XeroMarkets Review: Scrutinizing Assets and Regulatory Claims

When it comes to FX trading, XEROMARKETS catches attention as a division of Xero Capital Markets Ltd. While they’re active in Asia, questions have emerged regarding their plans for a European license.

This has given rise to concerns about the security of funds and the platform itself. Notably, this makes it challenging to recommend XEROMARKETS to traders. Despite their success in Asia, the absence of a European license adds a level of risk for those seeking to trade in Europe. Keep reading this XeroMarkets review for more details!

Regulatory Ambiguities: Scrutinizing Xero Markets’ Legitimacy

Xero Capital Markets Ltd has cast a shadow of uncertainty by hiding some crucial details. For example, we don’t know the identity of the regulatory body overseeing its operations.

This enigmatic move sends up cautionary signals. The absence of a current license becomes a red flag, raising questions about the broker’s credibility. In the online trading world, a vigilant focus on regulatory validation is of crucial importance. Retaining a valid regulatory license signifies a broker’s dedication to keeping to industry standards. Without this crucial validation, traders become vulnerable to potential risks and scams.

It’s vital to note that some prominent regulatory bodies include:

- The Cyprus Securities and Exchange Commission (CySEC)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

Each confers a seal of legitimacy upon brokers that adhere to their norms. The absence of such an endorsement serves as a stark warning. And traders must remain vigilant in the face of the potential pitfalls.

| General information | |

| Name: | Xero Capital Markets Ltd |

| Regulation status: | Unregulated Offshore Broker |

| Warnings from Financial Regulators: | No official warnings |

| Website link: | xeromarkets.com |

| Active since | 2018 |

| Registered in | St. Vincent and the Grenadines |

| Contact info: | (MY):603 – 3310 0891 |

| Trading platforms: | MT5 |

| The majority of clients are from: | MalaysiaIndonesia SingaporeBruneiAustralia |

| Customer support: | Yes (+44 20 8123 5544 , [email protected] , +603-3310 0891 (MY)) |

| Compensation fund: | No |

Trading Assets at Xeromarkets: A Limited Palette Revealed

Let’s delve into the trove of trading opportunities. XEROMARKETS lays out a somewhat modest selection of over 77 instruments spanning multiple asset classes.

This assortment attempts to take hold of offerings in forex, metals, and energy, yet the scope remains limited. Within this assortment, Xero Markets showcases 68 forex pairs, tantalizing traders with exotic currencies. They are the Danish Krona, Swedish Krona, Polish Zloty, Norwegian Krona, Hungarian Forint, Czech Krona, South African Rand, Turkish Lira, Singapore Dollar, and more.

While the allure of metals is undeniable, including gold, silver, palladium, and platinum, XeroMarket’s portfolio lacks diversity.

Notably, the broker avoids stocks, indices, commodities, and cryptocurrencies. This choice may leave traders yearning for more thorough options, potentially impacting their ability to diversify effectively.

XeroMarkets Platform: Weighing the Pros and Cons

In the online trading arena, XeroMarkets stands out for its exclusive use of the MetaTrader 5 (MT5) platform.

While this choice may seem efficient, a deeper look uncovers uncertainties due to the broker’s lack of regulation. Always remember that.

Note: RCE Banque is another unregulated firm. There are multiple warnings against them.

Advantages of XeroMarkets’ Platform

The MetaTrader 5 platform is a trusted name in the world of trading. It is known for its UI-friendly interface, advanced tools, and features suitable for traders of all levels.

With its ability to handle various assets, traders can diversify within a single interface. XeroMarkets’ embrace of MT5 offers traders familiarity and a robust environment. Automated trading tools, technical indicators, and real-time charts enhance trading decisions.

Navigating Unregulated Waters

Yet, reliance on MT5 doesn’t erase concerns about XeroMarkets’ unregulated status. The lack of regulation raises questions about transparency, financial stability, and fair practices.

Without regulatory oversight, traders face big vulnerability. In disputes or financial issues, legal recourse options may be limited, leaving traders exposed to risks.

While a strong trading platform matters, regulatory validation is crucial. MT5’s seamless experience shouldn’t overshadow concerns about operational standards.

Trading Environment at XeroMarkets

Let’s take a closer look at the trading environment. What are the XeroMarkets account types and other offerings? Stay tuned!

Account Offerings at XeroMarkets

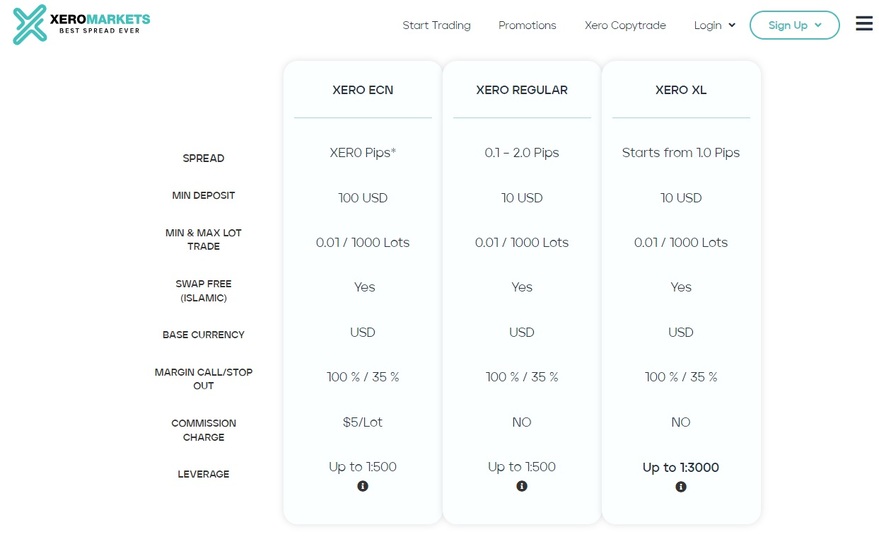

Beyond the domain of demo accounts, XeroMarkets extends a trio of live trading options: XERO ECN, XERO REGULAR, and XERO XL.

