenience traders seeking more direct assistance.

Customer support is also limited on weekdays, potentially affecting response times. Given the context of World Class Fin’s dubious operations, this lack of support could be a warning sign for customers. It may indicate that the company is not committed to a high standard of customer service. It can also be an indication of potential fraudulent activity.

Trader Reviews

Currently, there are no available reviews about World Class Fin on Trustpilot. Traders’ experiences and feedback regarding their services are not yet documented on this platform.

This absence of reviews on Trustpilot makes it challenging to gauge the overall satisfaction of traders who have engaged with World Class Fin. Potential clients may find it challenging to make informed decisions without the insights provided by user reviews on this reputable platform.

How the Scam Works

Sneaky companies use different schemes to trick you. They usually create trouble when you try to take out your money. They might also charge strange and excessive fees.

These fees can be really high, sometimes more than 20%. In addition, they may call them something else, like “withdrawal processing fees.” What’s more, they often ask for a fee upfront, saying it’s for your future profits. Please be mindful of that. They want you to spend money before you even start.

Another thing to watch out for is idealistic promised returns. This is a common trick too. Scammers will always tell you that you’ll make enormous profits. But be careful, as trading with things like leverage can be risky. Don’t fall for a con that says you’re guaranteed to make lots of cash in a short time period.

Long Story Short – World Class Fin

In summary, Worldclass Financial Intelligence presents itself as a global online trading provider but falls short of transparency and credibility. Despite offering a diverse range of trading instruments and competitive pricing, its lack of regulation, limited educational resources, and questionable location raise concerns. Traders considering World Class Fin should exercise caution and thorough research, as there are more reputable options available on the market.

If you need help choosing the right broker that fits your trading style and preferences, contact us today! Book a free consultation about the most suitable brokers today!

FAQ Section

What Is World Class Financial Intelligence?

WCF, or World Class Financial Intelligence, is a global online trading provider.

What Is Minimum Deposit with World Class Fin?

The World Class Fin minimum deposit requirement varies based on the chosen account type. The smallest amount is 500$.

How Long Does It Take To Withdraw Money From Worldclassfin.com?

They claim that withdrawal is instant when using a credit card, crypto, or local bank transfer.