Each comes with distinct features and varying minimum deposit requirements – $100, $10, and $10. But do these differences truly carve out unique advantages?

- XERO ECN. Positioned for those with a sturdier financial foundation, the $100 minimum deposit grants access to a potentially more broad trading experience.

- XERO REGULAR. With a $10 minimum deposit, this account beckons newcomers. But could accessibility come at a potential cost in terms of trading conditions?

- XERO XL. Sporting the same $10 minimum deposit as XERO REGULAR, one might question what differentiates the XL variant. Could it be an enticing pathway to better possibilities, or is it just a moniker?

To access your chosen account, proceed with the XeroMarkets login. However, safety is not guaranteed!

Xero Copytrade: Tempting Gains

Xero Markets Copytrade lures newcomers with promises of quick profits by mimicking Xero Pro traders’ strategies.

Dive in, but with mistrust, as the path to gains may be shrouded in uncertainty.

Here’s the drill:

- Sign Up and Fund. Register and deposit into your wallet, displaying uninvested funds. No assurance they’ll flourish.

- Mirror “Best” Traders: Copy strategies from supposedly top managers. Yet, can their success truly translate to your gains?

- Watch and Adjust: Keep an eye out as automation dances with your money. You can intervene, but is it enough to counterbalance potential risks?

Please remember, access isn’t a guarantee of prosperity. Doubt is your guide through enticing promises to the reality beneath.

Leverage

In the realm of XeroMarkets, the curtain rises on a maximum leverage of 1:3000.

Picture this: with 1:3000 leverage, graciously extended by XeroMarkets, a trader can command a position worth $30,000, with a simple $10 deposit. Despite being tempting, this can magnify losses in equal measure if the tides turn against you.

This potent tool truly requires keen awareness. As leverage surges, so does the potential for capital erosion.

Unregulated brokers like XeroMarkets and MountainWolf often entice novice traders with high leverage. That is a tempting invitation that beckons with promise but conceals potential danger.

Demo Account

Whether it’s the thrill of live trading or the pursuit of honing skills through demo accounts, XeroMarkets presents an avenue for both.

While real accounts invite you to navigate the financial markets, demo accounts offer a risk-free sandbox to master techniques. Yet, as you tread this dual path, it’s vital to dissect the intricacies of each account type. You should see whether their offerings align with your expectations.

Fees

Much like its counterparts in the forex landscape, XEROMARKETS imposes some fees, manifesting as either a commission fee ($7) or a spread fee.

The XeroMarkets spread is a crucial determinant of your trading costs and potential profits.

As you examine this, you will find many sketchy impacts on your trading endeavors.

XeroMarkets Payout Options

Here, a mix of payout avenues arises, spanning Help2Pay, PayPal, Direct Bank Transfer, Visa, MasterCard, Maybank, Fasapay, Tether, Bitcoin, Local Deposit, and Bank Wire Transfer.

Venturing deeper into this intricate terrain reveals a $10 minimum for card payments. Yet, beware – a dormant account for six months activates an unforeseen inactivity fee.

Customer Support

When in need, XEROMARKETS offers a variety of channels to connect with its support team.

Whether through a dial at +44 20 8123 5544, email: [email protected], or engaging in real-time dialogue via live chat, your questions have pathways to answers.

Also, this broker has a presence on Twitter, Facebook, Instagram, YouTube, TikTok, and LinkedIn.

Still, the ease of connection doesn’t necessarily translate to a seamless problem-solving experience. Remember that!

Trader Reviews

Always conduct thorough research on prospective firms, including XeroMarkets. Forum reviews expose reliability, platform performance, and customer service.

Mostly negative user feedback about XeroMarkets is prevalent on social media platforms and forums. Caution is advised when contemplating investments through this brokerage.

Know that research serves as a defense against fraudulent brokers and their hidden motives. Your diligent search deflects potential risks and guides you toward safer choices.

Long Story Short – XeroMarkets

XeroMarkets, operating under Xero Capital Markets Ltd, is an online FX and CFD broker founded in 2017.

Based in Saint Vincent and the Grenadines, it aims to capture the Asian market while wanting to get a European license. Despite offering the popular MetaTrader 5 (MT5) trading platform and a range of assets, its unregulated status raises questions about legitimacy. Traders should exercise caution and conduct thorough research before engaging with XeroMarkets and Primiselite, another unregulated broker.

If you’re interested in top-notch FX brokers, make sure to contact us today! You can book a free consultation here!

FAQs

Is XeroMarkets legit?

No, this trading company is unregulated and based offshore.

What is the welcome bonus for XeroMarkets?

This brokerage firm does not offer any valid bonuses.

Is It Safe To Trade With XeroMarkets?

No. Your money is not safe with this broker.